This data-file is a screen of leading PGM producers and recyclers. Eight companies control 90% of global production. Most are mid-caps. Four have primary listings in South Africa. Three are listed in Europe and the UK. Ore grades average 4 grams/ton, and recovery requires 60GWH/ton of energy, emitting 40kT/ton of CO2. But do recent company disclosures suggest that the gloom over PGMs is lifting?

This data-file is a screen of leading PGM producers, across mining, refining and recycling activities. We capture a dozen companies, whether they are public or private, their history, geography, number of employees, recent revenues, valuations, primary PGM production, secondary PGM production and interesting notes/disclosures.

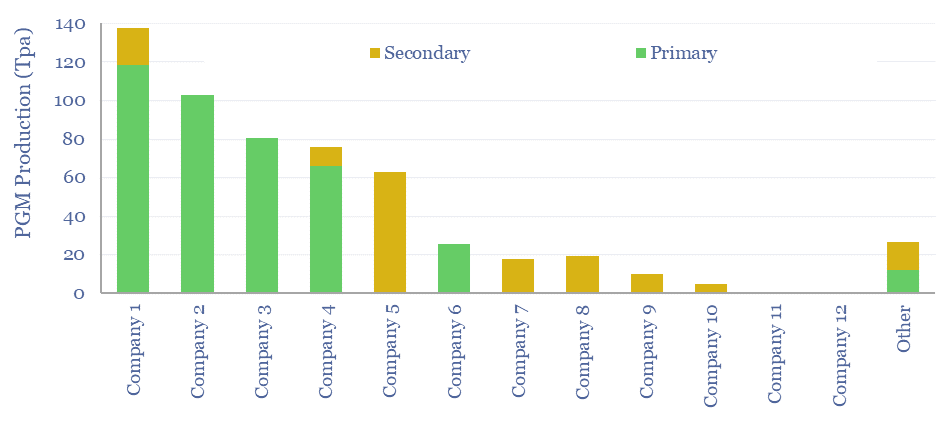

PGM production is highly concentrated. 8 companies effectively control 90% of all global production. It is these leading PGM producers that are the focus in this data-file.

Further downstream, there is far more fragmentation. For example, auto catalysts are an $8bn pa market in the US alone, manufactured by 177 companies, none of which have market shares higher than 5%.

PGM production is complex. 55% of global mined output is from South Africa and 25% is from Russia. Implats’s Rustenburg mine is 870m underground. Ore grades average 4 grams/ton, hence huge quantities of rock must be excavated, crushed, concentrated, smelted at 1,500ºC in electric arc furnaces, then electro-refined.

Based on the disclosures from large PGM producers, we estimate that the energy intensity of PGM production is around 60GWH/ton and the CO2 intensity of PGM production is around 40,000 tons/ton. This is even more than gold production.

More encouragingly, Johnson Matthey highlights that PGM recycling from spent catalytic converters can have 80% lower production costs, 80% lower energy use and up to 98% lower carbon footprints than primary mined PGMs.

Even the PGM industry has recently been downbeat over PGMs, with many companies diversifying into battery metals, as electric vehicles are seen displacing the need for PGMs within ICE catalytic converters (65% of the global PGM market today). Yet in 2023-24, as EVs have slowed down, these battery metal businesses have been profit-warning.

The work should be viewed alongside our recent note into the outlook for PGMs, and our models into long-term PGM demand.