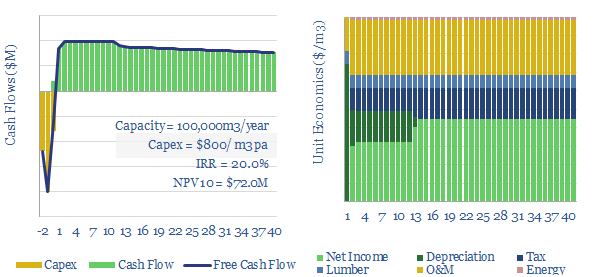

Cross laminated timber costs $1,200/ton, or $500/m3 pa, in order to derive 10-20% IRRs at a production facility costing $2,000/Tpa in capex. Cost lines include input costs of timber, polyurethane resins, labor, electricity, O&M, and capital costs. This data file is our economic model for mass timber production.

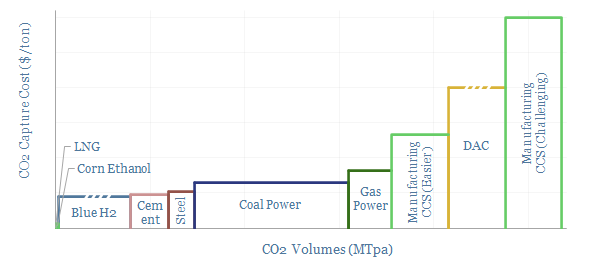

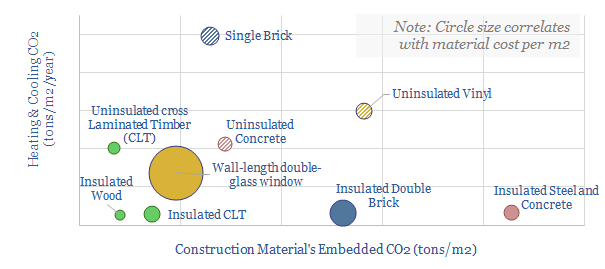

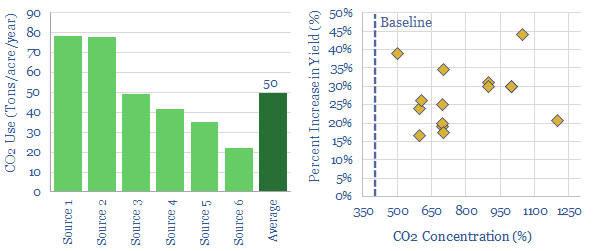

Cross-laminated timber (CLT) could become a more readily used construction material amidst the energy transition, with sufficient strength to build 40-80 story skyscrapers, yet 80% lower CO2 intensity than walls comprising steel and cement, while also providing long term carbon storage for nature-based CO2 sequestration.

CLT was invented in Austria in the 1990s. The concept is that layers of timber board are glued together. Each layer is arranged so that its grain runs perpendicular to adjacent layers. This gives exceptional strength and moisture performance.

This data-file captures cross-laminated timber costs, modelling that an $500/m3 sales price, equivalent to $1,200/ton, is needed on CLT products in order to generate 10-20% IRRs based on $25/ton timber input costs.

Capex cost of CLT production facilities are estimated in the data-file, and likely around $1,000 per m3 pa of output, or over $2,000/Tpa. This is based on aggregating bottom data (across input cost lines) and top down data (from past projects).

Resins are assumed to be polyurethanes. Other opex costs include labor and energy, which are also disaggregated in the data-file. Input variables can also be stress tested in the data-file, in order to evaluate cross laminated timber costs, compared with other construction materials.

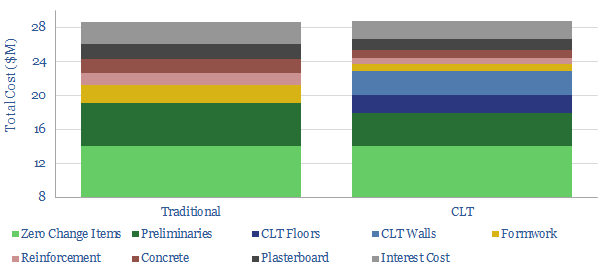

Cross laminated timber at $1,200/ton is clearly more expensive than steel at $600/ton and cement at $130/ton, however this can be recouped as less reinforcement is needed for lighter structures, construction times are faster, and there are other savings on formwork. Total costs of a CLT building and a traditional building may therefore be similar (below).

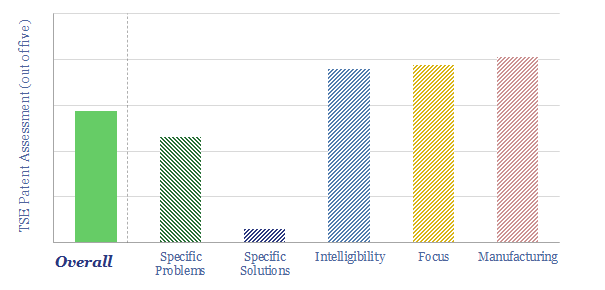

For further work into mass timber, please see our deep-dive report into cross laminated timber, and our patent review for Stora Enso. Or if you just want to browse some pretty picrtures of CLT architecture, we like this online collation here.