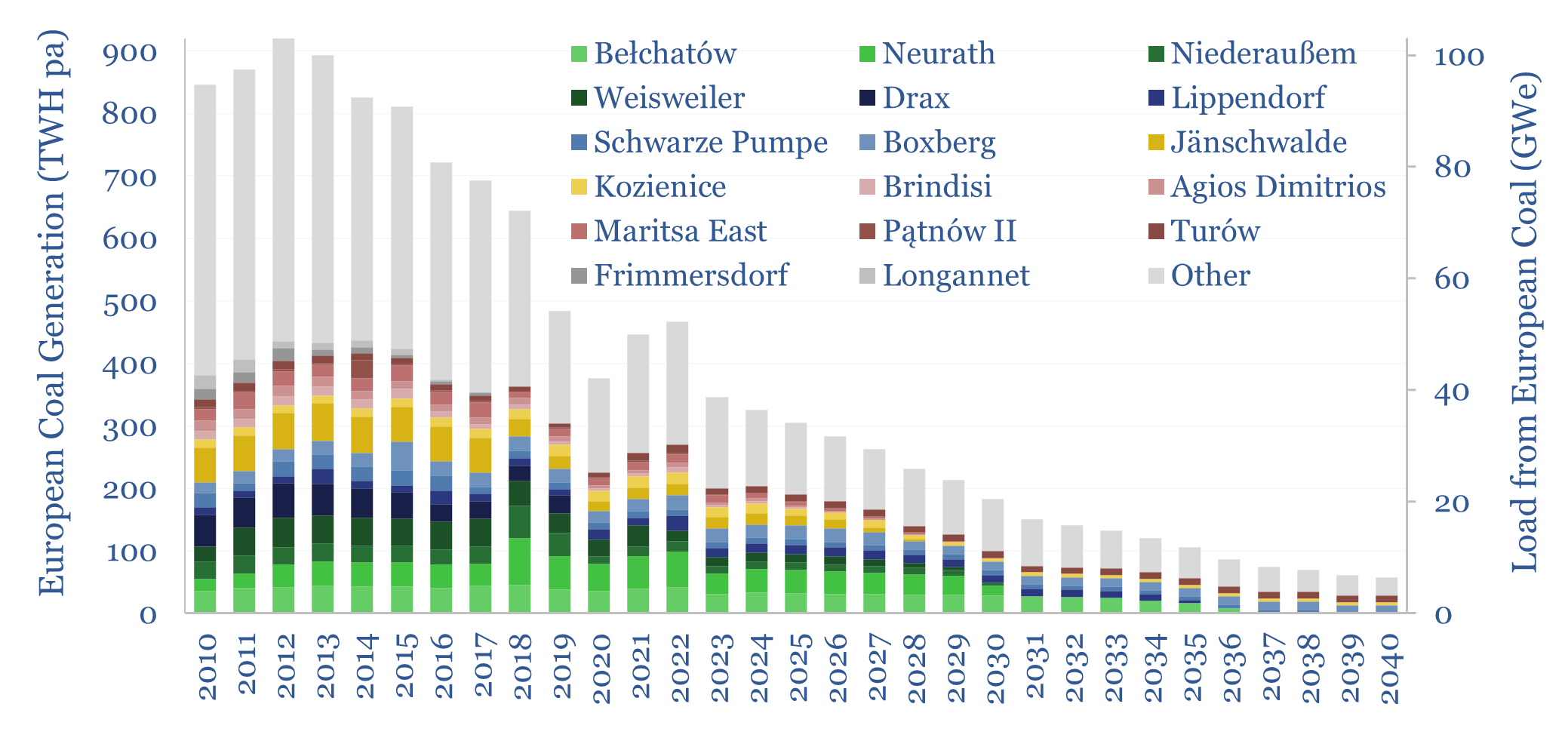

Europe generated 350TWH of electricity from coal in 2023, having halved over the prior decade, and potentially declining to zero around 2040. We have recently been wondering whether this phase-back of coal is compatible with geopolitical priorities or the need to keep pace with the rise of AI. Hence this data-file tracks European coal generation by facility and planned coal plant closures. It will be interesting to see if closure plans shift back.

This data-file tracks European coal generation by facility, as imputed from the EU ETS platform, which publishes data on every industrial emitter in Europe. It is a very large data-set. We have also tabulated public disclosures into the largest coal plants in Europe and plans for coal plant closures.

17 large coal plants with 40GW of capacity account for 60% of Europe’s coal-fired generation, followed by a long tail of smaller plants. In each case, we have compiled details of the power plant, its location, its owner, its capacity (in MW), utilization rate (%), recent generation (TWH), CO2 emissions (MTpa) and notes into closure plans.

The weighted average large coal plant in Europe has recently been running at c60% utilization and is scheduled to shut down entirely in 2033. The data inform our European gas and power models and global electricity models

Some shutdowns are permanent and irreversible. For example, the boiler house, turbine hall and control room at the UK’s Longannet power plant were demolished in a controlled explosion in 2021. Others may be reversible.

The two greater cheerleaders for European coal plant closures have been environmental lobbyists/protesters and the EU itself. The EU Just Transition Fund has €20bn of direct capital, and aims to mobilize €55bn of total capital, to incentivize activities such as coal plant closures. For example, RWE was allocated €2.6bn as part of a 2020 compromise to move Germany away from coal. The energy transition is obviously going to be inflationary, if you have to pay existing facilities to shut down, and then also pay for replacements.

At least one-third of the closures discussed in our data-file specifically call for the coal-fired capacity to be replaced with CCGTs. The economics of coal-to-gas switching depend on coal prices and gas prices. But there may also be growing wariness over Europe’s energy import reliance, and calls for improving energy self-sufficiency.

Some politicians have recently started to push back on coal mine closures. For example, in 2023, Poland’s Prime Minister Mateusz Morawiecki assured that he would not allow the Turów coal mine to close, until at least the 2040s, as it was crucial for the country’s energy security, providing 5-7% of the country’s electricity, supporting thousands of jobs, and powering hospitals, nurseries, schools and homes across Poland. If we had to guess, more coal plant closures will be deferred as energy priorities are changing in Europe.