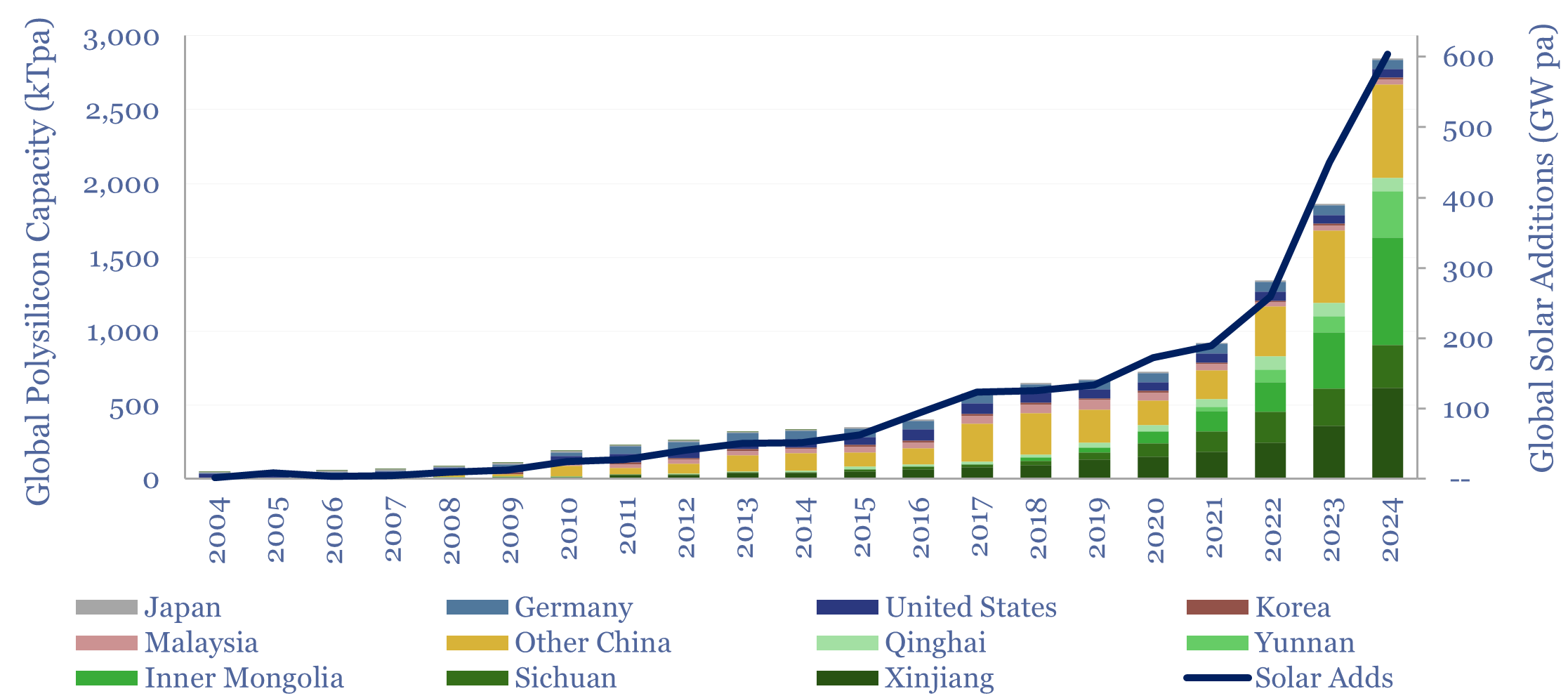

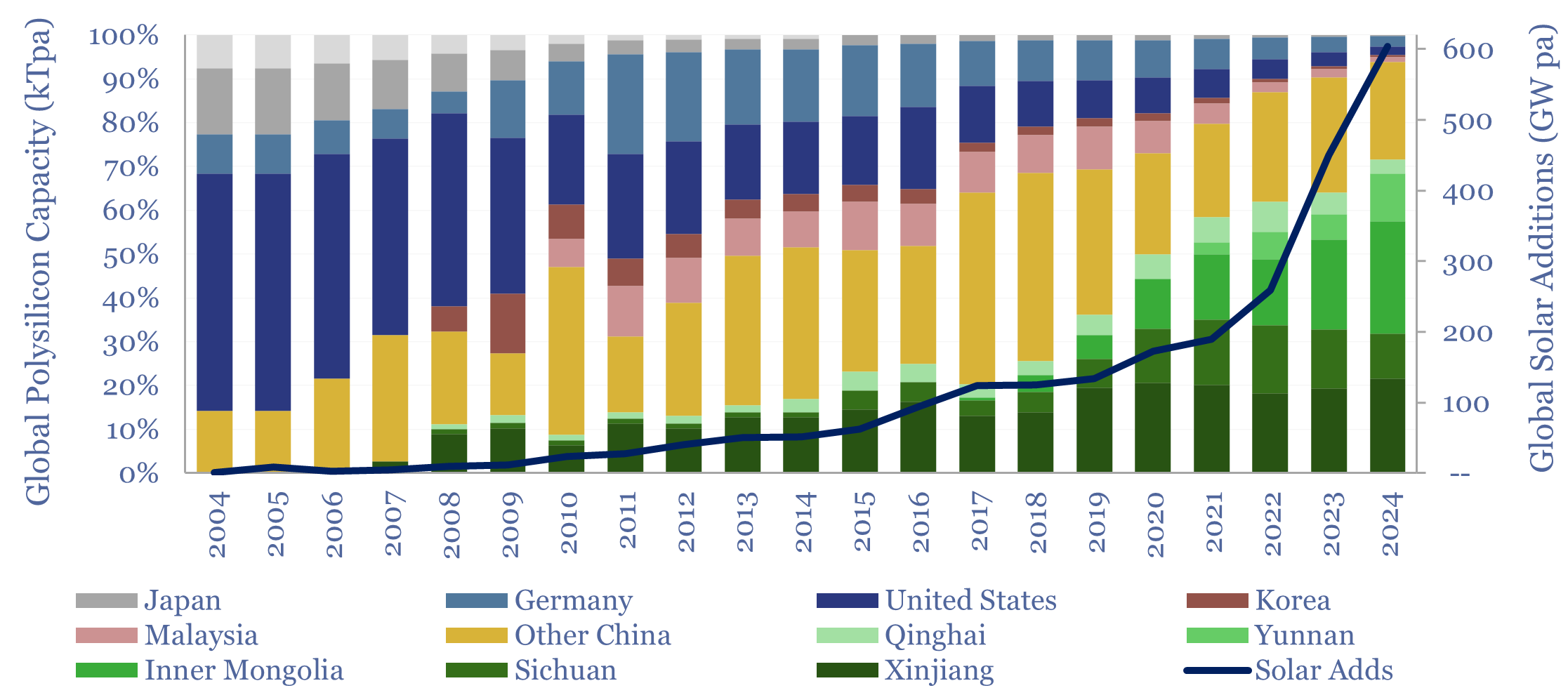

Polysilicon is a highly pure, crystalline silicon material, used predominantly for photovoltaic solar, and also for ‘chips’ in the electronics industry. Global polysilicon capacity reached 3MTpa in 2024, and global polysilicon production surpassed 1.7MTpa in 2024. China now dominates the industry, approaching 94% of all global capacity.

Polysilicon is a highly pure form of silicon material (over 99.999%), often formed via the Siemens process, converting 98-99% pure metallurgical grade silicon into silane gases, then vapor depositing pure silicon crystals out of the silane gas, at 10-20nm per minute, at 600-1,100◦C temperatures, for 80-110 hours. Polysilicon is then further purified and crystallized into mono-crystalline polysilicon via the Czochralski method, for use in photovoltaic solar and other semiconductor chips (over here, model here).

Global polysilicon production capacity likely reached 3MTpa in 2024 and global polysilicon production reached 1.7MTpa. For context, production of the key input material, silicon metal, is around 9MTpa (per the USGS), and production of the key raw material, silica, is around 350 MTpa (per our silica screen).

