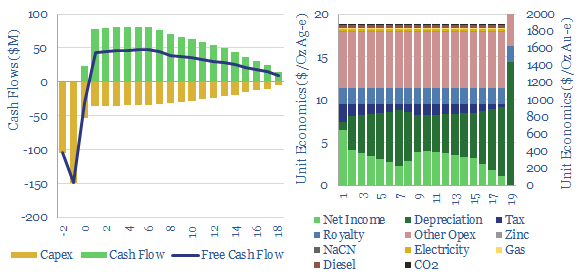

This data-file captures the marginal cost of silver and gold production, at an integrated mining-refining operation. In our base case, a 10% IRR requires a silver price of $17/Oz and a gold price of $1,750/Oz, while the energy and CO2 intensities are an eye watering 100-150 tons/ton and 9,000 tons/ton, respectively. Numbers vary widely on ore grade.

This model captures the entire mining-refining process for silver and gold. Ore is mined from a medium-grade gold-silver deposit. The ore is crushed, concentrated, roasted and leached. PGMs are extracted from the leach solution using the Merrill-Crowe process, doré is then smelted, and finally ultra-pure gold and silver are parted and purified using the Miller Chlorination process, followed by the Wohlwill and Moebius electrolytic processes.

Our base numbers require a silver prize of $17/Oz and a gold price of $1,750/Oz in order to derive a 10% IRR. Pricing can be flexed in the data-file. A good, free source of reference data for both gold and silver prices is linked here.

Energy intensity is extremely high. Energy costs are calculated at 250 MWH/ton of silver-equivalent and 20 GWH/ton of gold-equivalent, whereas most other materials in our research are in a range of 0.7 – 70 MWH/ton.

Likewise, CO2 intensity is very high, at 100-150 tons/ton of silver-equivalents and 9,000 tons/ton of gold-equivalents. These numbers are higher than most other commodities in our economic models.

In other words, pound-for-pound, gold that has been mined and refined from low-grade orders may be one of the most CO2 intensive materials in the world, on a unit mass basis. Although the impacts are diluted by using these metals in low quantities. At least to date.

Numbers are heavily dependent upon process conditions and ore grades. As a rough rule of thumb, halving/doubling the ore grade from our base case will double/halve the energy intensity, the CO2 intensity and the total marginal cost of silver and gold production. Where a middling-grade gold-silver project achieves 10% return, a 2x higher grade ore achieves 40% IRRs. Another key parameter is down to the resource and whether a roasting stage is needed before leaching.

Numbers and underlying input assumptions can be flexed in the data-file, which covers the marginal cost of silver and gold production, looking across over a dozen different input parameters, such as capex, opex, electricity prices, gas prices, diesel prices, zinc prices, sodium cyanide prices, other reagent prices and tax take.