Russia conflict: pain and suffering?

This 13-page on note presents 10 hypotheses on Russia’s conflict implications in energy markets. Energy supplies will very likely get disrupted, as Putin no longer needs to break the will…

This 13-page on note presents 10 hypotheses on Russia’s conflict implications in energy markets. Energy supplies will very likely get disrupted, as Putin no longer needs to break the will…

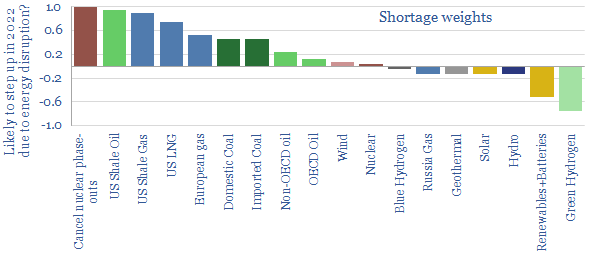

This 13-page note presents 10 hypotheses on Russia’s horrific conflict. Energy supplies will very likely get disrupted, as Putin no longer needs to break the will of Ukraine, but also…

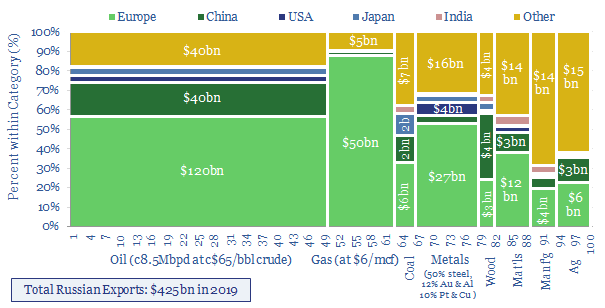

This data-file breaks down Russia’s export revenues, import country by import country, looking across oil, gas, coal, steel, aluminium, copper, gold, aluminium, ammonia, agricultural products, other metals, materials and manufactured…

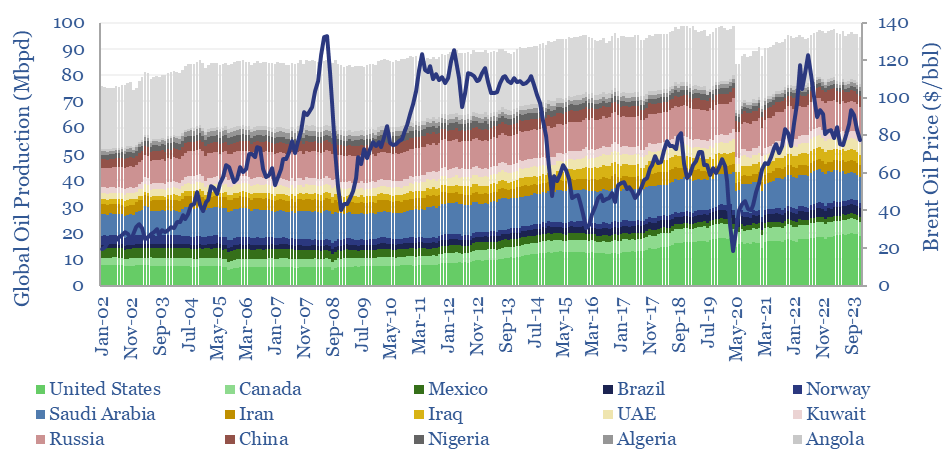

…by almost +1Mbpd/year over the past two-decades, led by the US, Iraq, Russia, Canada. Oil market volatility is usually very low, at +/- 1.5% per year, of which two-thirds is…

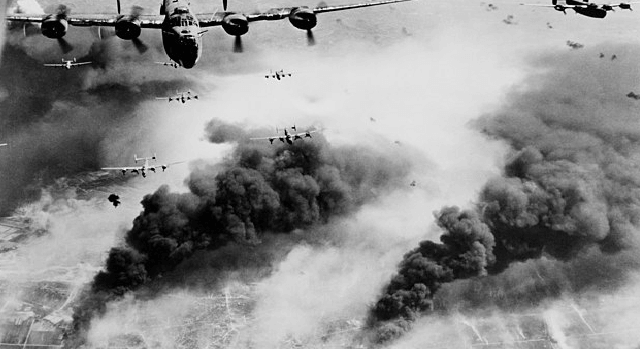

…World The entire future of the 20th century would also be partly decided by ‘who got there first’ in the liberation of Nazi Europe. Thus, Russia’s sphere of influence, was…

