-

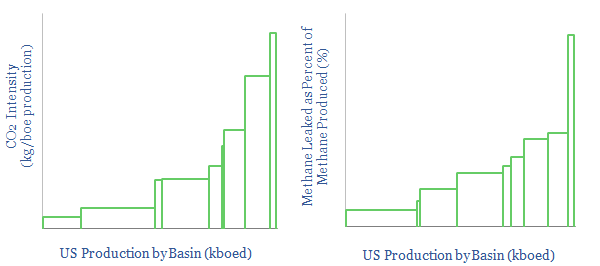

US CO2 and Methane Intensity by Basin

The CO2 intensity of oil and gas production is tabulated for 425 distinct company positions across 12 distinct US onshore basins in this data-file. Using the data, we can aggregate the total upstream CO2 intensity in (kg/boe), methane leakage rates (%) and flaring intensity (in mcf/boe), by company, by basin and across the US Lower 48.

-

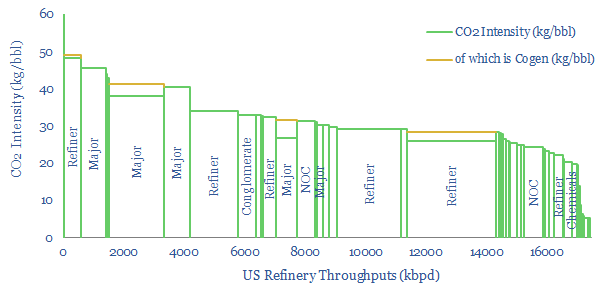

US Refinery Database: CO2 intensity by facility?

This US refinery database covers 125 US refining facilities, with an average capacity of 150kbpd, and an average CO2 intensity of 33 kg/bbl. Upper quartile performers emitted less than 20 kg/bbl, while lower quartile performers emitted over 40 kg/bbl. The goal of this refinery database is to disaggregate US refining CO2 intensity by company and…

