-

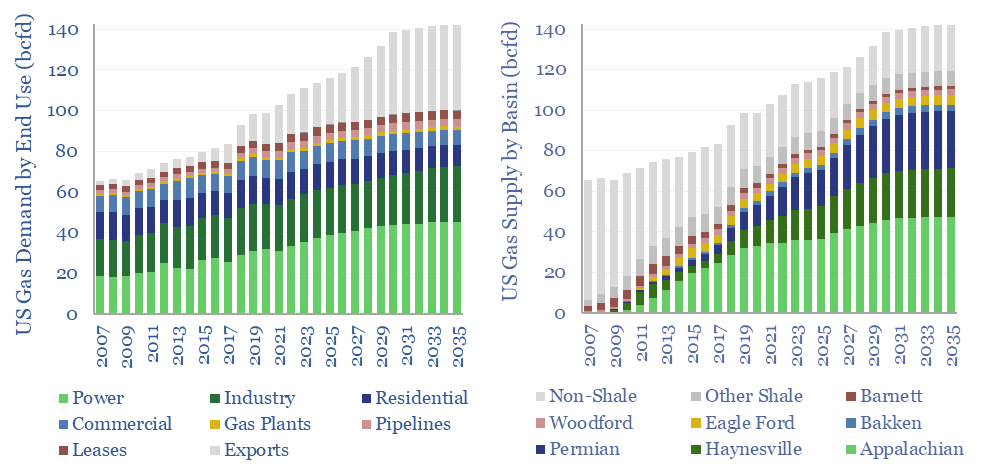

US natural gas: the stuff of dreams?

Modeling US gas supply and demand can be nightmarishly complex. Yet we have evaluated both, through 2035. This 13-page report outlines the largest drivers of demand, requires a +3% pa CAGR from the key US shale gas basins, and argues the balance of probability lies to the upside.

-

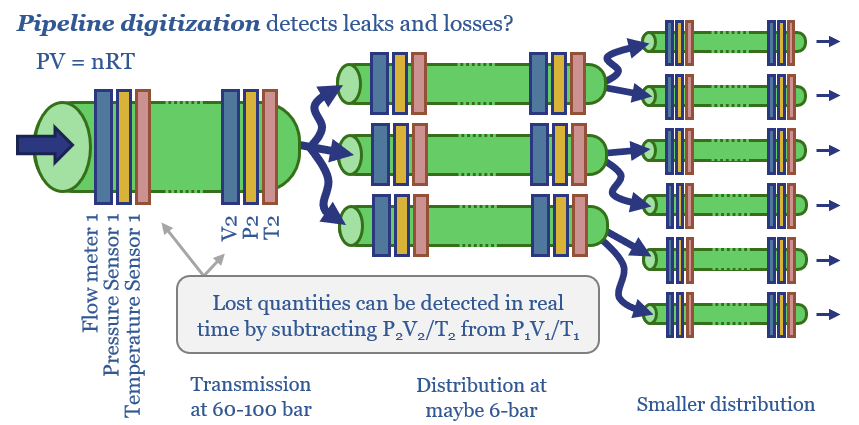

Seeing sense: digitize the downstream gas network?

Greater digitization of gas networks looks increasingly important, as gas, biogas, hydrogen and CCS all aim to shore up their futures. This 15-page note started as a deep-dive into the true leakage rates in downstream gas; and ended up finding opportunities in sensors and pipeline monitoring.

-

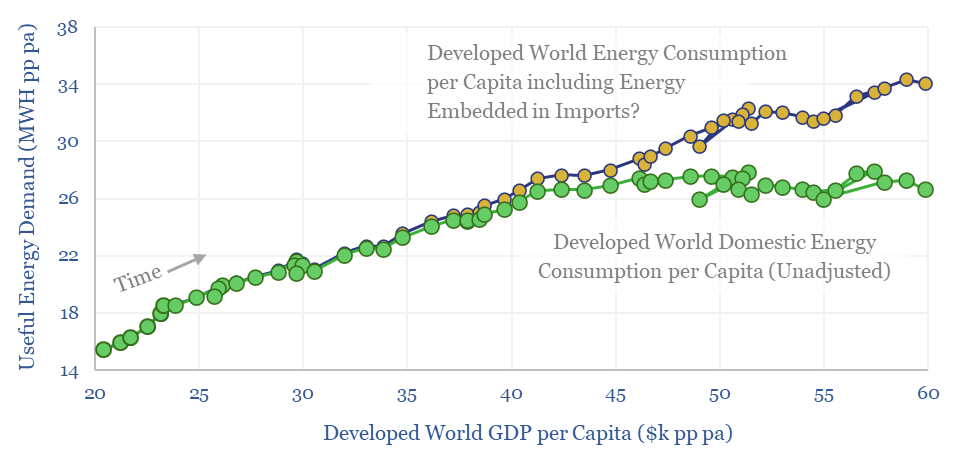

Global energy demand: false ceiling?