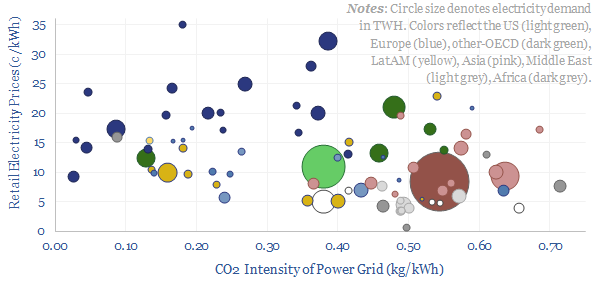

…is another outlier on the chart. Its grid has the same CO2 intensity as Russia’s or Pakistan’s, yet its retail electricity prices are 5-7x higher. Or stated another way, Germany’s…

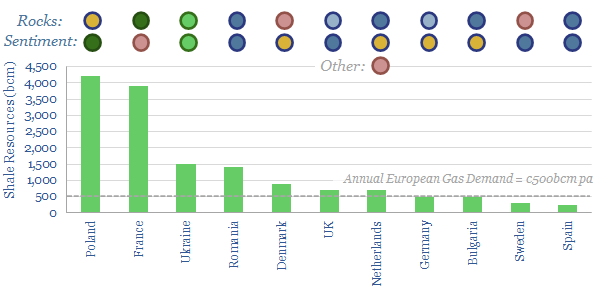

…Europe, which has large, high-quality shale resources, high continued reliance on coal (Poland, Bulgaria) and a growing desire to avoid Russian reliance. Ukraine has the best shale resources in all…

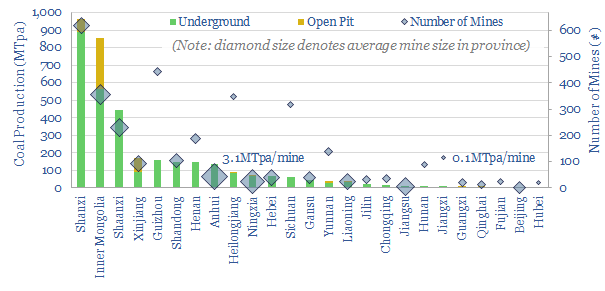

…zero’ scenario. Alternatively, might China ramp its coal to cure energy shortages, especially as Europe bids harder for renewables and LNG post-Russia? Today’s note presents our ‘top ten’ charts on…

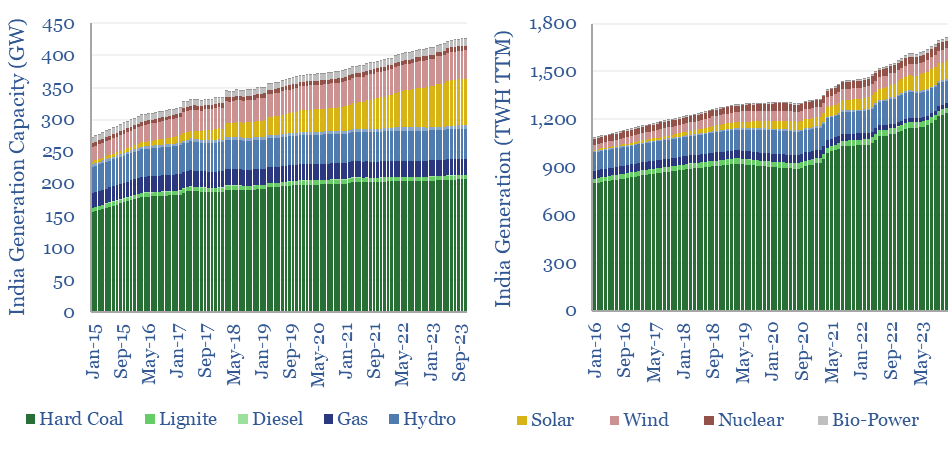

…growth rate of 5% per annum (chart below). Russia’s invasion of Ukraine has not helped, as Europe’s sudden thirst for LNG has pulled gas away from emerging world geographies. India’s…

…Canada, China, Colombia, Congo, Denmark, Egypt, Estonia, Finland, France, Germany, Greece, Hong Kong, India, Indonesia, Italy, Japan, Korea, Mexico, Netherlands, New Zealand, Nigeria, Norway, Poland, Portugal, Romania, Russia, South Africa,…