-

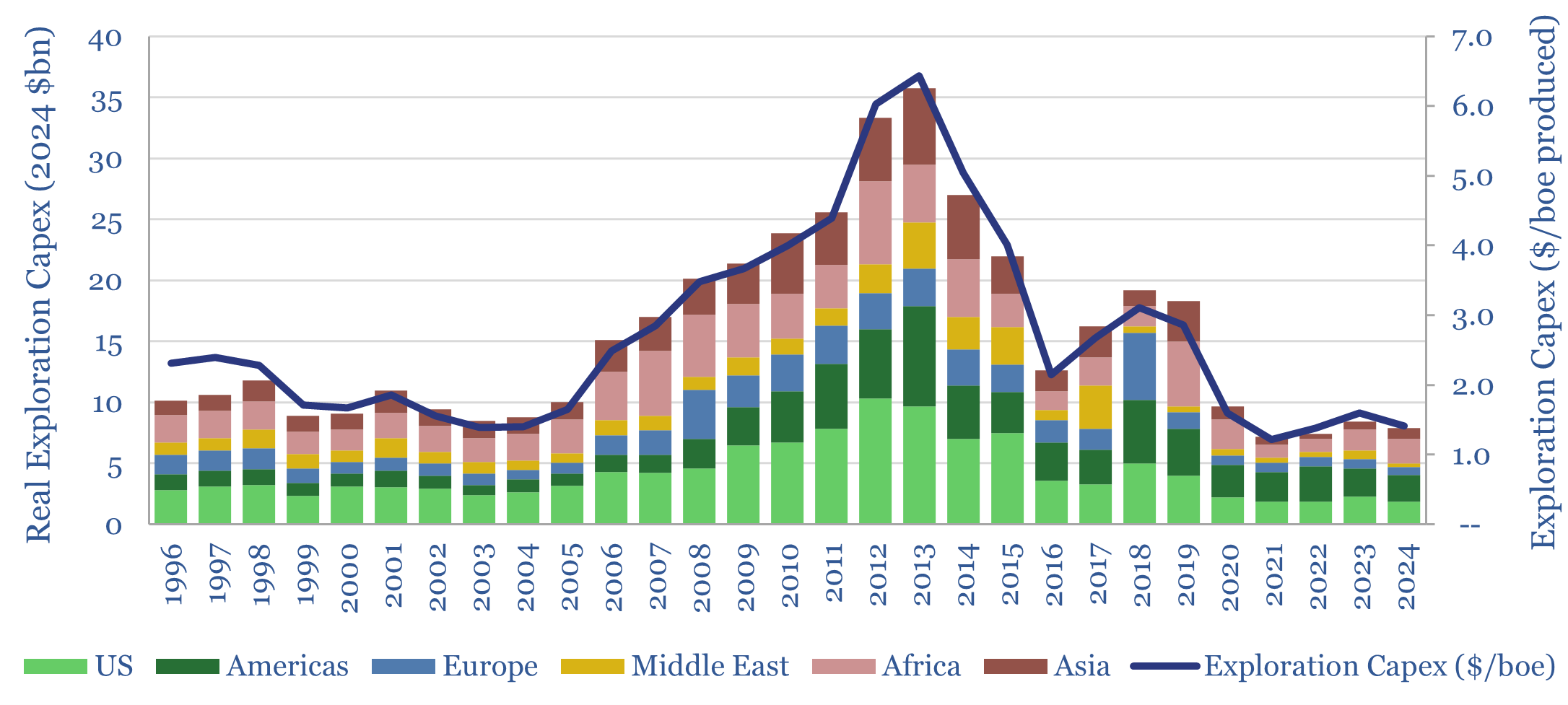

Exploration capex: long-term spending from Oil Majors?

This data-file tabulates the Oil Majors’ exploration capex from the mid-1990s, in headline terms (in billions of dollars) and in per-barrel terms (in $/boe of production). Exploration spending quadrupled from $1/boe in 1995-2005 to $4/boe in 2005-19, and has since collapsed like a warm Easter Egg. Exploration has been de-prioritized. Perhaps wrongly?

-

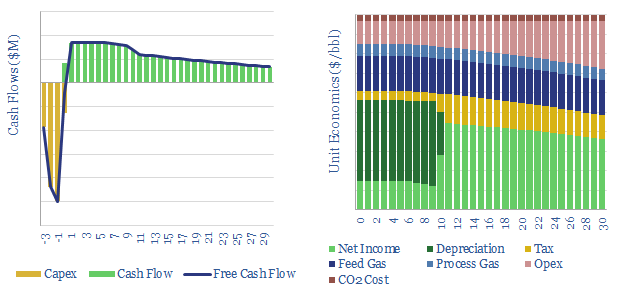

Gas-to-liquids: the economics?

This data-file captures the economics of gas-to-liquids via Fischer-Tropsch. Our base case requires $100/bbl realizations for a 10% IRR on a US project. You can stress-test the economics as a function of gas prices, capex costs, thermal efficiencies, et al, in the data-file.

-

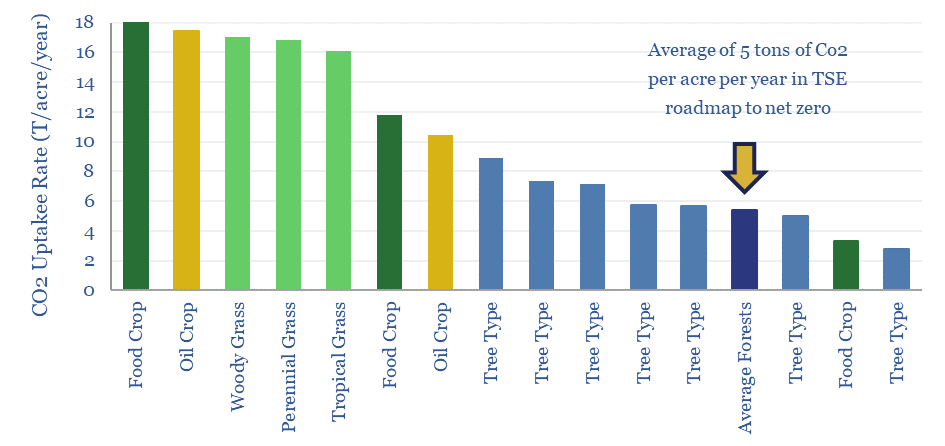

Biomass accumulation: CO2 fixed by trees and energy crops?

Different plant species fix 3-30 tons of CO2 per acre per year, as they accumulate biomass at 2-40 tons per hectare per year. The numbers matter for biofuels and for nature-based solutions. Hence this data-file compiles technical data into CO2 and biomass accumulation by plant species and by tree species, in different regions globally.

-

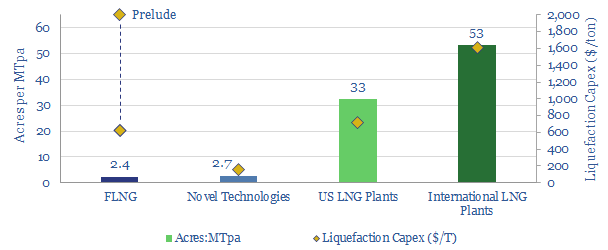

LNG plant footprints: compaction costs?

