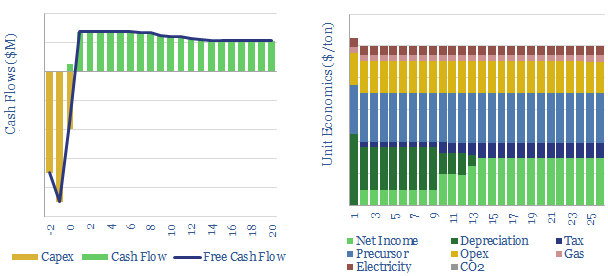

Carbon fiber production costs are estimated at $25/kg in this data-file, in order to generate a 10% IRR at a new world-scale carbon fiber plant. Energy economics are broken down across the value chain. The production process will likely emit 30 tons of CO2 per ton of carbon fiber if powered by a mixture of gas and electricity.

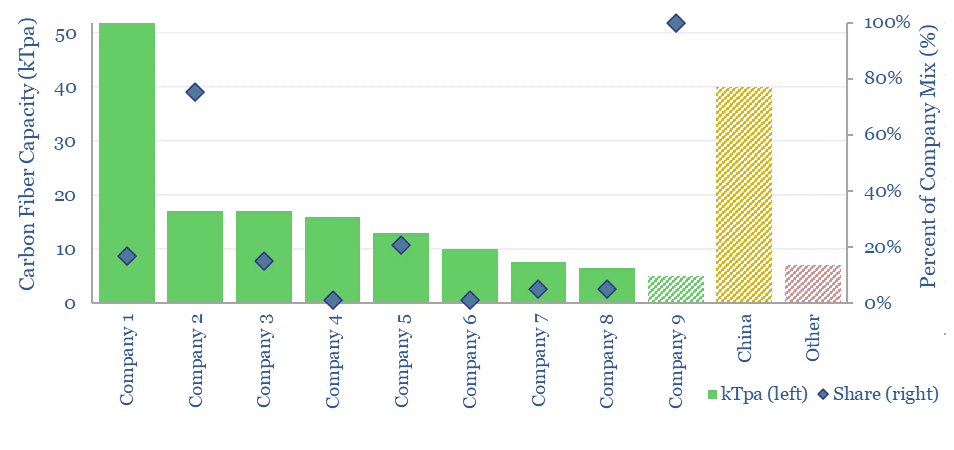

The global carbon fiber market is around 150kTpa as of 2024, of which c50% is used for aerospace and defence which is stepping up structurally in our macro outlook for defence versus decarbonization, c20% is for leisure equipment, and the remainder is largely linked to categories that matter in the energy transition, such as light-weighting vehicles, wind, advanced conductors and hydrogen storage.

Carbon fiber production costs are estimated in this data-file, building up from first principles, across capex, precursor materials, gas, electricity, opex, CO2 penalties, utilization rates, manufacturing yields and returns.

Carbon fiber pricing is tracked in our database of commodity prices. Recent buoyant pricing can unlock 30-40% facility-level IRRs.

This data-file also contains technical data across the entire value chain leading up to carbon fibers (e.g., polyacrylonitrate), tensile strength versus weight properties, and our detailed notes from technical papers.

A screen of leading companies in the carbon fiber industry is also provided, reviewing production volumes and positioning (below). Producers are listed in Japan, the US, Germany, and other Asia/Europe. The screen was last updated in May-2024.

The carbon fiber market has been hampered in 2020-21 by weak volumes in the aviation industry (post-COVID) which is now slowly recovering, and in 2023 by a slowdown for offshore wind.

Please download the data-file to stress test inputs for carbon fiber production costs, such as capex costs, electricity costs, gas prices and CO2 costs. Our outlook for 2024 sees potentially growing demand for advanced conductors to help resolve power grid bottlenecks.