-

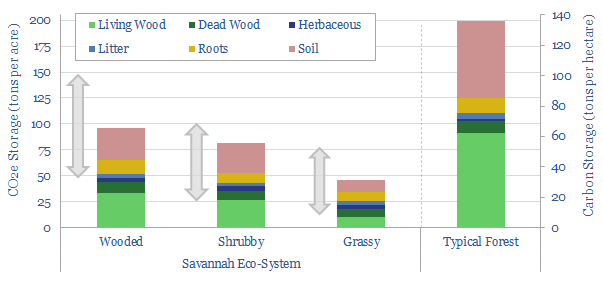

Savanna carbon: great plains?

Savannas are an open mix of trees, brush and grasses. They comprise up to 20% of the world’s land, 30% of its CO2 fixation, and their active management could abate 1GTpa of CO2 at low cost. This 17-page research note was inspired by exploring some wild savannas and thus draws on photos and observation.

-

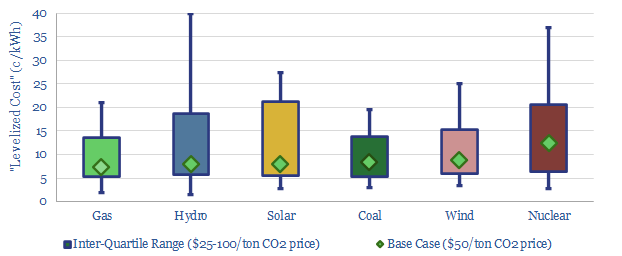

Levelized cost: ten things I hate about you?

‘Levelized cost’ analysis can be mis-used, as though one ‘energy source to rule them all’ was on the cusp of pushing out all the other energy sources. Cost depends on context. Every power source usually ranges from 5-15c/kWh. A resilient, low-carbon grid is diversified. And there is hidden value.

-

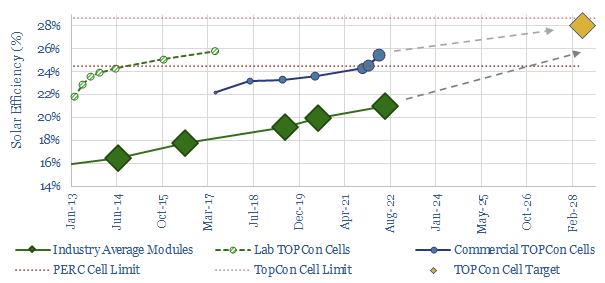

TOPCon: maverick?

A new solar cell is vying to re-shape the PV industry, with 2-5% efficiency gains and c25-35% lower silicon use. This 13-page note reviews TOPCon cells, which will take some sting out of solar re-inflation, tighten silver bottlenecks and may further entrench China’s solar giants.

-

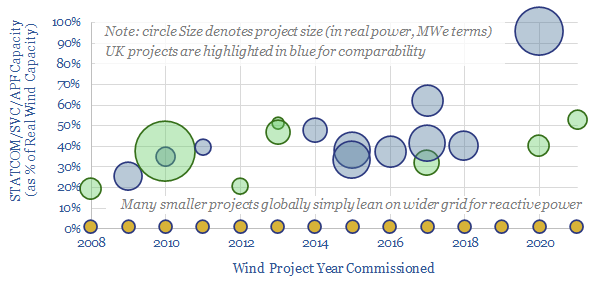

FACTS of life: upside for STATCOMs & SVCs?

Wind and solar have so far leaned upon conventional power grids. But larger deployments will increasingly need to produce their own reactive power; controllably, dynamically. Demand for STATCOMs & SVCs may thus rise 30x, to over $25-50bn pa. This 20-page note outlines the opportunity and who benefits?

-

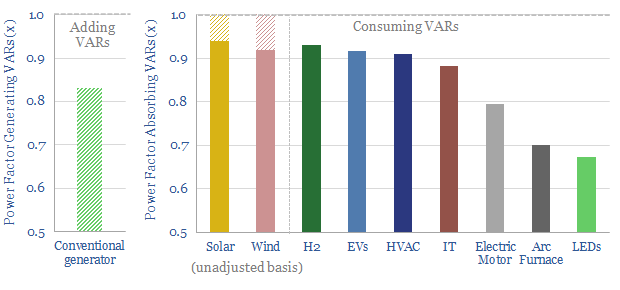

Capacitor banks: raising power factors?

Power factor corrections could save 0.5% of global electricity, with $20/ton CO2 abatement costs in normal times, and 30% pure IRRs during energy shortages. They will also be needed to integrate more new energies into power grids. This note outlines the opportunity in capacitor banks, their economics and leading companies.

-

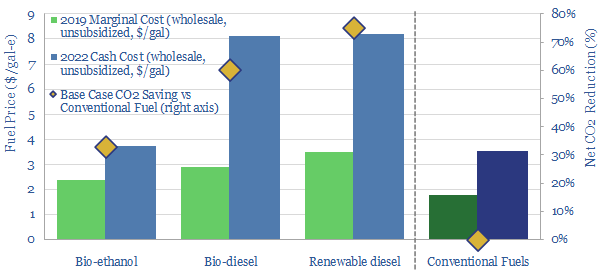

Biofuels: the best of times, the worst of times?