Can GDP decouple from energy demand? Wealthier countries’ energy use has historically plateaued after reaching $40k of GDP per capita. Hence could global energy demand disappoint? This 15-page report argues it is unlikely. Adjust for the energy intensity of manufacturing and imports, and energy use continues rising with incomes.

-

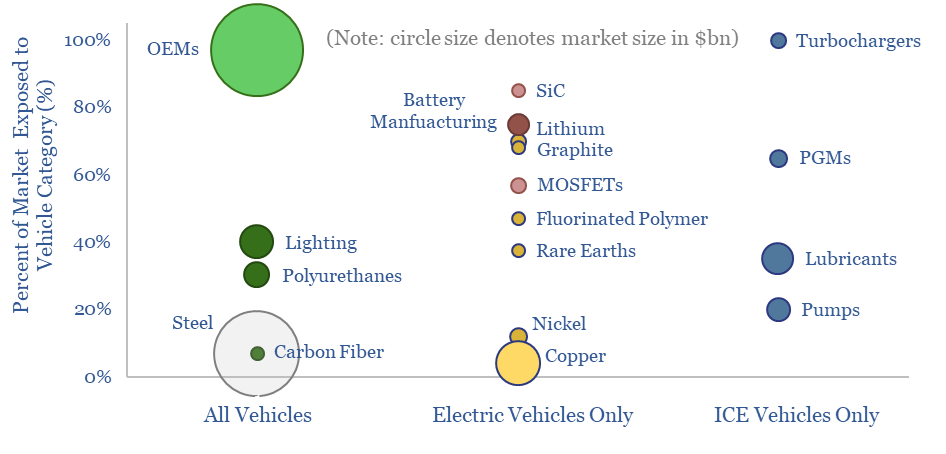

Mapping vehicle value chains?

Who is impacted if vehicle sales, EVs or ICE volumes surprise? Autos are a $2.7 trn pa global market, a vast 2.5% of global GDP. 15% is gross margin for OEMs. The other 85% is spread across vehicle value chains, encompassing metals, materials and capital goods. Hence this 14-page note highlights 200 companies from our…

-

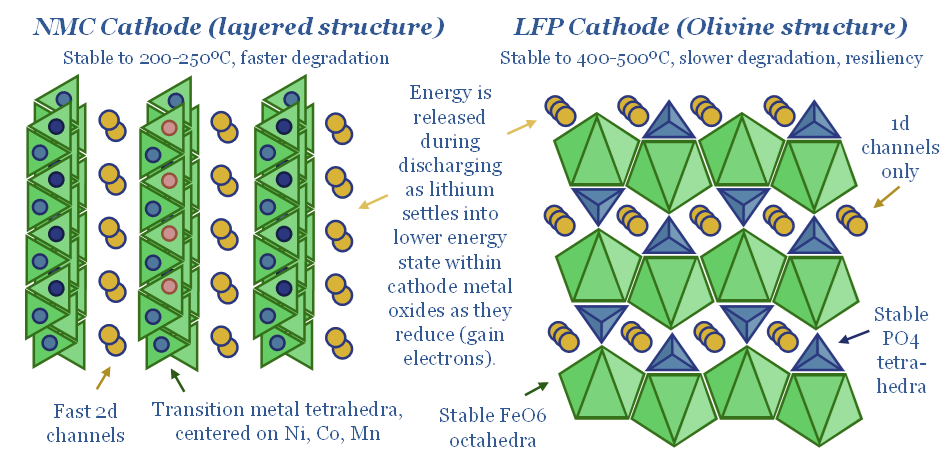

LFP batteries: cathode glow?

LFP batteries are fundamentally different from incumbent NMC cells: 2x more stable, 2x longer-lasting, $15/kWh cheaper reagents, $5/kWh cheaper manufacturing, and $25/kWh cheaper again when made in China. This 15-page report argues LFP will dominate future batteries, explores their costs, and draws implications for EVs and renewables.