This data file tabulates the acreage footprints of c20 recent LNG projects. FLNG is 20x more compact than a comparable onshore plant, which may elevate costs. To benefit from compactness, we see more potential in novel “liquefaction” technologies.

-

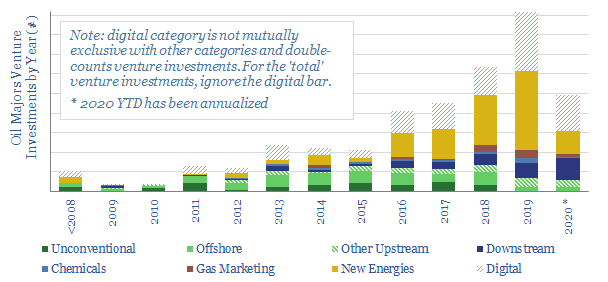

Ventures for an Energy Transition?

This database tabulates c300 venture investments, made by 9 of the leading Oil Majors. Their strategy is increasingly geared to advancing new energies, digital technologies and improving mobility. Different companies are compared and contrasted, including the full list of venture investments over time.

-

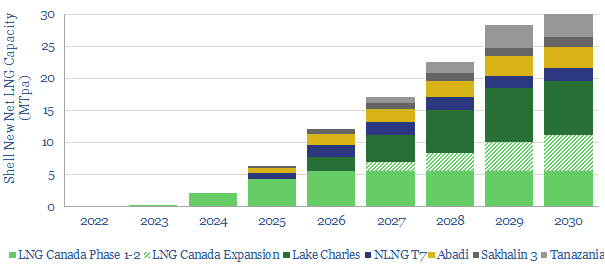

Shell: the future of LNG plants?

Shell is revolutionizing LNG project design, based on reviewing 40 of the company’s gas-focused patents from 2019. The innovations can lower LNG facilities’ capex by 70% and opex by 50%; conferring a $4bn NPV and 4% IRR advantage over industry standard greenfields. Smaller-scale LNG, modular LNG and highly digitized facilities are particularly abetted. This note…

-

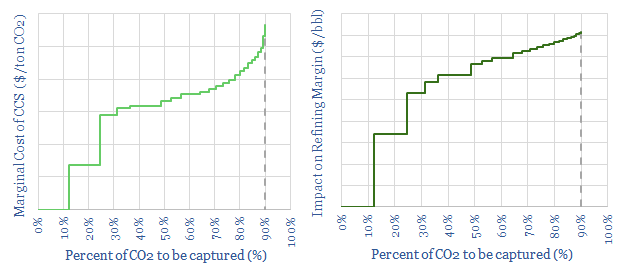

Carbon Capture Costs at Refineries?

Refineries emit 1bn tons pa of CO2, or around 30kg per bbl of throughputs. Hence this model tests the relative costs of retro-fitting carbon capture and storage (CCS), to test the economic impacts. c10-20% of emissions will be lowest-cost to capture. The middle c50% will cost c3x more. But the final 25% could cost up…

-

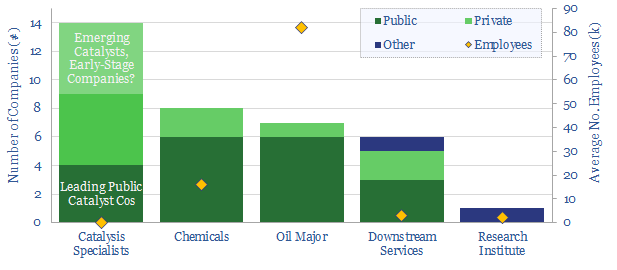

Overview of Downstream Catalyst Companies

This data-file tabulates headline details of c35 companies commercialising catalysts for the refining industry, in order to improve conversion efficiencies and lower CO2 emissions. Five early-stage private companies stand out, while we also profile which Majors have recently filed the most patents to improve downstream catalysis.

Content by Category

- Batteries (87)

- Biofuels (44)

- Carbon Intensity (49)

- CCS (63)

- CO2 Removals (9)

- Coal (38)

- Company Diligence (92)

- Data Models (829)

- Decarbonization (159)

- Demand (110)

- Digital (58)

- Downstream (44)

- Economic Model (203)

- Energy Efficiency (75)

- Hydrogen (63)

- Industry Data (277)

- LNG (48)

- Materials (82)

- Metals (77)

- Midstream (43)

- Natural Gas (146)

- Nature (76)

- Nuclear (23)

- Oil (164)

- Patents (38)

- Plastics (44)

- Power Grids (126)

- Renewables (149)

- Screen (114)

- Semiconductors (30)

- Shale (51)

- Solar (67)

- Supply-Demand (45)

- Vehicles (90)

- Wind (43)

- Written Research (350)