Oil

-

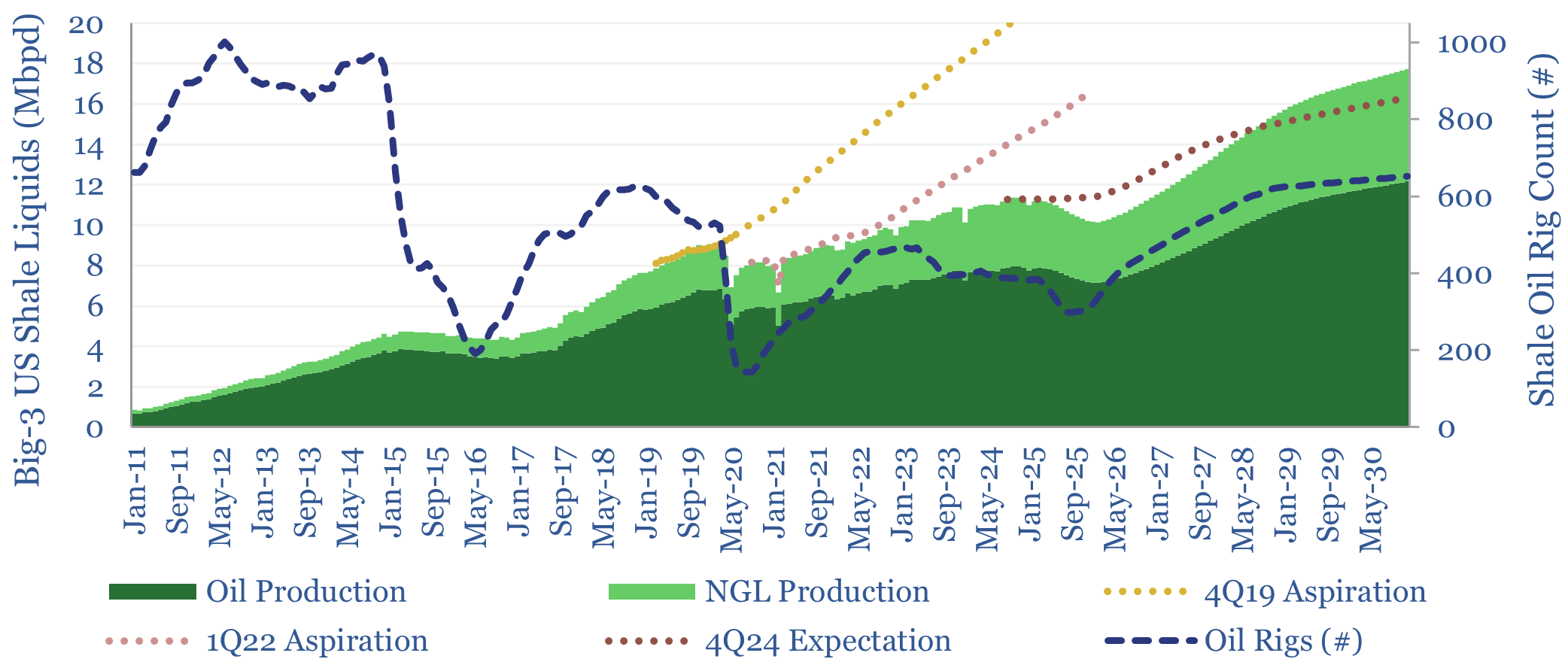

US shale: outlook and forecasts?

