Heavy truck costs are estimated at $0.14 per ton-kilometer, for a truck typically carrying 15 tons of load and traversing over 150,000 miles per annum. Today these trucks consume 10Mbpd of diesel and their costs absorb 4% of post-tax incomes. Electric trucks would be 20-50% more costly, and hydrogen trucks would be 45-75% more, which is inflationary.

Heavy trucks, aka Class 8 trucks, consume 10Mbpd of oil, covering 1trn miles per year, moving substantively everything in global supply chains. Each truck typically carries around 15 tons of cargo, covering up to 1,000 miles per day, with a range of about 2,000-miles between fueling.

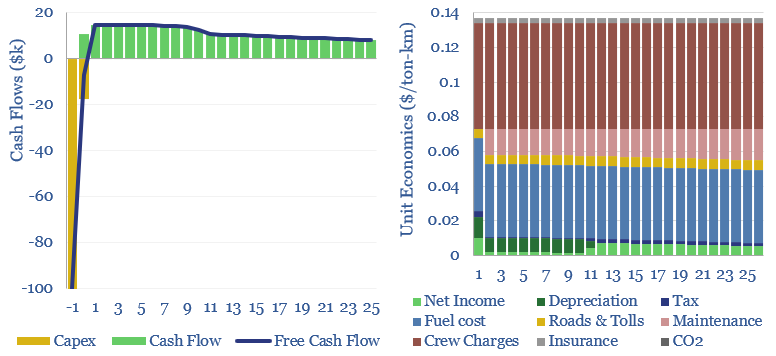

Heavy truck costs are estimated at $0.14 per ton-kilometer, for a typical vehicle, in the base case economics captured in this data-file. This is in the US. Additional fuel taxes apply in Europe.

Half of the costs of trucking comprises the labor costs of a driver, which accrue per hour or per year, and thus the ultimate per kilometer costs of truck transport depend on the amount of ground that can be covered. This is why utilization is crucial.

A standard diesel truck fills up 2 x 150-gallon tanks, imparting 2,000 miles of range, in about 5-minutes. A challenge for electric trucks, hydrogen trucks and other non-standard truck fuels is that fueling (or charging) may take materially longer (45-minutes for a hydrogen fuelling, up to 4-hours for a battery charging). Especially if a detour or a wait is needed to access scarce charging infrastructure.

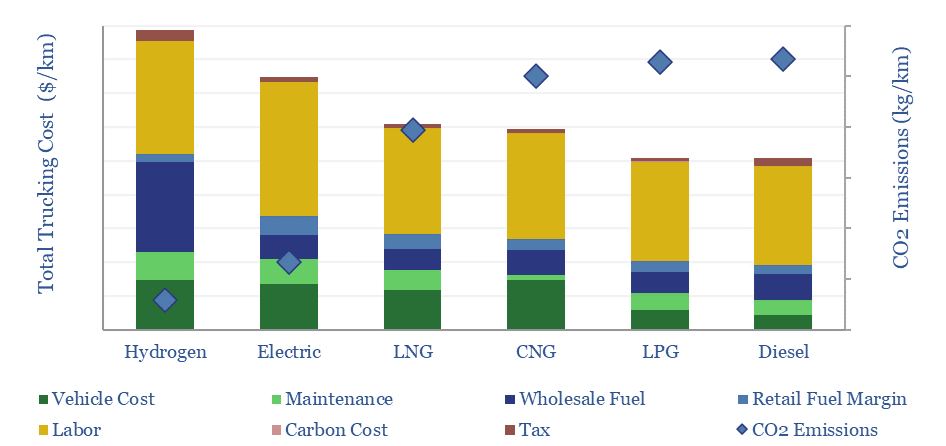

Trucking costs and CO2 intensities of truck freight are compared in the data-file for diesel trucks, LPG trucks, CNG trucks, LNG trucks, electric trucks and hydrogen trucks (chart below).

Electric trucks with 4-6 ton batteries, and 700-1,000km ranges, likely cost $110-170k more (i.e., 2x) than a typical diesel truck up-front. Fuel economy is 2x higher. Nevertheless, adding the costs of dedicated vehicle charging stations, the total energy costs can end up similar for both, especially in the US, where fuel taxes are lower.

Hydrogen trucks have been proposed for longer ranges, which could have fuel economies between diesel trucks and electric trucks. The key challenge is the high up-front costs of these fuel-cell vehicles, plus high cost of green hydrogen, which we estimate to be 2.5x higher than diesel trucks. We have also written on other challenges of hydrogen trucks.

Overall, the total costs of electric trucks are around 20% higher in Europe and 50% higher in the US; while the total costs of hydrogen trucks would be around 45% higher in Europe and 75% higher in the US. This is material. The look-through costs of trucking goods to meet the consumption needs of the average developed world citizen run to about $1,000 per person per year, or 4% of average post-tax incomes. 20-75% re-inflation eats up 1-3% of average incomes.

LNG trucks can be close to competitive. On an energy-equivalent basis, $3/mcf gas is 4x more economical than $3/gal diesel. However, the advantages are offset by higher vehicle costs, operational costs and logistical costs for LNG fueling stations. Mild environmental positives of gas are also offset by mild operational challenges.

This data-file compares different trucking fuels — diesel, CNG, LNG, LPG, electric trucks and Hydrogen — across 35 variables. Most important are the economics, which are fully modelled, in the 2020s in the US, in the 2020s in Europe and incorporating deflation in the 2040s.