-

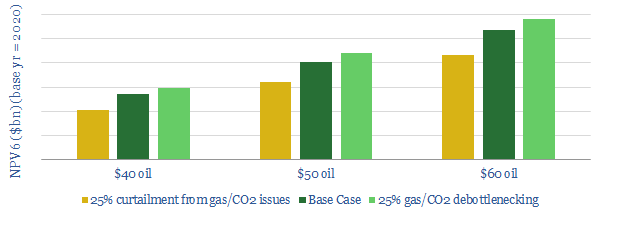

Mero Revolutions: countering CO2 in pre-salt Brazil?

The super-giant Mero field in pre-salt Brazil is not like its predecessors. It has a 2x higher gas cut, of which c45% is CO2. Handling the CO2 is critical. Hence, Petrobras, Shell, TOTAL and partners are pushing the boundaries of deepwater technology. We review four innovations, which can sway the field’s value by $6bn.

-

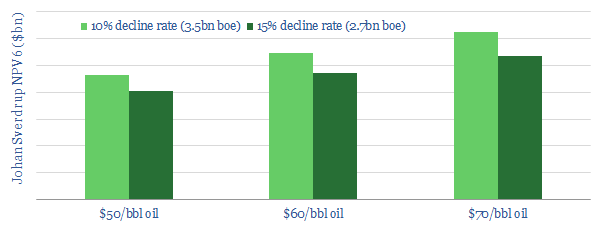

Johan Sverdrup: Don’t Decline?

Equinor is deploying three world-class technologies to mitigate Johan Sverdrup’s decline rates, based on reviewing c115 of the company’s patents and dozens of technical papers. Our 15-page note outlines how its efforts may unlock an incremental $3-5bn of value, as production surprises to the upside.

-

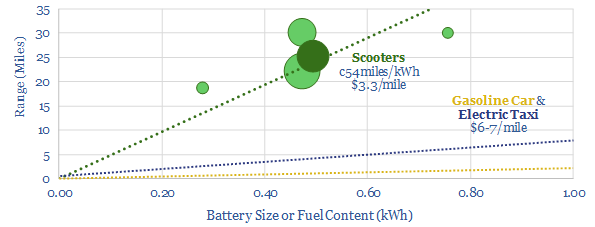

Scooter Wars?

E-scooters can transform urban mobility, eliminating 2Mbpd of oil demand by 2030, competing amidst the ascent of “electric vehicles” and re-shaping urban economies. These implications follow from e-scooters having 25-50x higher energy efficiencies, higher convenience and c50% lower costs than gasoline vehicles, over short 1-2 mile journeys. Our 12-page note explores the consequences.

-

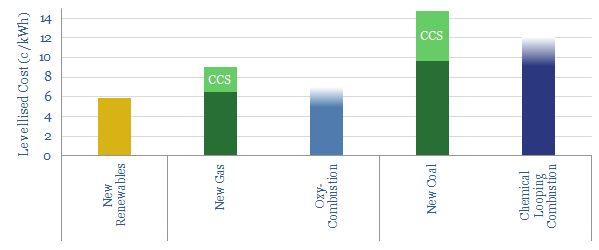

De-Carbonising Carbon?

Decarbonisation is often taken to mean the end of fossil fuels. It is more feasible simply to de-carbonise them, with next-generation combustion technologies. This 19-page note explores our top two opportunities: ‘Oxy-Combustion’ using the Allam Cycle and Chemical Looping Combustion. This means zero carbon coal & gas at competitive economics. Leading Oil Majors are supporting…

-

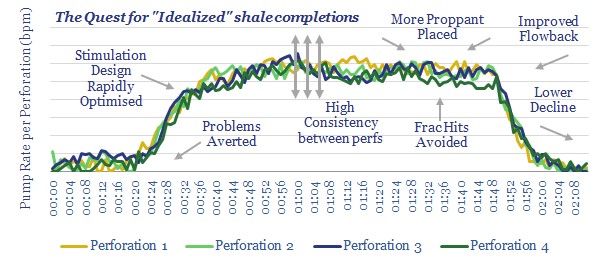

Shale: Upgrade to Fiber?

Distributed Acoustic Sensing (DAS) uses fiber-optic cables to “hear” along a shale well, meter-by-meter, in real time. It is transformational for optimising completions and now gaining critical momentum. Our new note outlines the technology, its maturation and how it can help double shale productivity. Economics work at $15/bbl. The service industry is disrupted. Leading companies…

-

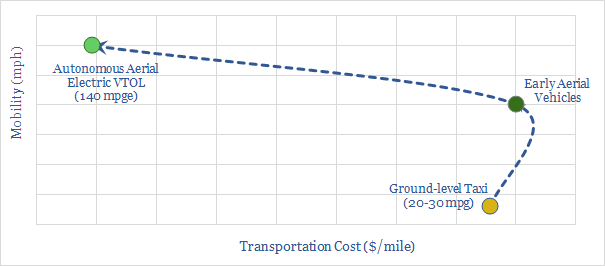

Aerial Ascent: why flying cars fly

Aerial vehicles will do in the 2020s what electric vehicles did in the 2010s: going from a niche technology to a global mega-trend that no forecaster can ignore, improving mobility by 100x. The technology is advancing rapidly. Fuel economies and costs are transformational. Aerial vehicles accelerate the energy transition.