-

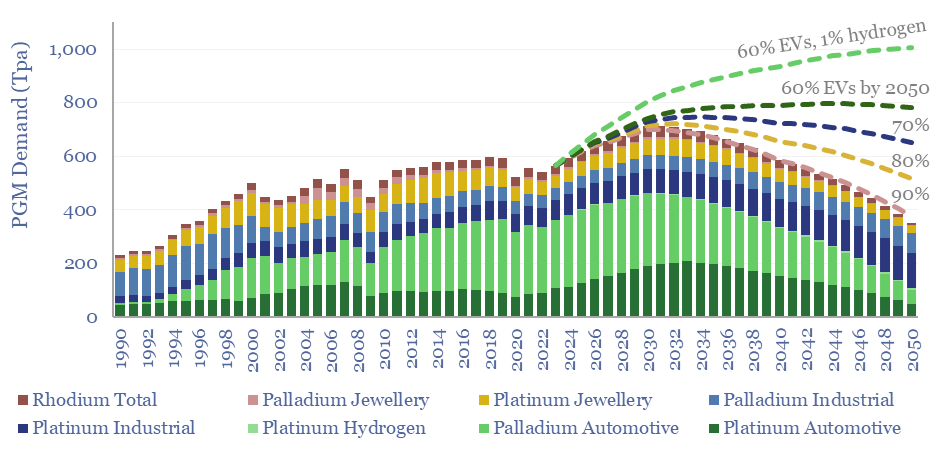

Going platinum: PGMs in energy transition?

Could PGMs experience another up-cycle through 2030, on more muted EV sales growth in 2025-30, and rising catalyst loadings per ICE vehicle? This 16-page note explores global supply chains for platinum and palladium, the long-term demand drivers for PGMs in energy transition, and profiles leading PGM producers.

-

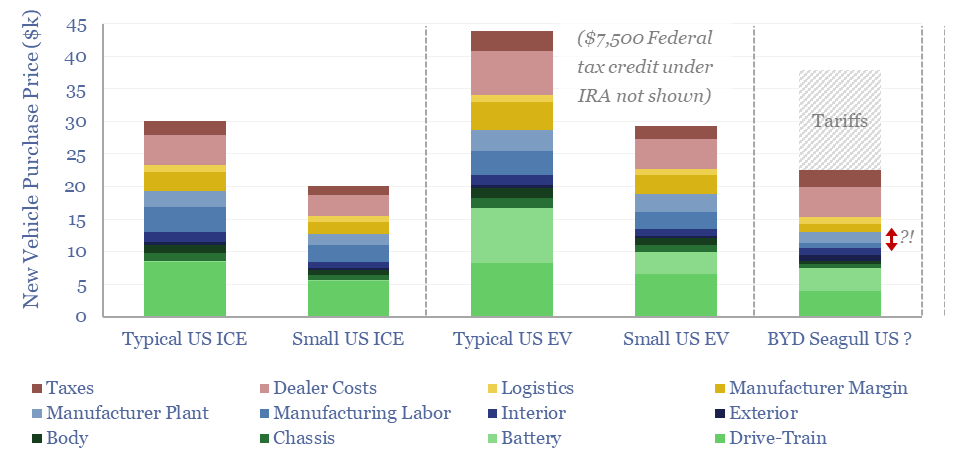

Electric vehicles: the road to cost parity?

Could electric vehicles deflate towards cost parity with ICEs in 2025-30, helping to re-accelerate EV adoption? This 13-page report contains a granular sum-of-the-parts cost breakdown for EVs vs ICEs. Then we consider battery deflation, power train deflation, small urban EVs, tax incentives, and the representativeness of low-cost Chinese EVs.

-

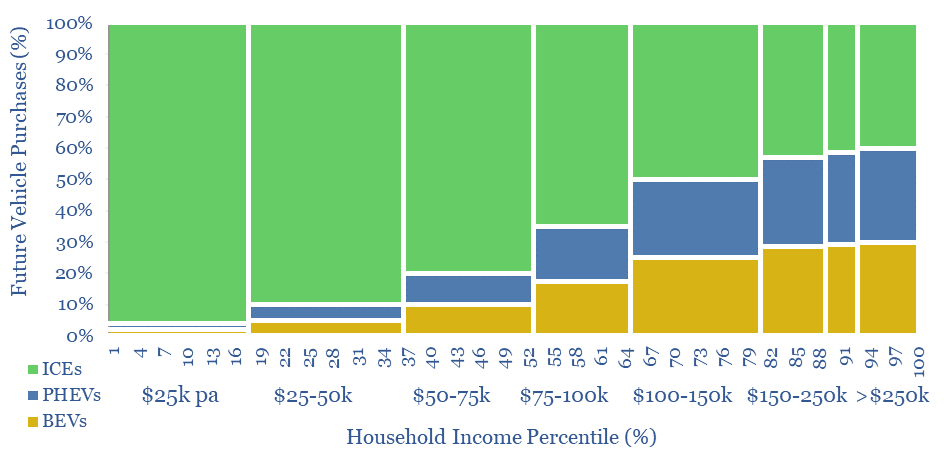

Electric vehicles: saturation point?

