c150bcm of gas was flared globally in 2019, including 15bcm in the United States, which emitted 30MT of CO2-equivalents. This data-file simplifies the economics of flare gas capture, by gathering the gas, cleaning the gas, and compressing the gas into a regional pipeline.

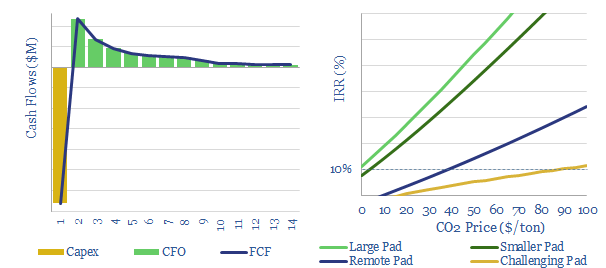

Generally, double-digit returns are achievable at a large new shale pad, by capturing and commercialising associated gas rather than flaring it. Economics are more challenging at smaller pads, remote pads and for wet or contaminated gas. Economics are highly variable, site-by-site, as can be stress-tested in the model.

Carbon prices would dramatically improve the economics of capturing flare gas. A c$40/ton CO2 price would incentivize capturing gas from the majority of remote pads, while it would unlock c40-50% IRRs on flare gas capture from large pads, a very expensive opportunity cost for any operator to ignore. As a rough estimate, a $100/ton CO2 price could eliminate flaring in the US, subject to pipeline availability.

Please download the data file to stress test our numbers for flare gas capture. Our conclusions from this analysis are summarised in the article sent to our distribution list here, along with our related report discussing the improvements within oil and gas from a CO2 price.