-

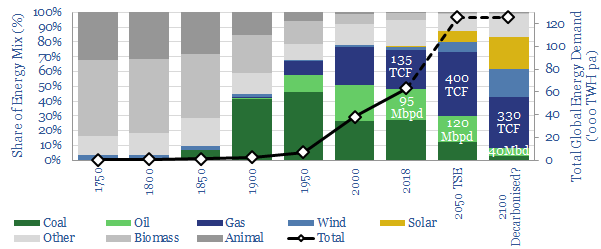

Oil Companies Drive the Energy Transition?

There is only one way to decarbonise the energy system: leading companies must find economic opportunities in better technologies. No other route can source sufficient capital to re-shape the industry. We outline seven game-changing opportunities. Remarkably, leading energy Majors are already pursuing them.

-

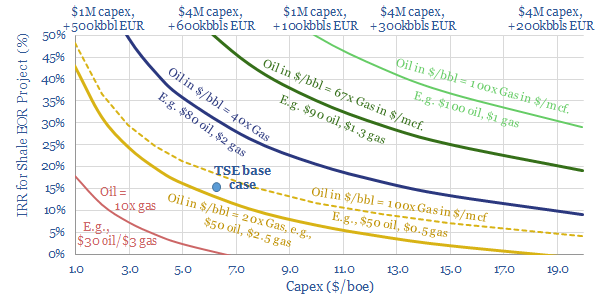

Shale EOR: Container Class

Will Shale-EOR add another leg of unconventional upside? The topic jumped into the ‘Top 10’ most researched shale themes last year, hence we have reviewed the opportunity in depth. Stranded in-basin gas will improve the economics to c20% IRRs (at $50 oil). Production per well can rise by 1.5-2x. The theme could add 2.5Mbpd to…

-

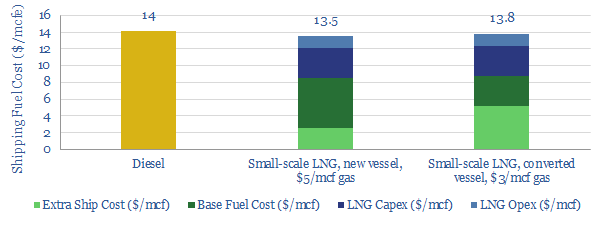

LNG in transport: scaling up by scaling down?

Next-generation technology in small-scale LNG has potential to reshape the global shipping-fuels industry. Especially after IMO 2020 sulphur regulations, LNG should compete with diesel. Opportunities in trucking and shale are less clear-cut.

-

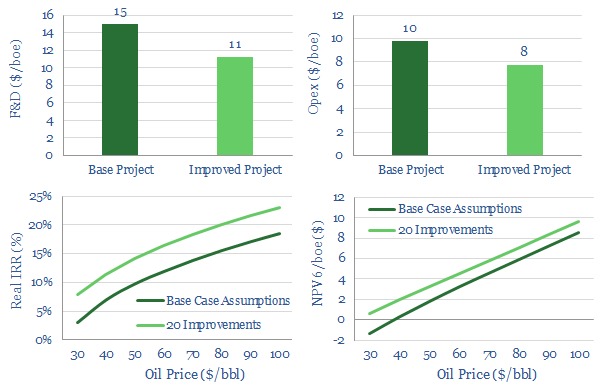

Can Technology Revive Offshore Oil?

We model our ‘top twenty’ technology opportunities for offshore oil. These can double deep-water NPVs and improve IRRs 4-5%. To re-excite investment, it is crucial to harness the best technologies.

Content by Category

- Batteries (89)

- Biofuels (44)

- Carbon Intensity (49)

- CCS (63)

- CO2 Removals (9)

- Coal (38)

- Company Diligence (94)

- Data Models (838)

- Decarbonization (160)

- Demand (110)

- Digital (59)

- Downstream (44)

- Economic Model (204)

- Energy Efficiency (75)

- Hydrogen (63)

- Industry Data (279)

- LNG (48)

- Materials (82)

- Metals (80)

- Midstream (43)

- Natural Gas (148)

- Nature (76)

- Nuclear (23)

- Oil (164)

- Patents (38)

- Plastics (44)

- Power Grids (130)

- Renewables (149)

- Screen (117)

- Semiconductors (32)

- Shale (51)

- Solar (68)

- Supply-Demand (45)

- Vehicles (90)

- Wind (44)

- Written Research (354)