This model sets out our US shale production forecasts by basin. It covers the Permian, Bakken, Eagle Ford, Marcellus/Utica and Haynesville, as a function of the rig count, drilling productivity, completion rates, well productivity and type curves. The data-file was last updated in May-2025, revising liquids growth negative in 2025-26, which in turn tightens US…

-

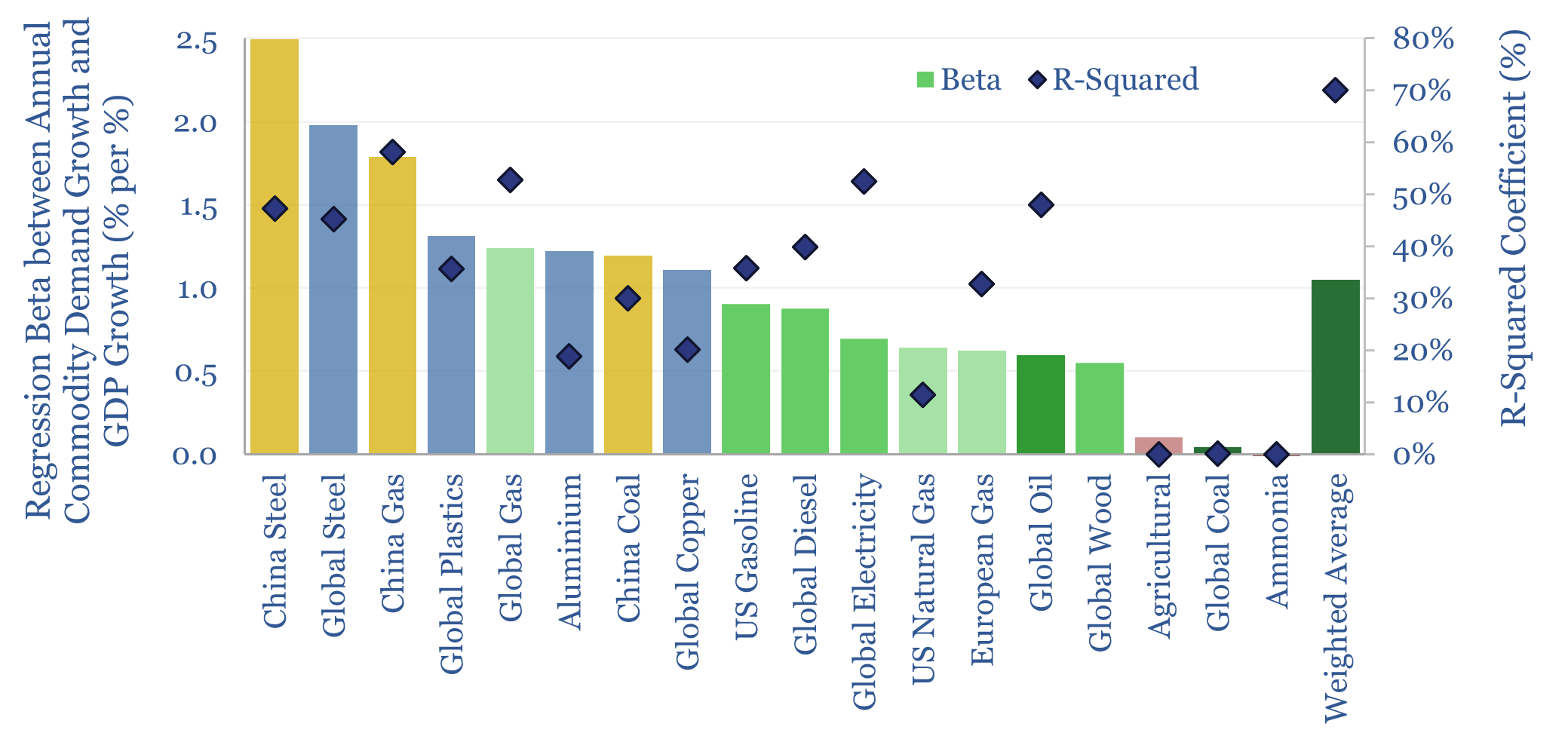

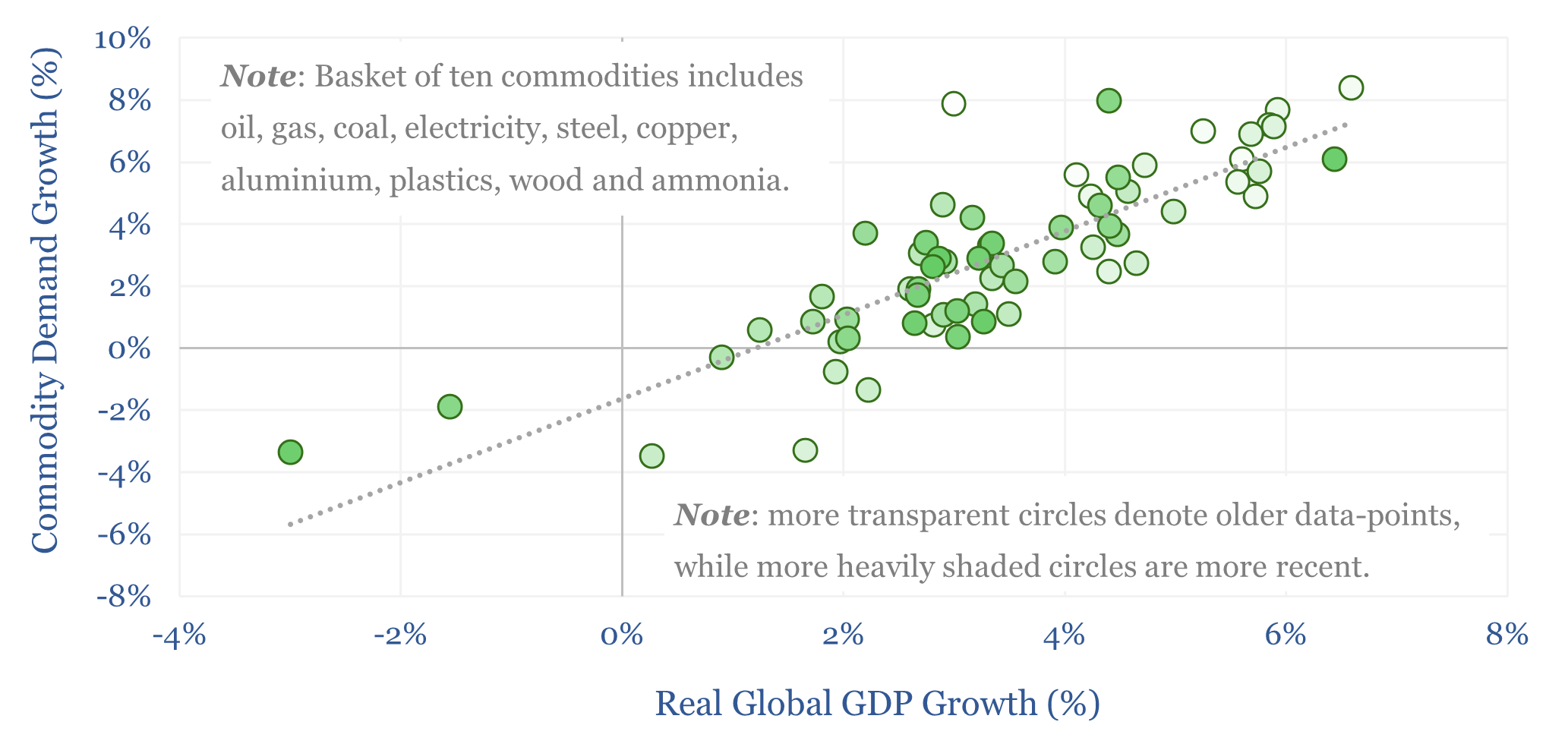

