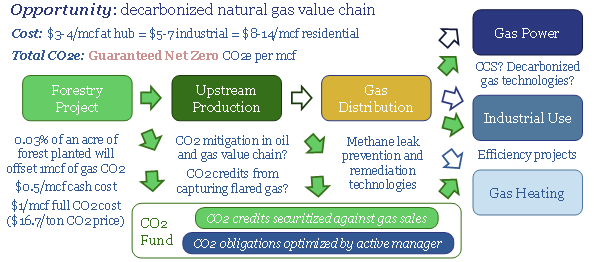

Gas value chains present the largest and lowest cost decarbonization opportunity on the planet, commercialising zero carbon energy for an incremental cost below $1/mcfe ($17/ton of CO2). This compares with end gas prices of $4-14/mcf and other CO2 mitigation options up to $800/ton. This 15-page report outlines how to optimize a decarbonized gas value chain, securitizing forestry-based carbon commitments in an actively managed carbon fund.

Pages 2-4 outline why natural gas is the optimal fossil fuel for a decarbonized value chain, requiring the reforestation of 15-60% less land than other fossil fuels.

Pages 5-8 present the economics for forestry projects, with a breakeven cost of $50/ton, of which $15/ton is cash cost and $35/ton is capital cost.

Pages 9-11 explain how to securitize forestry carbon credits into gas sales agreements, obviating the $35/ton capital costs and creating a dedicated CO2 fund.

Pages 12-13 compare the costs of our decarbonized gas value chains against other decarbonization options, at $15/ton versus $300-800/ton for alternatives.

Pages 14-15 suggest opportunities for active managers to optimize carbon funds, sequestering more CO2 and disbursing “profits” to the funds’ limited partners.