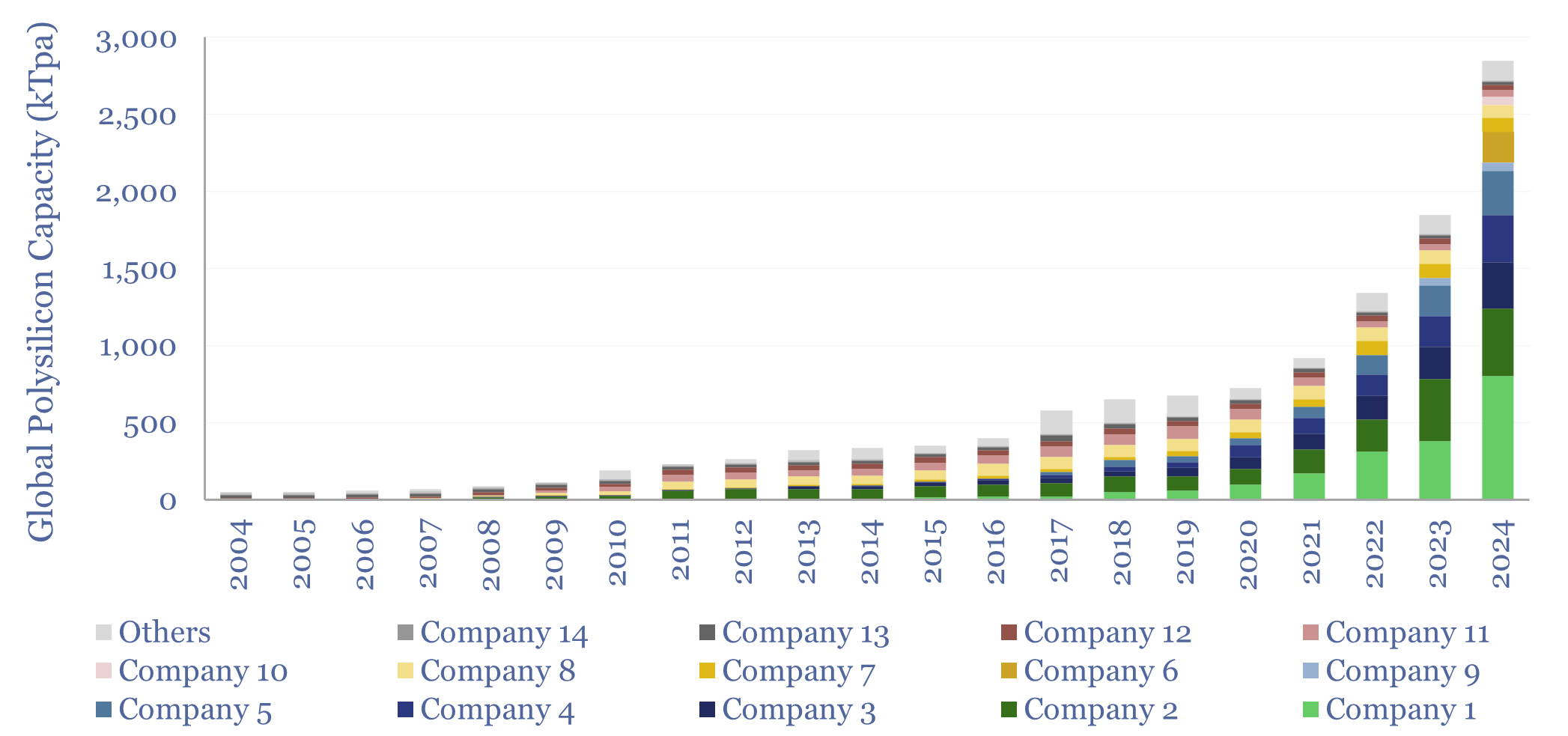

This data-file aggregates polysilicon production by facility, by company, by region, by country and over time. China now controls almost 94% of the world’s polysilicon production capacity, with six large Chinese companies comprising over 80% of capacity.

Aggregating polysilicon production data is opaque. Some large Chinese producers publish surprisingly little data. Others have mysteriously deconsolidated production facilities, especially in Xinjiang, after international groups criticized their use of Uyghur labor. Another issue is that some facilities have appeared to operate well above nameplate capacity, raising questions about what their ‘capacity’ really is.

Global polysilicon production by company is estimated in one tab of this data-file, simply taking the best public data-points we can find, triangulating between different sources, and settling on the most sensible estimates that we can find.

