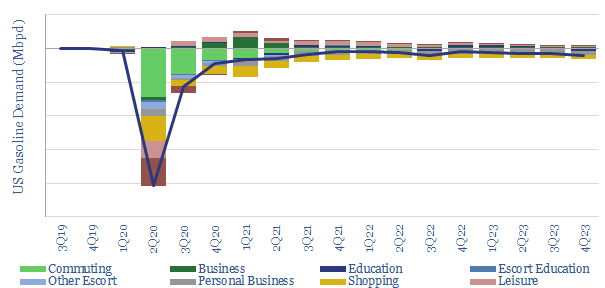

US gasoline is the largest component of global oil demand, at c9Mbpd, or c9% of the global market. Hence we have modelled how it could be impacted by COVID-19, looking line by line, across a granular, c100-line breakdown.

A -2Mbpd contraction is possible in 2Q20, if 34% of all US workplaces close temporarily and 50% of non-essential travel is cancelled. This is an extreme scenario, commensurate with a c5pp slowdown in US GDP, comparable to the “Great Recession” of 2008-09 in economic terms, but with 8x deeper demand destruction for gasoline.

Such steep declines are not inconceivable, from a modelling perspective. They could underpin a c10Mbpd YoY collapse in global oil demand.

How quickly could demand rebound? Very minimal long-term impacts persist from 2022 onwards, with demand destruction of just 60kbpd in 2023-24. We can even construct scenarios where US gasoline demand surprises to the upside, rising +0.5Mbpd, if COVID is brought under control. So when the oil market does turn, it may turn very quickly.

To run your own scenarios, please download the model.