Energy transition technologies are often envisaged to follow S-curves: rapidly inflecting, then reaching 100% market adoption. However, this 17-page report argues electric vehicles will more likely saturate at 15-30% of sales in 2025-30. EVs were already at 15% of sales in 2023. So what would the more limited EV upside mean for energy and materials?

-

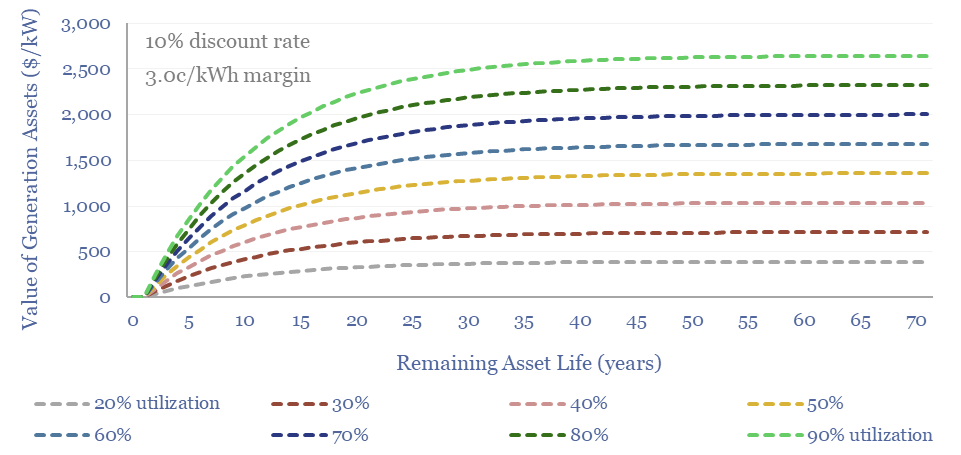

Purchasing power: what are generation assets worth?

There has never been more controversy over the fair values of power generation assets, which hinge on their remaining life, utilization, flexibility, power prices, rising grid volatility and CO2 credentials. This 16-page guide covers the fair value of generation assets, hidden opportunities and potential pitfalls.

-

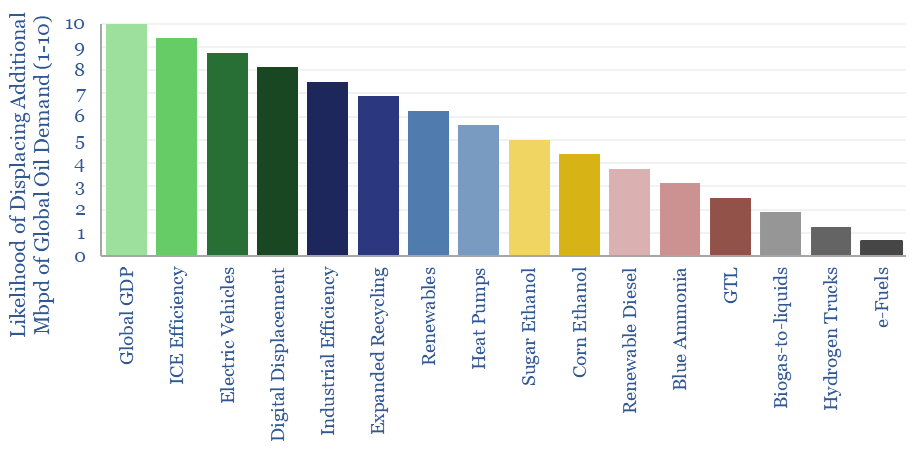

Oil demand: making millions?

What does it take to move global oil demand by 1Mbpd? This 22-page note ranks fifteen themes, based on their costs and possible impacts, to show where risks lie for oil markets, and where opportunities are greatest to drive decarbonization. We still think oil demand plateaus around 105Mbpd mid-late in the 2020s, before declining to…

Content by Category

- Batteries (89)

- Biofuels (44)

- Carbon Intensity (49)

- CCS (63)

- CO2 Removals (9)

- Coal (38)

- Company Diligence (94)

- Data Models (838)

- Decarbonization (160)

- Demand (110)

- Digital (59)

- Downstream (44)

- Economic Model (204)

- Energy Efficiency (75)

- Hydrogen (63)

- Industry Data (279)

- LNG (48)

- Materials (82)

- Metals (80)

- Midstream (43)

- Natural Gas (148)

- Nature (76)

- Nuclear (23)

- Oil (164)

- Patents (38)

- Plastics (44)

- Power Grids (130)

- Renewables (149)

- Screen (117)

- Semiconductors (32)

- Shale (51)

- Solar (68)

- Supply-Demand (45)

- Vehicles (90)

- Wind (44)

- Written Research (354)