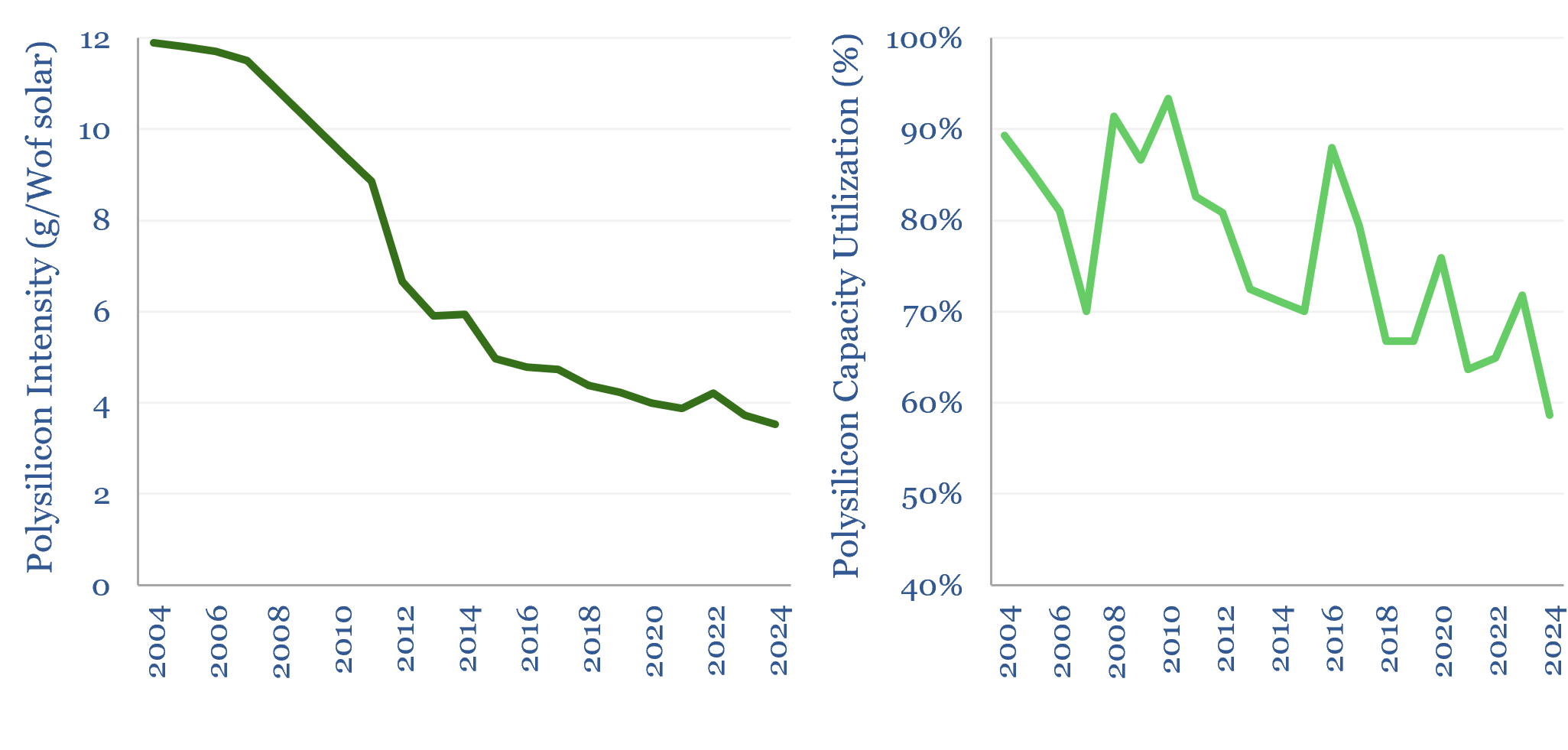

Although gross solar additions have risen by 65x in the past 15-years, growing at a CAGR over 30% per annum, surpassing +600GW YoY in 2024, this has not been entirely propitious for polysilicon incumbents. The materials balance of a solar module has seen thinner wafers reducing polysilicon intensity by two-thirds since 2005 (chart below-left), while rapid capacity expansion in China has seen utilization fall from around 85% on average around 2010 to below 60% in 2024 (chart below-right). This may be an important lesson for other value chains with large growth ahead in the energy transition.

Profiling this industry does not reveal bottlenecks in polysilicon de-railing the rise of solar, but if anything, the opposite. We foresee solar module additions hitting 700GW in 2025, 1TW pa in 2028 and 3TW pa by 2050. There may be soft bottlenecks in silver and ITO thin films. But the main bottleneck for solar is in the grid.