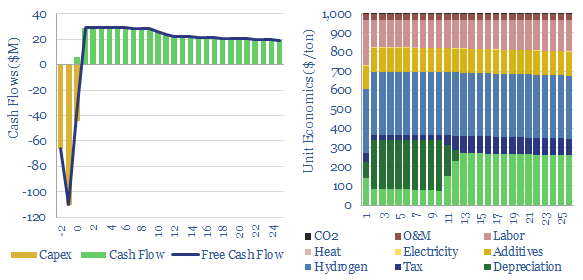

Hydrogen peroxide production costs run at $1,000/Tpa, to generate a 10% IRR at a greenfield production facility, with c$2,000/Tpa capex costs. Today’s market is 5MTpa, worth c$5bn pa. CO2 intensity runs to 3 kg of CO2 per kg of H2O2. But lower-carbon hydrogen could be transformational for clean chemicals?

Hydrogen peroxide is a 5MTpa and $5bn pa commodity chemical market. It is an oxidizing agent, used in producing paper, detergents and in water treatment. And increasingly in producing materials that matter for the energy transition, such as propylene oxide for polyurethane insulation/EVs and for etching semiconductors.

Hydrogen peroxide production costs? This data-file estimates the economic costs of producing hydrogen peroxide, at $1,000/ton per ton of 100%-pure H2O2. An important definitional point is that H2O2 is often transported at 30-70% concentration, then later diluted for end use at 3-8% concentration. Clearly, the more you dilute the product, the more you dilute the price. But our numbers are per (hypothetical) ton of pure H2O2.

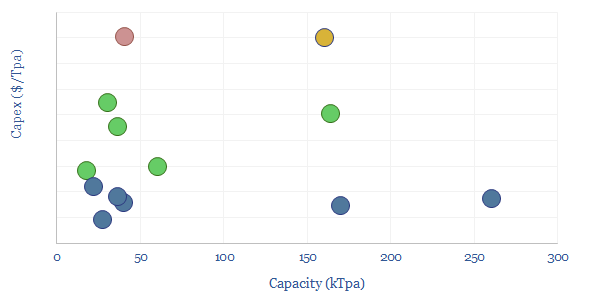

Capex costs of hydrogen peroxide plants also vary by technology, product concentration and product purity. Please see the data-file for further details. But our base case is around $2,000/Tpa of capex costs for a new, greenfield hydrogen peroxide plant. High purity hydrogen peroxide for the semiconductor industry costs more.

How is hydrogen peroxide produced? The dominant method is anthraquinone auto-oxidation. The key input is hydrogen, which reduces anthraquinone. The reduced anthraquinone can later be oxidized, in the presence of air, forming both H2O2 and H2O, and regenerating the anthraquinone. The process uses a palladium catalyst. It is exothermic, so heating inputs are low.

How much hydrogen is used up in making hydrogen peroxide? The key challenge is minimizing over-consumption of hydrogen (or in other words, maximizing hydrogen conversion and selectivity). Our estimates into hydrogen consumption of hydrogen peroxide production are tabulated in the data-file.

The CO2 intensity of hydrogen peroxide production is 3 tons/ton, as our base case estimate, for today’s production process. The largest contributor is the embedded CO2 of hydrogen, which also comprises one-third of total hydrogen peroxide production costs.

Could clean hydrogen be a game-changer? What if IRA incentives allow hydrogen peroxide plants to source cheaper hydrogen? Each $0.1/kg reduction in the input hydrogen price raises cash flow by 8% and IRRs/ROCEs by a full percentage point (1pp). Our best single note on booming blue hydrogen value chains is linked here.

Low carbon hydrogen can realistically reduce the CO2 intensity of hydrogen peroxide from 3 kg/kg, to below 0.5 kg/kg. Further downstream, this can reduce the total CO2 intensity of propylene oxide production from 2-3 kg/kg to 1 kg/kg. Further downstream, propylene oxide can react with CO2 in a molar ratio of 1:1 (forming polyether polycarbonates) or 2:1 (forming polycarbonate polyols), and switching in low-carbon hydrogen can make these overall value chains close to carbon neutral for the polyether polycarbons, and substantially lower carbon for downstream polyurethanes.

Leading hydrogen peroxide producers, such as Solvay, Evonik and Arkema, may thus benefit from low carbon hydrogen? Some recent notes on each company are in the data-file. Evonik purchased PeroxyChem for $640M in 2020, consolidating the global hydrogen peroxide market. In June-2023, Solvay said it would develop Europe’s first hub for the production of “green hydrogen peroxide” by mid-2026, with a 9.5MW dedicated PV installation, yielding 756Tpa of green hydrogen, to reduce Solvay’s total CO2 footprint at its Rosignano plant by 15%.