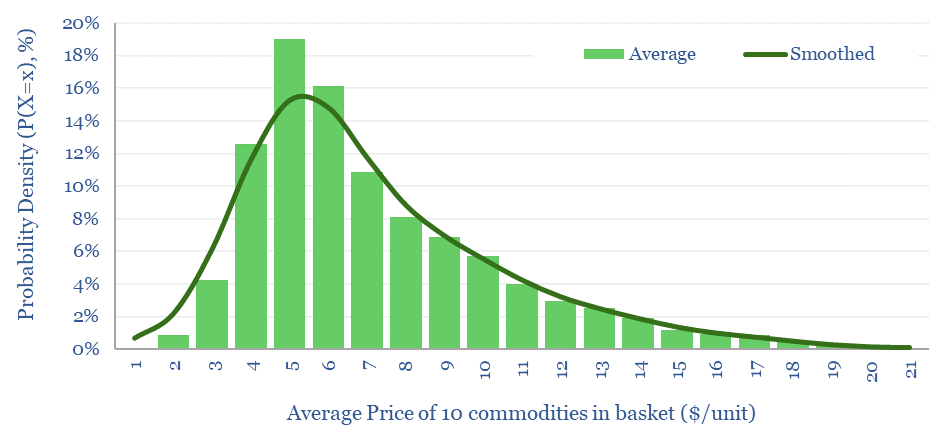

Commodity demand: how sensitive to GDP growth?

How sensitive is global commodity demand to GDP growth? This 15-page report runs regressions for 25 commodities. Slower GDP growth matters most for oil markets, which are entering a new, more competitive, era. China is also slowing. But we still see bright spots in gas, metals, materials in our 2025 commodity outlook.

