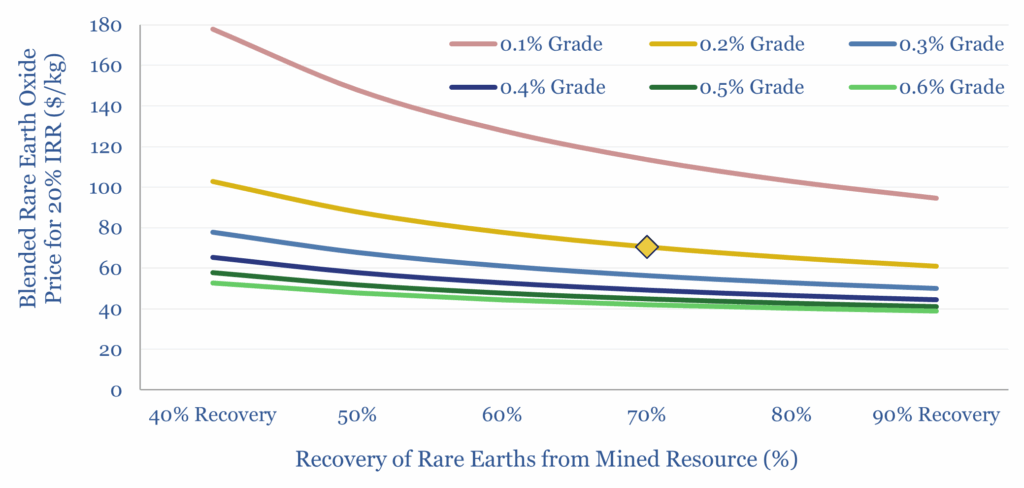

The costs of Rare Earth mining and refining are captured in this model, requiring a $70/kg blended product price, to generate a 20% IRR on $150,000/Tpa of capex. Primary energy intensity exceeds 100 MWH/ton and CO2 intensity exceeds 20 tons/ton. Economics are particularly sensitive to ore grade, recovery rates and chemical costs.

Our recent research has argued that disruptions to Rare Earth supply chains could cause a future commodity shock similar to the oil shocks of the 1970s. It is easy to overlook the need for yttrium in gas turbines, permanent magnets in servo motors behind robotics, indium tin oxide on the front of an iPhone, or doping agents in fiber optics and lasers.

American Rare Earths is listed in Australia, with $85M of market cap at the time of writing. In April-2025, the company released an updated scoping study for its Halleck Creek project in Wyoming, which would mine 3MTpa of material, and recover 4kTpa of Rare Earth Oxides, such as NdPr Oxide (didymium), Terbium Oxide, Dysprosium Oxide, SEG Concentrates and Lanthanum Concentrate. The scoping study sees the NPV10 value of the resource at $558M.

The production process includes mining 3MTpa from Halleck Creek, trucking it, crushing the ore, floating out the gangue alongside Wet High Intensity Magnetic Separation, across four stages. The concentrate will then be trucked to a Rare Earths refinery in Wheatland, Wyoming, where it will be calcined and leached with H2SO4. After removing impurities (including a small amount of uranium and thorium, iron and cerium), the Rare Earths will be separated via solvent extraction, precipitated out with oxalic acid, then once again calcined.