How will food and energy shortages re-shape liquid biofuels? This 11-page note explores four questions. Could the US re-consider its ethanol blending to help world food security? Could rising cash costs of bio-diesel inflate global diesel prices to $6-8/gal? Will renewable diesel expansion be dialed back? What outlook for each biofuel in the energy transition?

-

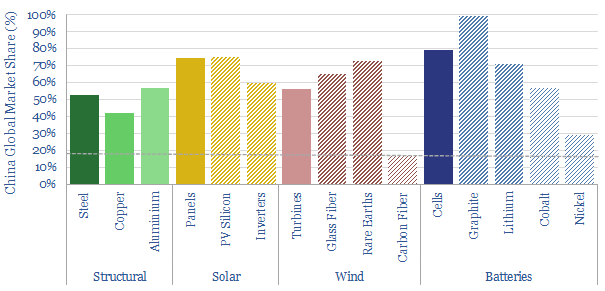

East to West: re-shoring the energy transition?

China is 18% of the world’s people and GDP. But it makes c50% of the world’s metals, 60% of its wind turbines, 70% of its solar panels and 80% of its lithium ion batteries. Re-shoring is likely to be a growing motivation after events of 2022. This 14-page note explores resultant opportunities.

-

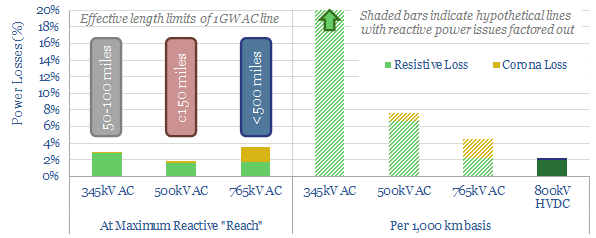

Power transmission: raising electrical potential?

Electricity transmission matters in the energy transition, integrating dispersed renewables over long distances to reach growing demand centers. This 15-page note argues future transmission needs will favor large HVDCs, costing 2-3c/kWh per 1,000km, which are materially lower-cost and more efficient than other alternatives.

-

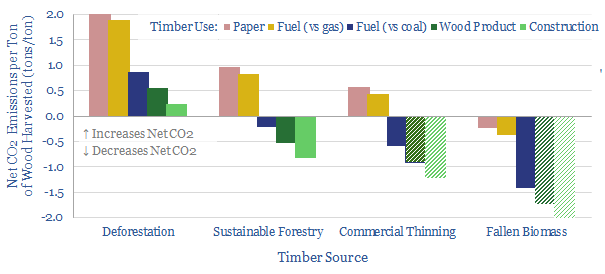

Wood use: what CO2 credentials?

The carbon credentials of wood are not black-and-white. They depend on context. So this 13-page note draws out the numbers and five key conclusions. They highlight climate negatives for deforestation, climate positives for using waste wood and wood materials (with some debate around paper), and very strong climate positives for natural gas.

-

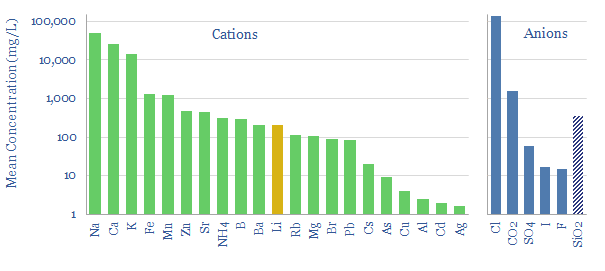

Direct lithium extraction: ten grains of salt?

Direct Lithium Extraction from brines could help lithium scale 30x in the Energy Transition; with costs and CO2 intensities 30-70% below mined lithium; while avoiding the 1-2 year time-lags of evaporative salars. This 15-page note reviews the top ten challenges that decision-makers need to de-risk.

Content by Category

- Batteries (89)

- Biofuels (44)

- Carbon Intensity (49)

- CCS (63)

- CO2 Removals (9)

- Coal (38)

- Company Diligence (95)

- Data Models (840)

- Decarbonization (160)

- Demand (110)

- Digital (60)

- Downstream (44)

- Economic Model (205)

- Energy Efficiency (75)

- Hydrogen (63)

- Industry Data (279)

- LNG (48)

- Materials (82)

- Metals (80)

- Midstream (43)

- Natural Gas (149)

- Nature (76)

- Nuclear (23)

- Oil (164)

- Patents (38)

- Plastics (44)

- Power Grids (130)

- Renewables (149)

- Screen (117)

- Semiconductors (32)

- Shale (51)

- Solar (68)

- Supply-Demand (45)

- Vehicles (90)

- Wind (44)

- Written Research (354)