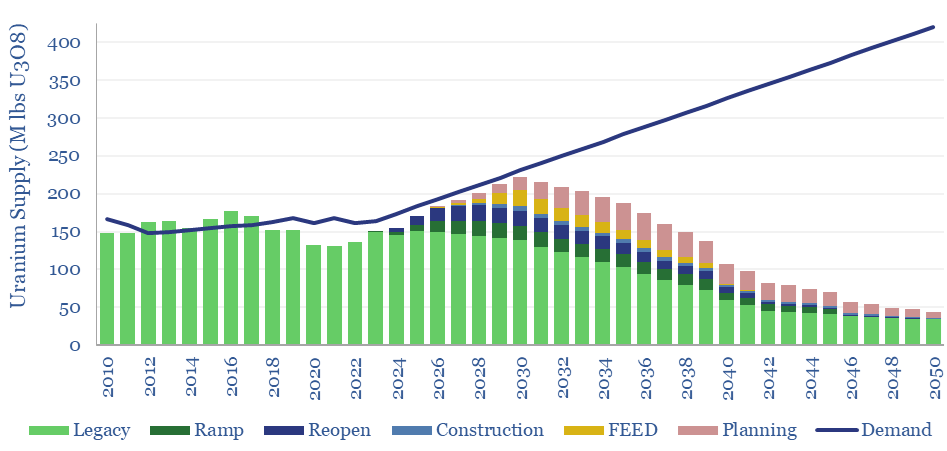

Our global uranium supply-demand model sees the market 5% under-supplied through 2030, including 7% market deficits at peak in 2025, as demand ramps from 165M lbs pa to 230M lbs pa in 2030. This is even after generous risking and no room for disruptions. What implications for broader power markets, decarbonization ambitions, and uranium prices?

The world’s nuclear fleet generated 2,700 TWH of electricity in 2023, consuming 165 M lbs of mined uranium (on a U3O8 yellow-cake basis). We see these numbers rising to 3,800 TWH pa of electricity and 230 M lbs pa of uranium by 2030, then to 7,000 TWH pa and 420 M lbs by 2050 as part of our Roadmap to Net Zero.

But can uranium production keep up? Global uranium production was only 150 M lbs in 2023, as nuclear utilities were over-contracted in 2012-2017, and have been drawing down inventories for the past five years. Of course, inventory draws cannot continue forever.

This uranium supply-demand model sees the market 5% under-supplied in aggregate through 2030, with the under-supply peaking at 7% of the market in 2025.

This is concerning because as things stand there will not be enough uranium mined and upgraded to ramp nuclear generation. In the short-term, this could raise power prices and demand could surprise to the upside for other round-the-clock generation sources, such as natural gas.

Uranium prices must sustainedly rise above the incentive price for developing more uranium mines. And perhaps they may sustain far above this incentive price, amidst persistent market shortages, as regional reserve margins require for nuclear plants to run, and each $10/lb on the uranium price only adds 0.05 c/kWh to the marginal cost at a nuclear power plant.

These uranium supply forecasts are based on evaluating around 100 production assets and developments, generating an outlook for each one.

Assumptions include a typical decline rate of 3% pa, 80% risking on new assets re-opening and developments that are underway, 50% risking on FEED-stage projects and 30% risking on planning-stage projects, on average throughout the model.

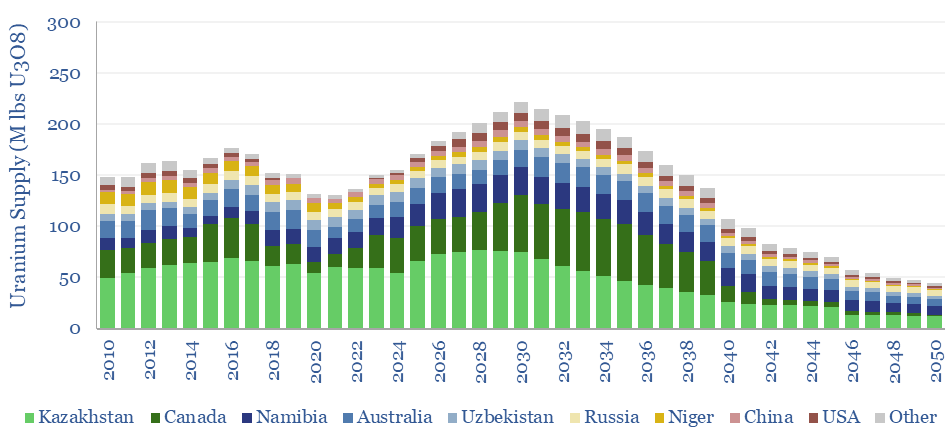

Uranium production by country is also disaggregated in the data-file. 40% of global output is from Kazakhstan today. Canada, which is 20% of today’s supply, doubles its output in the next decade. Growth is also seen in Namibia and Australia, which are about 10% of today’s output. The US grows most in percentage terms, rising from almost nil to almost 10 M lbs pa in the next decade.

Uranium production by company is available in our screen of uranium producers, which also has more commentary on the underlying companies developing various projects.

Notes on each project in our global uranium supply-demand model can be viewed in the notes tab, and risking factors can be varied in the assets tab of the data-file.