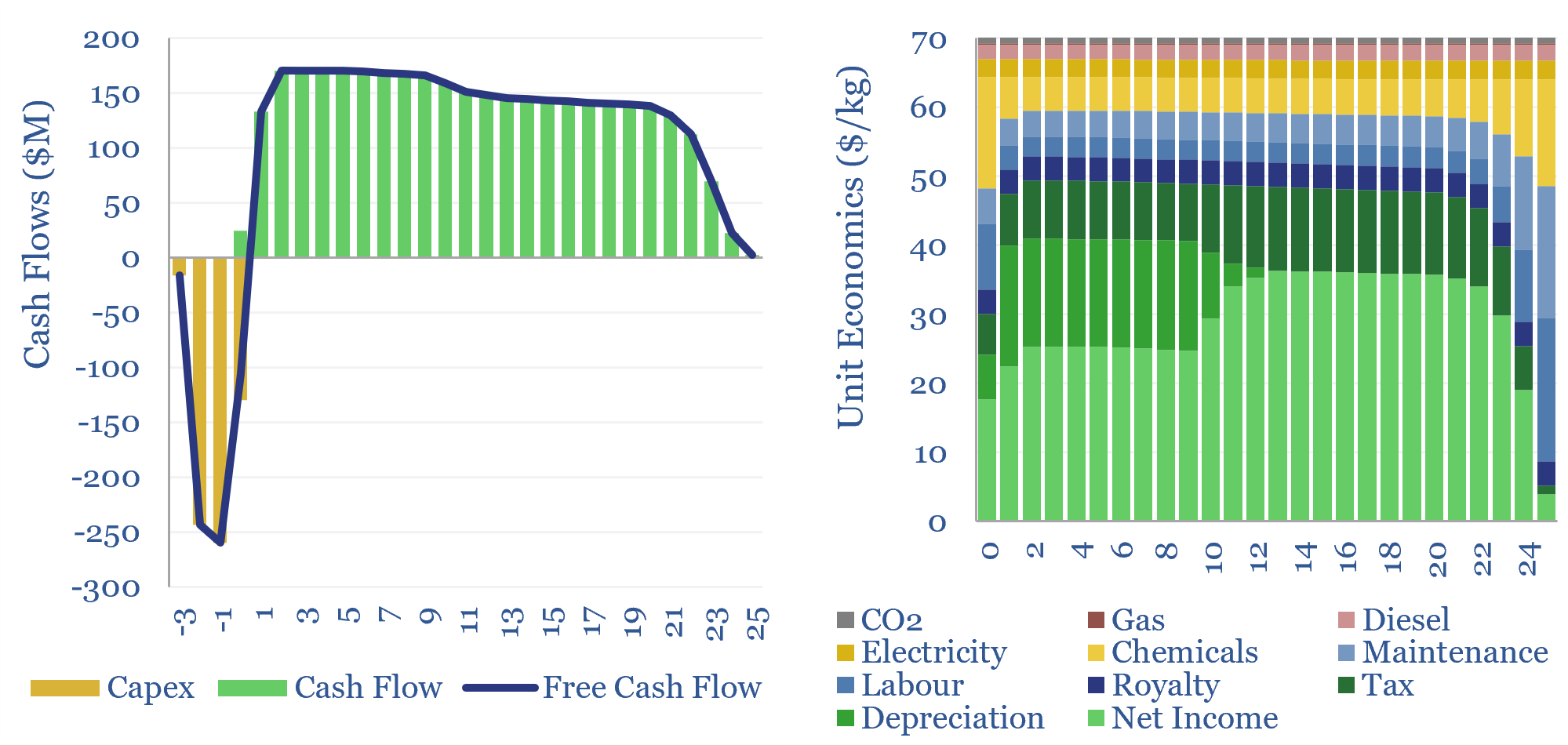

We have used American Rare Earth’s scoping study as the basis for this economic model, covering the costs of Rare Earth mining and refining. We see a $70/kg blended product price unlocking a 20% IRR on an integrated mining and refining project. We have built-up the pricing, capex, energy use, chemicals use and personnel requirements in backup tabs.