-

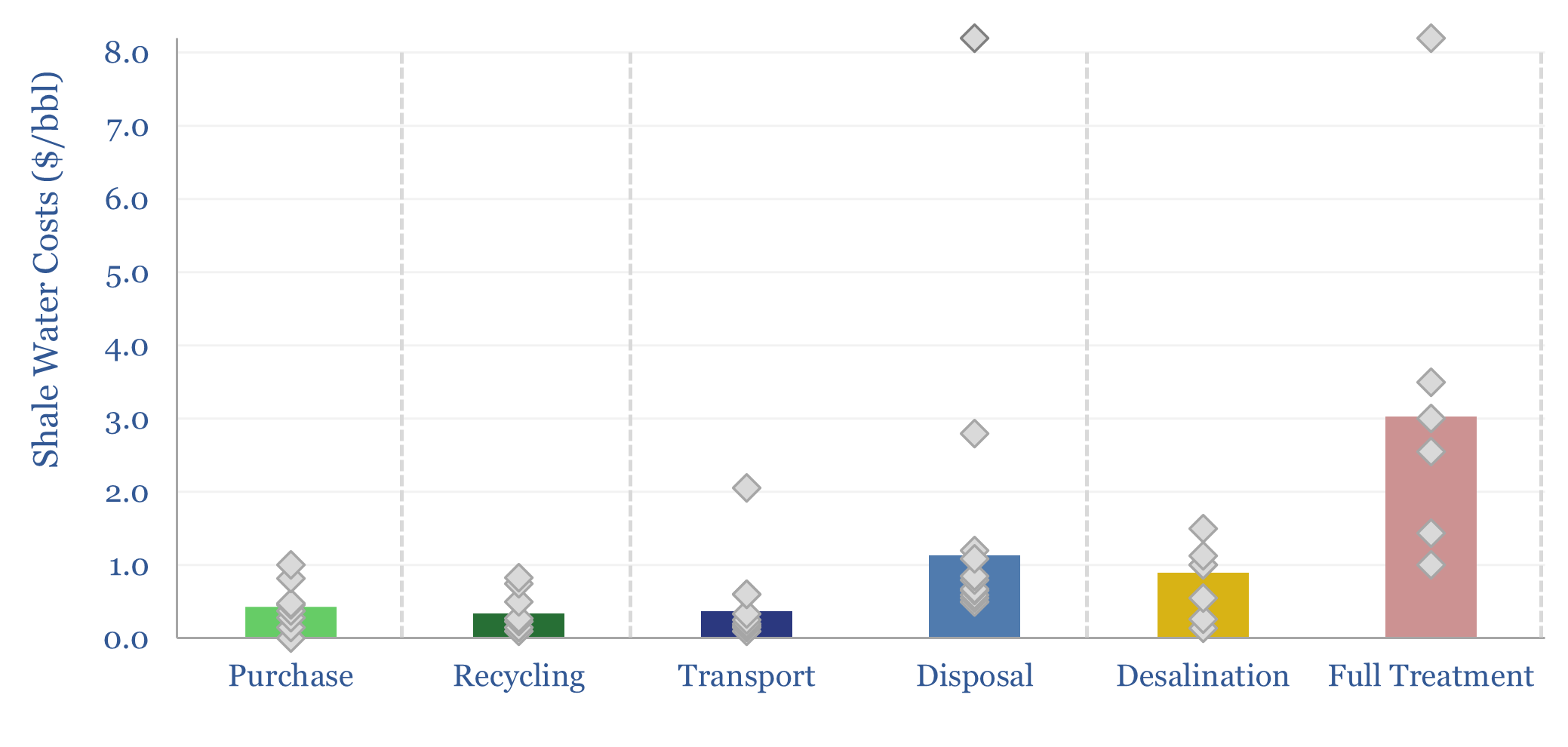

Shale water costs: transport, treatment and disposal?

Shale water costs might average $0.3/bbl for filtering and recycling, $0.4/bbl to procure new water, $1/bbl for disposal and $3/bbl for full treatment back to