This patent screen reviews Eastman’s molecular recycling technology. Specifically, Eastman is spending over $2bn, to construct 3 plants, with 380kTpa of capacity, to break down hard-to-recycle polyesters back into component monomers, with 20-80% lower CO2 intensity than virgin product. We find evidence for 30-years of fine-tuning, and can bridge to 10% IRRs if buyers pay sufficient premia for the recycled outputs.

Eastman Chemical is a specialty materials company, founded in 1920, once part of Kodak, headquartered in Tennessee, with 14,000 employees, 2023 revenues of $9.2bn, EBIT of $1.3bn, and market cap of $11.5bn at the time of writing. It has 36 manufacturing facilities in 12 countries.

The reason for this patent screen is to explore whether Eastman has an edge in hard-to-recycle polyesters, via the methanolysis technology it has been fine-tuning for the past 30+ years, and where it is spending over $2bn to construct three 110-160kTpa facilities in the US and Normandy.

Specifically, Eastman notes “we are transforming the plastics industry by creating solutions that enable a circular economy for plastics, where waste is minimized and materials are reused and recycled… by leveraging our unique molecular recycling technologies, which allow us to convert plastic waste into high-performance, high-quality products”.

This data-file contains our notes on Eastman’s three polyester methanolysis plants, at Kingsport (Tennessee), Longview (Texas) and Normandy (France), tabulating disclosures into their capacities, costs and energy/CO2 intensities, which are 20-80% lower than virgin polyester production, which starts via naphtha cracking.

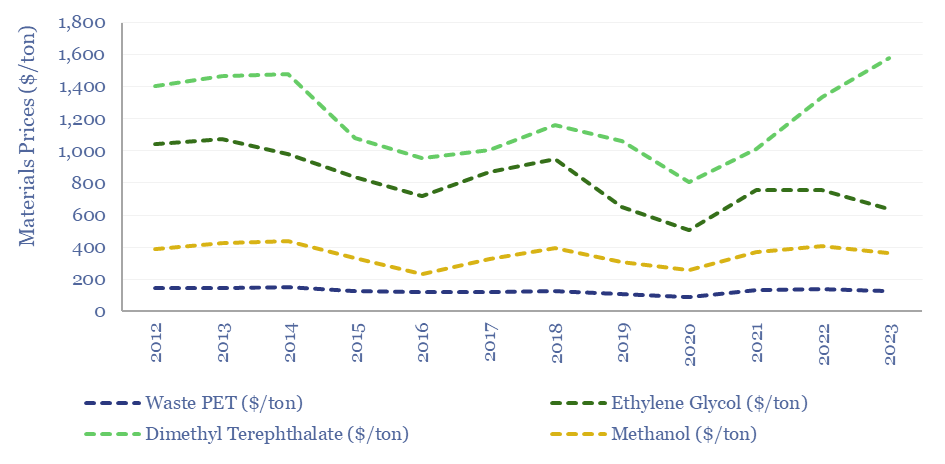

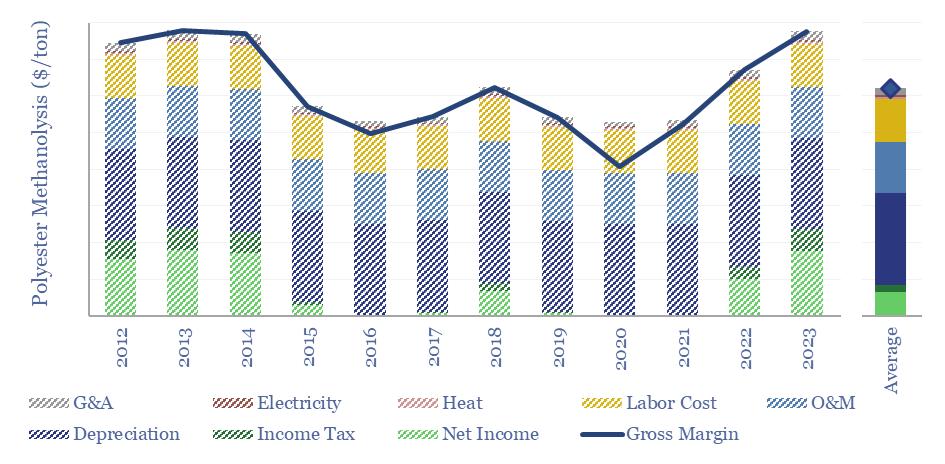

We have also assessed the economics of Eastman’s methanolysis technology, which dissolves polyesters in ethylene glycol and dimethyl terephthalate, then uses 200ºC methanol at 30-50 psi of pressure to cleave apart the ester bonds, releasing more ethylene glycol and dimethyl terephthalate, which can later be separated out. We have based our EBIT calculations on ten years of polymer pricing history and on our broader model of mechanical plastic recycling.

What economics for polyester methanolysis? IRRs, margins and total EBITDA for Eastman’s molecular recycling technology, at different pricing premia, are discussed in the data-file. 10% IRRs are achievable at these projects if buyers are willing to pay a premium for recycled products.

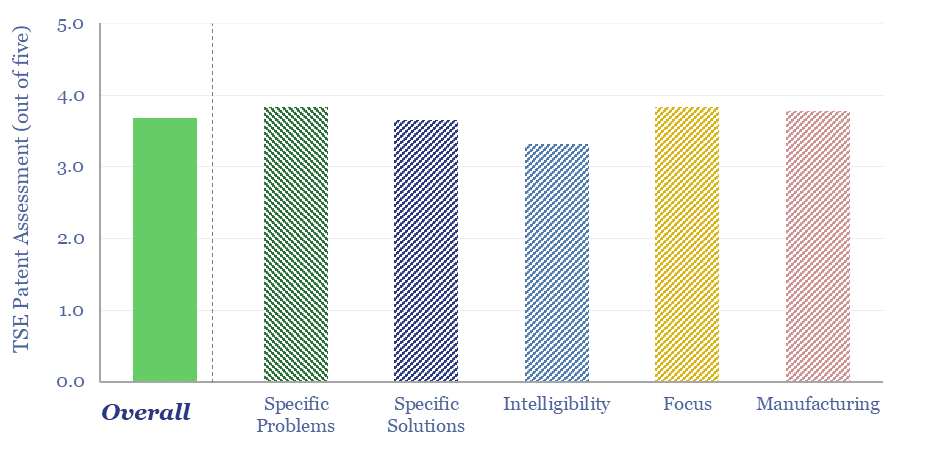

Finally, our sense from reviewing Eastman’s polyester methanolysis patents is that 30-years have been spent fine-tuning the yields, efficiency and resiliency. The key positive for us, was the patent disclosure into improved catalysts, which seems well locked-up.

The key challenge is the complexity of Eastman’s molecular recycling technology, which still seems sensitive to feedstock contaminants. Purifying side-reaction products is also adding to the high capex costs and complexity. More details from our patent review are in the data-file.