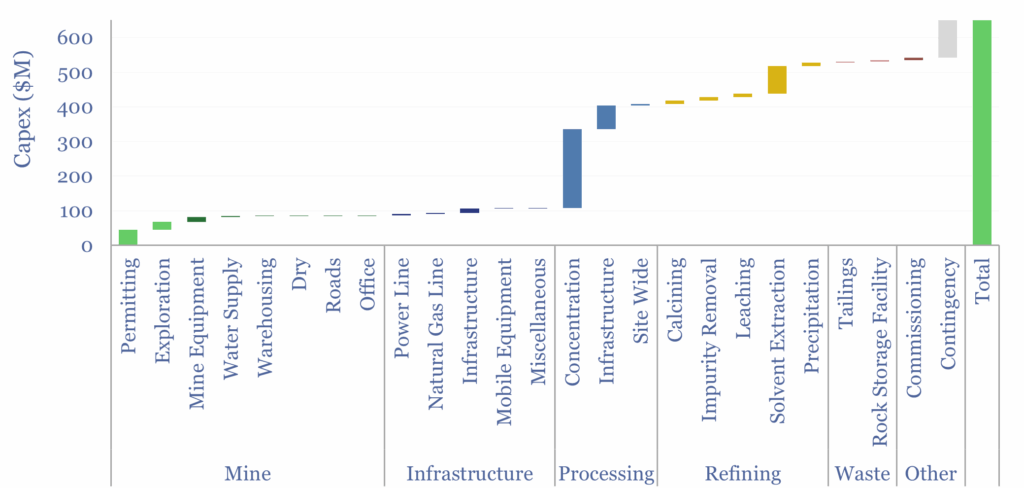

20% IRR is a reasonable hurdle as uncertainties remain with the flow sheet (e.g., additives, scavengers and the precise quantities needed), and frankly, this will not be fully de-risked until a production facility is up-and-running. However, a 20% IRR also means that after $650M of capex (chart above), the NPV10 value of the project at start-up would be $1.4bn, potentially unlocking a 2x cash-on-cash return (unlevered) after 5-years.

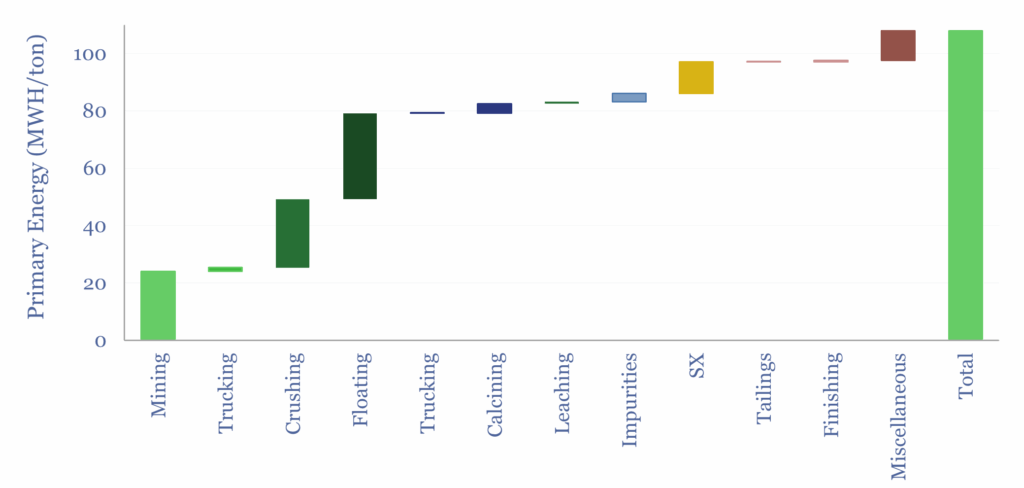

Primary energy intensity of the process is estimated at 110,000 kWh/ton, similar to lithium mining. This is mostly to generate electricity, for the crushing and flotation circuits. CO2 intensity exceeds 20 tons/ton, which is lower than we have assumed for other Rare Earths. In this particular project, there is no need for extensive heat-treatment of ores prior to concentration, and the Bond index for crushing is also helped by a low-competency ore grade. Other projects may use more energy.

Please download the data-file to stress test the costs of Rare Earth mining and refining. Inputs that can be flexed include Rare Earth prices ($/kg), mined material (kTpa), resource grade (%), recovery rates (%), capex ($/Tpa), energy prices, CO2 prices, reagent costs, labor rates, royalties and tax treatment. Economics are particularly sensitive to ore grade, chemicals costs and recovery rates.