-

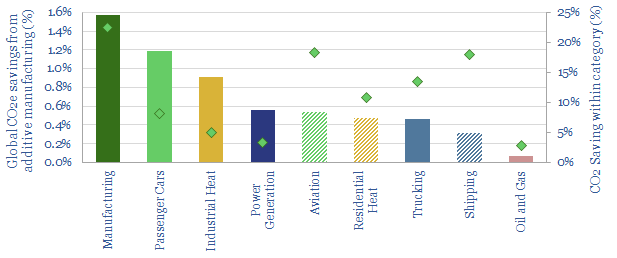

3D printing an energy transition?

Additive manufacturing (AM) can eliminate 6% of global CO2, across manufacturing, transport, heat and supply chains. This 21-page note quantifies each opportunity and reviews 5,500 patents to identify who benefits, among Capital Goods companies, AM Specialists and the Materials sector.

-

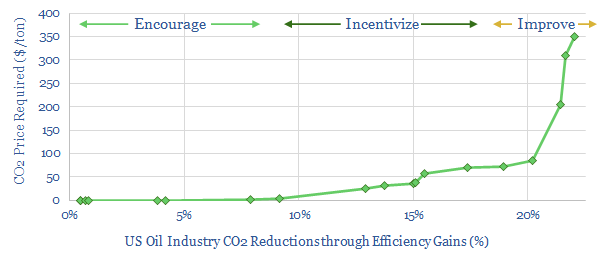

Efficient frontiers: improvements from a CO2 price within oil and gas?

A CO2 price of $40-80/ton could double the pace of industrial efficiency gains in the oil and gas sector, eliminating 15-20% of its CO2 emissions, as outlined in this 14-page note. Cost-curves would steepen in E&P and refining. Technology leaders benefit. Spending would also accelerate, particularly for heat exchangers, compressors, digitization and electrification projects.

-

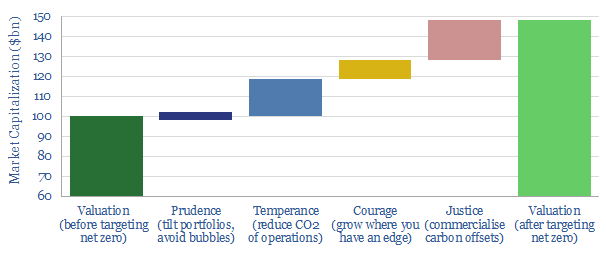

Net zero Oil Majors: four cardinal virtues?

Attaining ‘Net Zero’ can uplift an Energy Major’s valuation by c50%. This means emitting no net CO2, either from the company’s operations or from the use of its products. This 19-page report shows how a Major can best achieve ‘net zero’ by exhibiting four cardinal virtues. Decarbonization is not a threat but an opportunity.

-

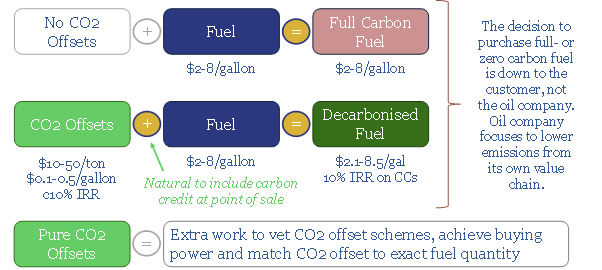

Can carbon-neutral fuels re-shape the oil industry?

Fuel retailers have a game-changing opportunity seeding new forests, outlined in our 26-page note. They could offset c15bn tons of CO2 per year at a competitive cost, well below c$50/ton. We 15-25% uplifts in the value of fuel retail stations, allaying fears over CO2, and benefitting as road fuel demand surges after COVID.

-

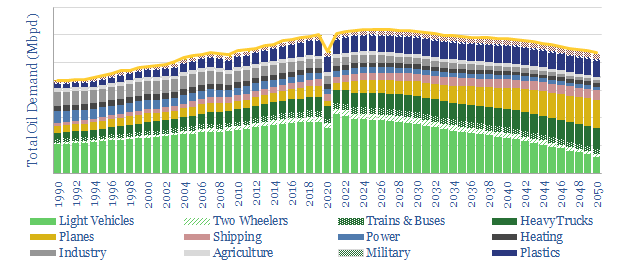

On the road: long-run oil demand after COVID-19?

Another impact of COVID-19 may still lie ahead: a 1-2Mbpd upwards jolt in global oil demand. This 17-page note upgrades our 2022-30 oil demand forecasts by 1-2Mbpd above our pre-COVID forecasts. The increase is from road fuels, reflecting lower mass transit, lower load factors and resultant traffic congestion.

-

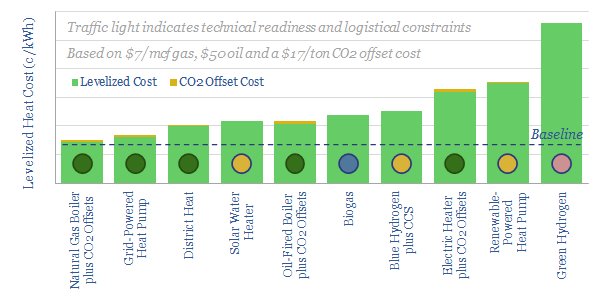

Decarbonize Heat?