agricultural/cooling-quality water. There is variability in water properties and throughout shale basins. This data-file aggregates disclosures into shale water costs.

-

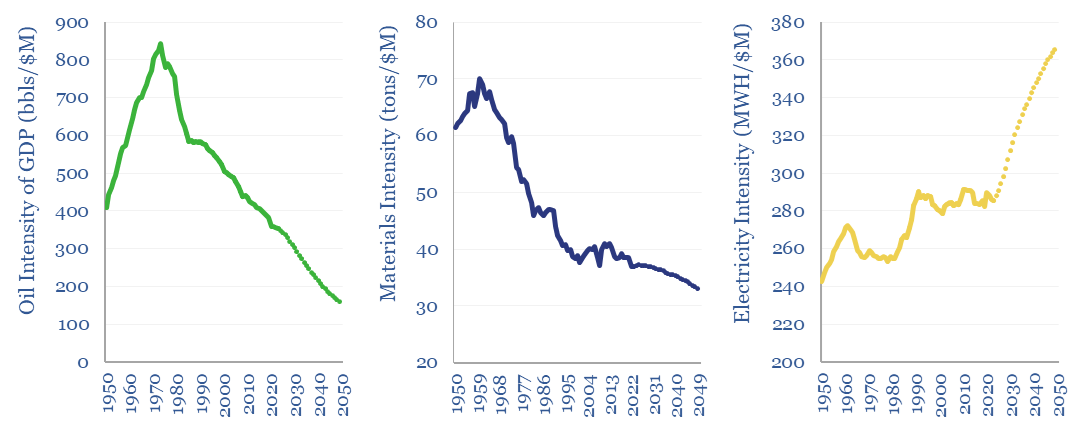

Commodity intensity of global GDP in 30 key charts?

