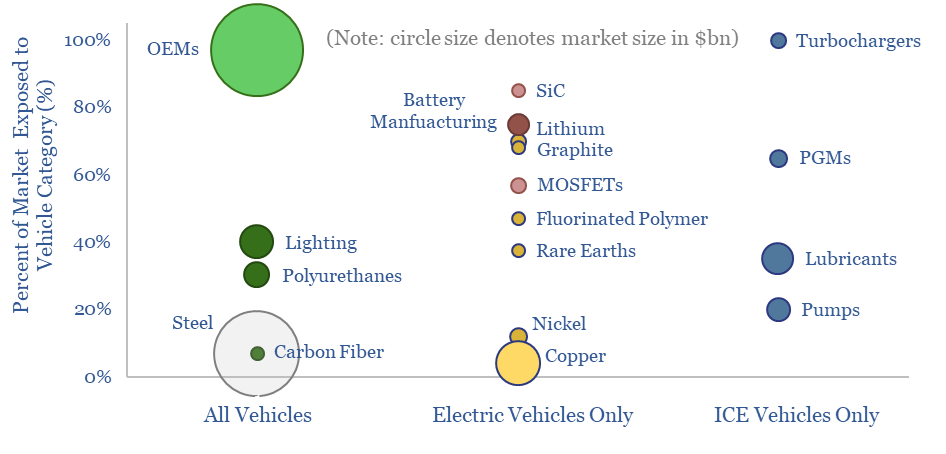

Who is impacted if vehicle sales, EVs or ICE volumes surprise? Autos are a $2.7 trn pa global market, a vast 2.5% of global GDP. 15% is gross margin for OEMs. The other 85% is spread across vehicle value chains, encompassing metals, materials and capital goods. Hence this 14-page note highlights 200 companies from our database of 1,500 companies. Some are geared to ICEs. Some to EVs. And some to both.

Our research in 3Q24 has wondered whether EV sales might saturate at 15-30% of developed world vehicle sales through 2030, due to total costs of ownership and challenges reaching cost-competitiveness. This means our latest vehicle forecasts only see 40M EV sales in 2030, down from 65M envisaged a year ago.

The aim of this 14-page report is to look through our companies database, which covers 2,500 mentions of 1,500 companies in value chains that matter for energy transition. Specifically for vehicle value chains, which companies are geared to ICEs, geared to EVs, or to both?

Automotive OEMs are most directly geared to vehicle purchasing decisions, as our screen of global OEMs finds that the top twenty largest auto producers have adopted very different strategies towards electrification, as discussed on pages 4-5.

Our best ideas into the themes and companies that are geared to ICEs are outlined on pages 7-9. We highlight three companies in detail, amidst a broader discussion of c25 companies.

Our best ideas into the themes and companies that are geared to EVs are outlined on pages 10-12. It is astounding how many industries’ story is now tied to the long-run ascent of EVs.

Another idea that we discuss is the possibility of consumers simply owning more vehicles overall: EVs for clean urban mobility AND ICEs for longer distance travel with larger payloads. (It is interesting how many clients have written in, off the back of our broader EV research in 3Q24, to highlight how they have purchased EVs as the second, third… or in one case, sixth (!) vehicle within their households).

Our best ideas into the themes and companies that are geared to greater vehicle ownership are on pages 12-13. It is fascinating that one of these themes in vehicle value chains overlaps with our thesis into power grid bottlenecks and advanced conductors.

If one thing stands out to us from reviewing the companies in these various value chains, it is the danger of distraction. How many companies have diverted resources away from improving their core products, in order to enter new markets, with uncertain strategies, uncertain costs, uncertain demand, uncertain competition? This concern is not just for vehicle value chains, but across the energy transition. This highlights the importance of energy transition research, data and analysis in corporate decision-making.