Natural gas fuels two-thirds of residential and commercial heating, which in turn comprises c10% of global CO2. We assessed ten technologies to decarbonize heat, including heat pumps, renewables, biogas and hydrogen. The lowest cost solution is to double down on natural gas with nature-based carbon offsets.

-

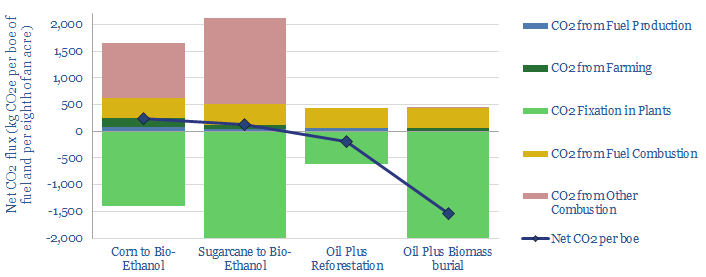

Biofuels: better to bury than burn?

The global bioethanol industry could be disrupted by a carbon price. Somewhere between $15-50/ton, it becomes more economical to bury the biofuel crop, rather than convert it into biofuels. This would remove 8x more CO2 per acre, at a lower total cost. Ethanol mills and blenders would be displaced.

-

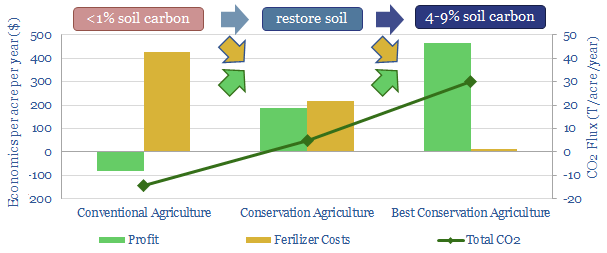

Conservation agriculture: farming carbon into soils

Conservation agriculture builds up carbon in soil. It can sequester 3-15 bn tons of CO2 per year, generating carbon credits, while restoring loss-making farmlands to exceptional profitability. Fertilizer demand would be decimated. This 17-page report outlines the opportunity, costs, CO2-removal, winners and losers.

-

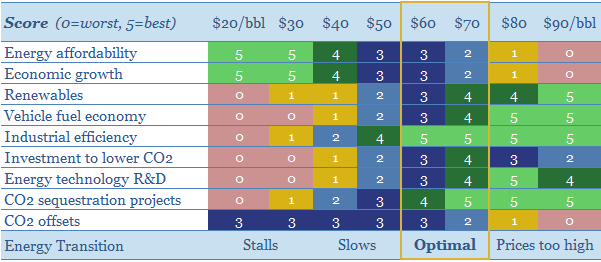

What oil price is best for energy transition?

$30/bbl oil prices stall the energy transition. They kill the relative economics of electric vehicles, renewables, industrial efficiency, flaring reductions, CO2 sequestration and new energy R&D. This 15-page note finds $60/bbl oil is ‘best’ for decarbonization. Policymakers should target $60 oil.

-

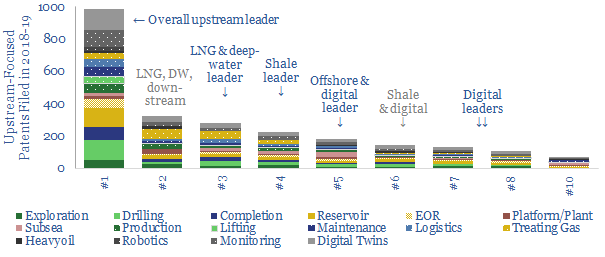

Upstream technology leaders: weathering the downturn?

This 14-page report assesses 6,000 patents from 2018-19, to determine which Energy Majors are best-placed to weather the downturn, benefit from dislocation and thrive in the recovery. We find clear leaders in onshore, offshore, shale, LNG and digital. Other Majors may be pulling back from upstream oil and gas.

Content by Category

- Batteries (89)

- Biofuels (44)

- Carbon Intensity (49)

- CCS (63)

- CO2 Removals (9)

- Coal (38)

- Company Diligence (95)

- Data Models (840)

- Decarbonization (160)

- Demand (110)

- Digital (60)

- Downstream (44)

- Economic Model (205)

- Energy Efficiency (75)

- Hydrogen (63)

- Industry Data (279)

- LNG (48)

- Materials (82)

- Metals (80)

- Midstream (43)

- Natural Gas (149)

- Nature (76)

- Nuclear (23)

- Oil (164)

- Patents (38)

- Plastics (44)

- Power Grids (130)

- Renewables (149)

- Screen (117)

- Semiconductors (32)

- Shale (51)

- Solar (68)

- Supply-Demand (45)

- Vehicles (90)

- Wind (44)

- Written Research (354)