The commodity intensity of global GDP has fallen at -1.2% over the past half-century, as incremental GDP is more services-oriented. So is this effect adequately reflected in our commodity outlooks? This 4-page report plots past, present and forecasted GDP intensity factors, for 30 commodities, from 1973->2050. Oil is anomalous. And several commodities show rising GDP…

-

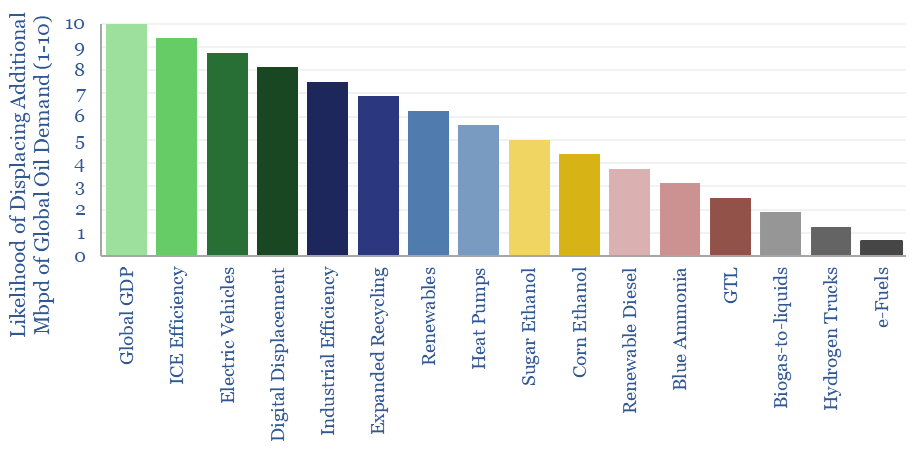

Oil demand: making millions?

What does it take to move global oil demand by 1Mbpd? This 22-page note ranks fifteen themes, based on their costs and possible impacts. We still think oil demand plateaus around 105Mbpd mid-late in the 2020s, before declining to 85Mbpd by 2050. But the risks now lie to the upside?

-

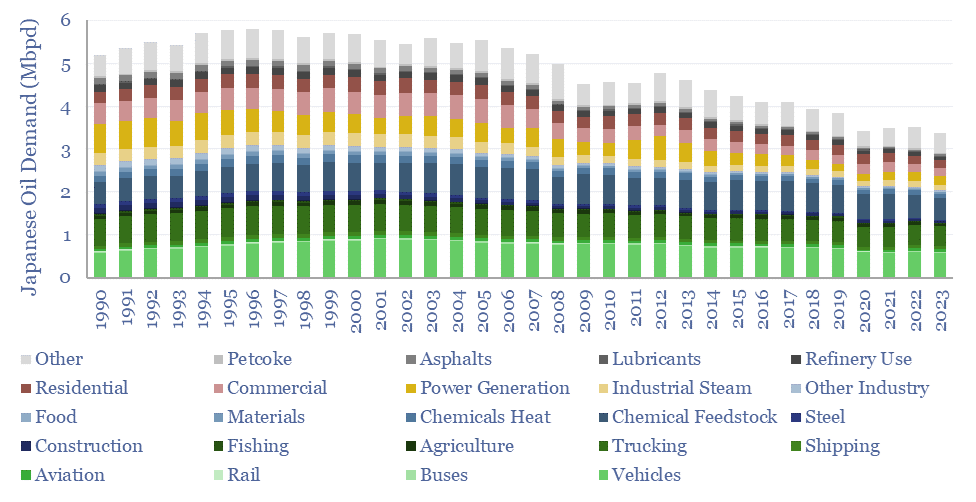

Japan oil demand: breakdown over time?

Japan’s oil demand peaked at 5.8Mbpd in 1996, and has since declined at -2.0% per year to 3.4Mbpd in 2023. To some, this trajectory may be a harbinger of events to come in broader global oil markets? While to others, Japan has unique features that do not generalize globally? Hence this report and data-file…

