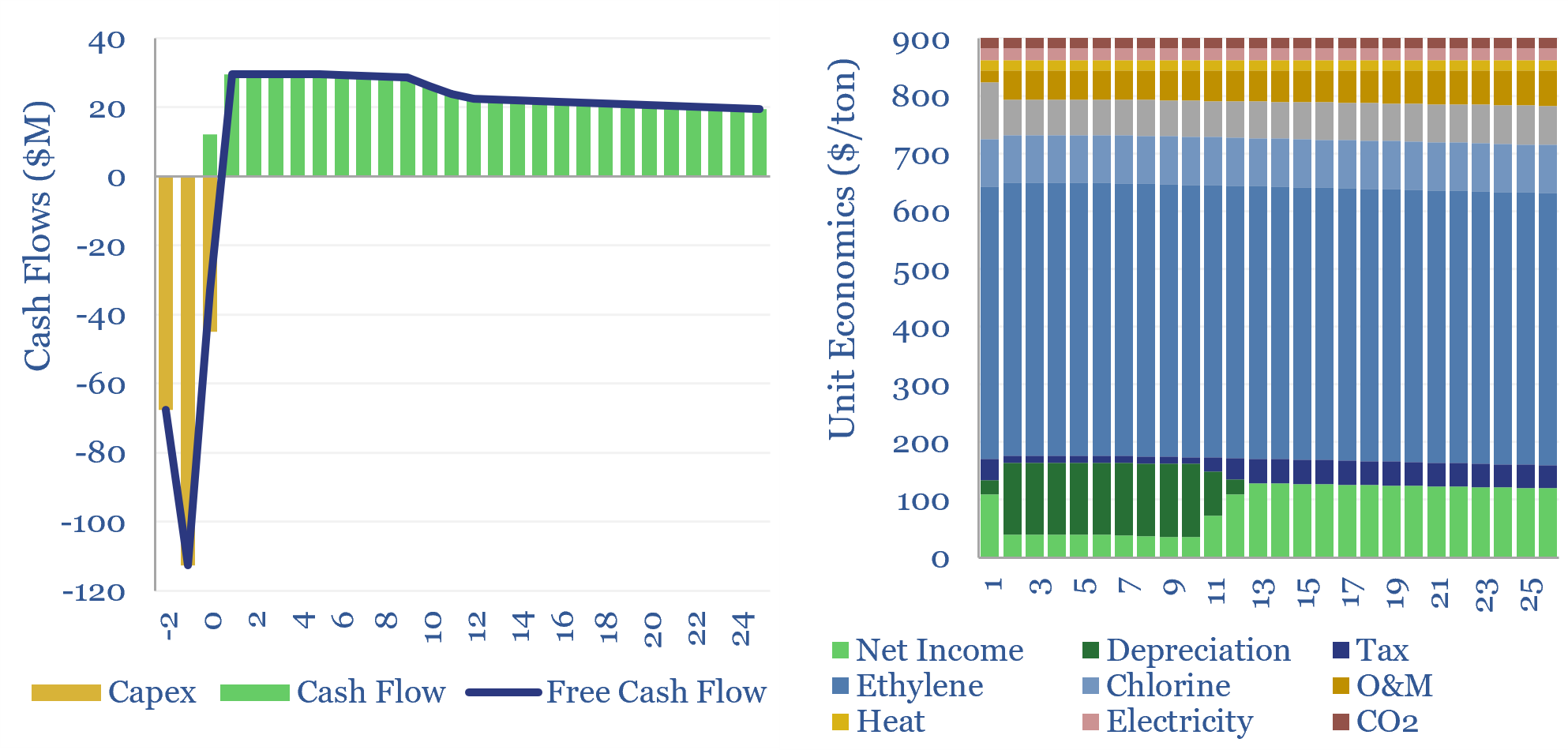

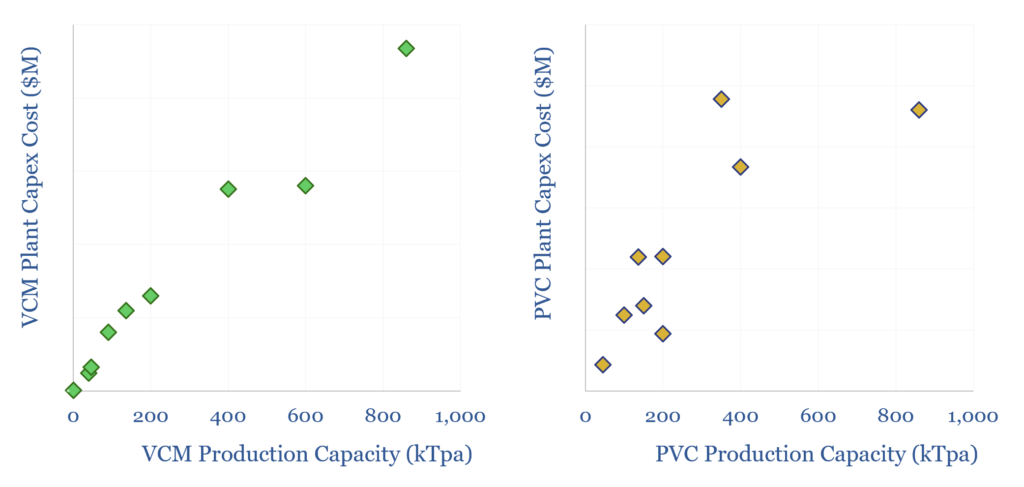

This data-file estimates the cost of PVC production and the cost of VCM production, from first principles, based on capex, input materials, heat, electricity, labor and other opex. As a rule of thumb, 10% IRRs require c$900/ton PVC and c$750/ton VCM, and PVC will embed around 2 tons of CO2 per ton of PVC. Numbers can be stress-tested in the data-file.

The global market for Poly Vinyl Chloride (PVC) is over 50MTpa, worth over c$40bn pa. PVC is a high-strength thermoplastic, used predominantly for profiles (e.g., automotive parts), pipes and other construction materials, and the insulation around electrical cables.

PVC is made by the polymerization of Vinyl Chloride Monomer (VCM), which in turn is mostly derived by reacting chlorine gas from the chlor-alkali process) with ethylene (either from an ethane cracker or a naphtha cracker), then the re-cracking of 1,2-dichloroethane at 500°C, re-releasing HCl as a by-product.

The capex costs of PVC plants, and precursor VCM plants, are built-up in this data file from case studies of prior projects, and technical papers. We have done our best here, although it does require some guesswork, where past project disclosures have been vague over the share of capex that can be ascribed to different parts of integrated projects.

Energy costs of producing PVC and VCM (in kWh/ton), and electricity use (also in kWh/ton) are also built up from technical papers and past project disclosures, including those from Shintech, a subsidiary of Shin Etsu, which is the largest PVC producer in the world.

Other large PVC producers include Formosa, Westlake, INEOS, Orbia and Syensqo. And within integrated energy companies, note that Oxy’s OxyChem subsidiary, which is c20% of group revenue and EBIT, is also focused on the chlorovinyls value chain.

The cash cost of PVC production is estimated at about $700/ton for well-positioned producers, based on the inputs in this data-file, although it will be higher in locations with higher electricity prices, ethylene prices and CO2 taxes.

An economic return on a new PVC production facility requires pricing of $900/ton, while strong returns would ideally require pricing of $1,000/ton or more. This also fits with the disclosures from across the industry.

For example, Orbia has been considering a 1MTpa PVC production facility on the US Gulf Coast, but the facility needs prices to stabilize above $1,000/ton. We think that expanding US chemicals value chains may offer one of the best opportunities to restore the US trade balance.

Please download the data-file to stress-test the cost of PVC production.