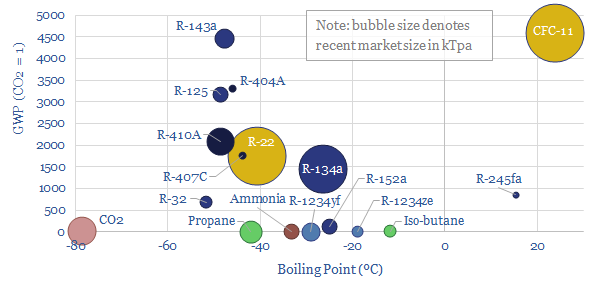

What chemicals are used as refrigerants? This data-file is a breakdown of the c1MTpa market for refrigerants, across refrigerators, air conditioners, in vehicles, industrial chillers, and increasingly, heat pumps. The market is shifting rapidly towards lower-carbon chemicals, including HFOs, propane, iso-butane and even CO2 itself. We still see fluorinated chemicals markets tightening.

Refrigerants are used for cooling. The thermodynamic principle is that these chemicals have low boiling points (averaging around -30ºC). They absorb heat from their surroundings as they evaporate. Then later these vapors are re-liquefied using a compressor.

The global market includes over 1MTpa of refrigerants, for use in refrigerators (around 100 grams per fridge), passenger cars (1 kg per vehicle) and home AC systems (4 kg per home). There is also an industrial heating-cooling industry, including MW-scale chillers that might contain 400kg of refrigerants, to large global LNG plants.

The market is growing. Structurally, heat pumps could add another 4kg of refrigerant demand per household, especially in markets such as Europe with traditionally low penetration of AC. Rapid rises are also occurring in global AC demand.

From the 1930s onwards, CFCs were used as refrigerants. But CFCs are inert enough to reach the middle of the stratosphere, where they are broken down by UV radiation, releasing chlorine radicals. These chlorine radicals break down ozone (O3 into O2). Hence by the 1980s, abnormally low ozone concentrations were observed over the South Pole. Ozone depletion elevates the amount of UV-B radiation reaching Earth, increasing skin cancer and impacting agriculture. And hence CFCs were phased out under the Montreal Protocol of 1989.

CFCs were largely replaced with fluorocarbons, which do not deplete the ozone layer, but do have very high global warming potentials. For example, R-134a, which is tetrafluoroethane, is a 1,430x more potent greenhouse gas than CO2.

The Kigali Amendment was signed by UN Member States in 1989, and commits to phase down high-GWP HFCs by 85% by 2036. This has been supplemented by F-gas regulation in the EU and the AIM Act in the US. High GWP fluorocarbons are effectively banned in new vehicles and stationary applications in the developed world.

In addition, there has long been a market for non-fluorinated chemicals as refrigerants, but the challenge with these alternatives is that they tend to be flammable. Over half of domestic refrigerators use iso-butane as their refrigerant, which is permissible under building codes because each unit only contains about 100 grams of refrigerant (e.g., in Europe, a safety limit has historically been set at around 150 grams of flammable materials in residential properties, and is being revised upwards).

So what outlook for the fluorinated chemicals industry? Overall, we think demand will grow mildly. It is true that regulation is tightening, and phasing out fluorocarbons.

However, some of the leading refrigerants that are being “phased in” as replacement actually use more fluorinated chemicals than the refrigerants they are replacing…

Hydrofluoroolefins (HFOs) have no ozone depleting potential and GWPs <10. As an example, R-1234yf is now used in over 100M vehicles, and comprises 67% fluorine by mass. This is an increase from the 44% fluorine content in R-22, which was the previous incumbent for vehicle AC systems.

Impacts of electric vehicles? You could also argue that EVs will have increasing total refrigerant demand, as there are in-built cooling systems for many fast-chargers.

Using CO2 as a refrigerant could also be an interesting niche. It is clearly helpful for our energy transition ambition to increase the value in capturing and using CO2. But the challenging is that even if 215M annual refrigerator sales all used 100% CO2 as their refrigerant, this would only “utilize” around 25kTpa of CO2, whereas our Roadmap to Net Zero is looking for multi-GTpa scale CCUS.

For heat pumps, we think manufacturers are going to use propane, CO2, HFOs and a small class of low-GWP fluoro-carbons. So there is a small pull on the fluorinated chemicals value chain from the ramp-up of heat pumps. But the main pull on the fluorinated chemicals chain is going to be coming from batteries and solar, as explored in our recent fluorinated polymers research.

Leading Western companies making refrigerants in the data-file include Honeywell, DuPont, Chemours, Arkema, Linde, and others in our fluorinated chemicals screen.