-

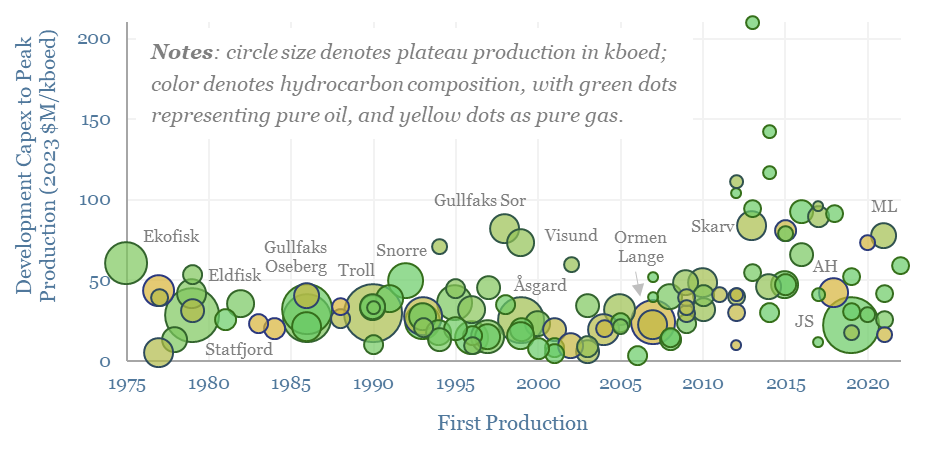

Offshore oilfields: development capex over time in Norway?

Across 130 offshore oil fields in Norway, going back ato 1975, real development capex per flowing barrel of production has averaged $33M/kboed. Average costs have been 2x higher when building during a boom, when one-third of projects blew out to around $100M/kboed or higher. The data support countercyclical investment strategies in energy.

-

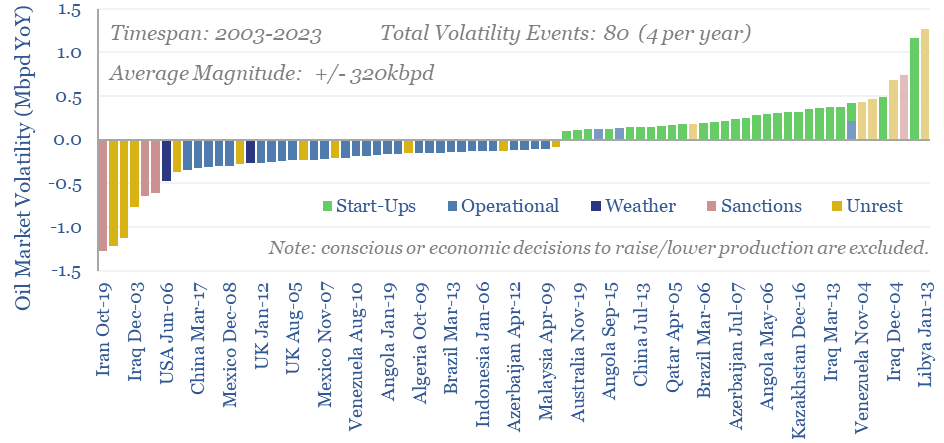

Oil markets: rising volatility?

Oil markets endure 4 major volatility events per year, with a magnitude of +/- 320kbpd, on average. Their net impact detracts -100kbpd. OPEC and shale have historically buffered out the volatility, so annual oil output is 70% less volatile than renewables’ output. This 10-page note explores the numbers and the changes that lie ahead?

Content by Category

- Batteries (88)

- Biofuels (44)

- Carbon Intensity (49)

- CCS (63)

- CO2 Removals (9)

- Coal (38)

- Company Diligence (93)

- Data Models (834)

- Decarbonization (160)

- Demand (110)

- Digital (59)

- Downstream (44)

- Economic Model (203)

- Energy Efficiency (75)

- Hydrogen (63)

- Industry Data (278)

- LNG (48)

- Materials (82)

- Metals (79)

- Midstream (43)

- Natural Gas (148)

- Nature (76)

- Nuclear (23)

- Oil (164)

- Patents (38)

- Plastics (44)

- Power Grids (127)

- Renewables (149)

- Screen (116)

- Semiconductors (30)

- Shale (51)

- Solar (67)

- Supply-Demand (45)

- Vehicles (90)

- Wind (43)

- Written Research (352)