This data-file summarizes the leading companies in solar trackers, their pricing (in $/kW), operating margins (in %), company sizes, sales mixes and recent news flow. Five companies supply 70% of the market, which is worth $10bn pa, and increasingly gaining importance?

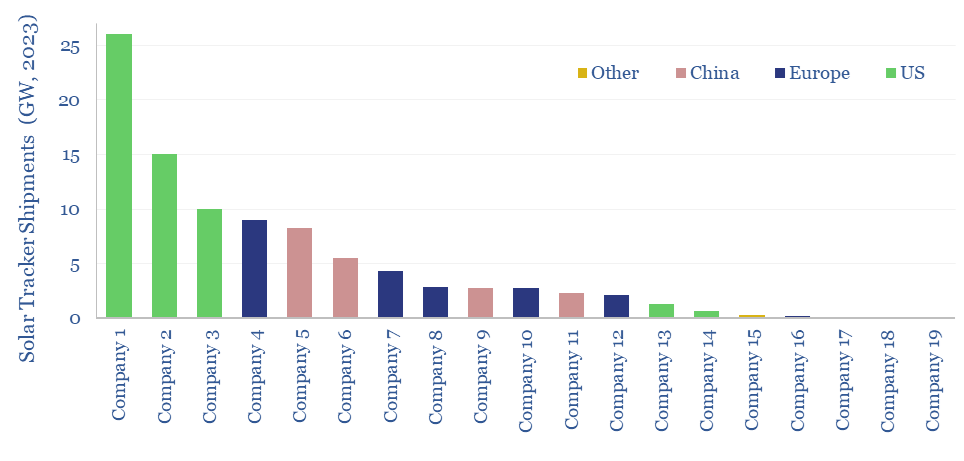

The solar tracker industry is worth c$10bn pa, as 20 companies shipped 95GW of trackers in 2023, mostly single-axis horizontal systems.

It is a rare part of the solar supply chain, that is not dominated by Chinese suppliers – unlike PV silicon, or PV modules. The leading markets for deployment are the US and Europe, and this is also where many of the leading companies in solar trackers are based.

The solar tracker industry is concentrated. Five companies have c70% market share, helped by features that facilitate installation, and software to optimize the operations of utility-scale solar.

This data-file summarizes the leading companies in solar trackers, their pricing (in $/kW), operating margins (in %), company sizes, sales mixes and recent news flow.

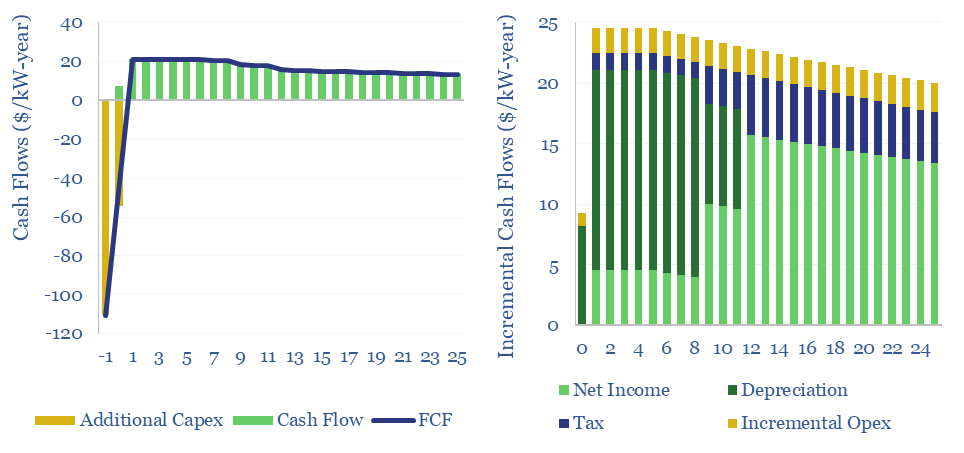

The economics of solar trackers are also assessed, and can be stress-tested in the data-file. 10% IRRs can be achieved on solar trackers costing $165/kW (installed basis) that uplift solar revenues by 25%, through a mixture of higher output and higher time-value.

Uplifts in performance can be determined top-down using reported performance of solar trackers, or bottom-up from first principles, based on calculating solar insolation.

IRRs reach 20-30% of the best systems, which is tantamount to lowering solar LCOEs by 2c/kWh, when flowed through our model of utility-scale solar economics.

Hence, as one of the leaders, Array Technologies, has highlighted, solar tracker demand has been growing 30% faster than the overall solar market in recent years.