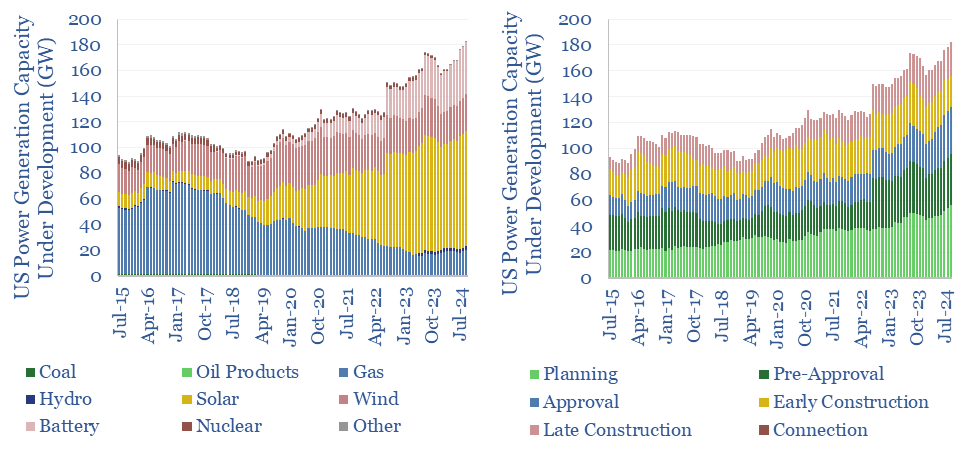

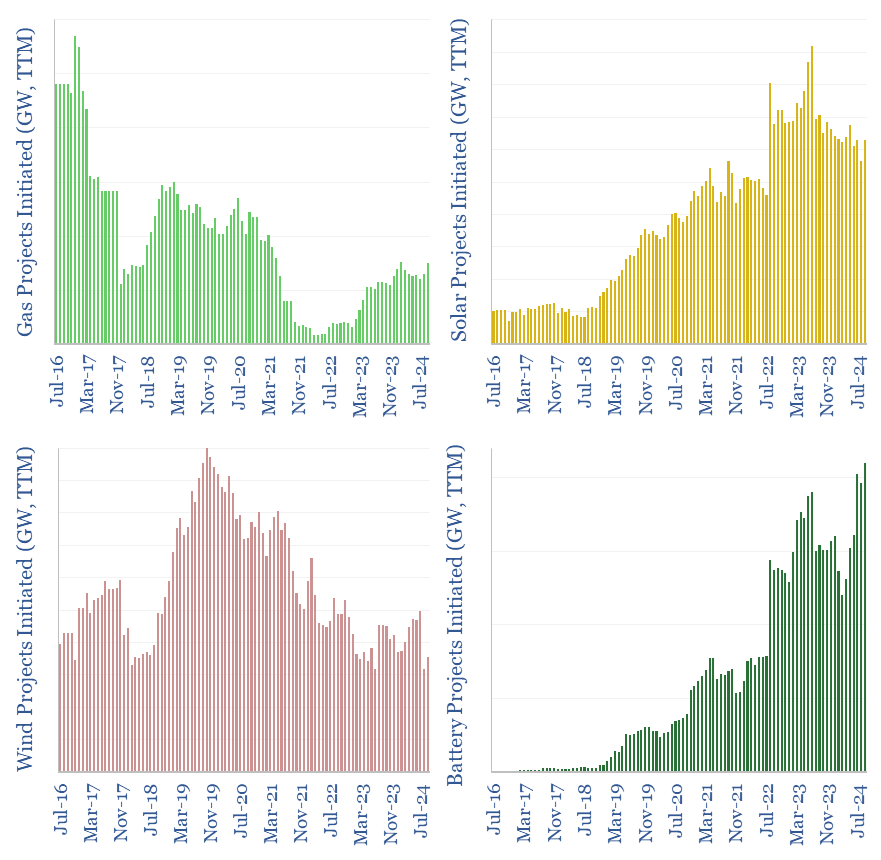

An all-time record of 180GW of new power generation is currently under development in the US in 4Q24, enough to expand the US’s 1.3TW power grid by almost 15%. This data-file tracks US power generation under development, as a leading indicator for gas turbine, wind, solar and battery demand. Gas turbines and battery co-deployments are accelerating in 2024, while wind and solar initiations are slowing on grid bottlenecks?

This data-file captures the development pipeline of new US power capacity, based on 860M reports from the EIA, which cover all existing and proposed generating units of >1MW of greater. As a leading indicator for wind, solar, gas turbine and battery demand, we have aggregated the data in these c110 monthly reports, from 2015 to 2024, to track the pipeline over time, and how expectations have progressed.

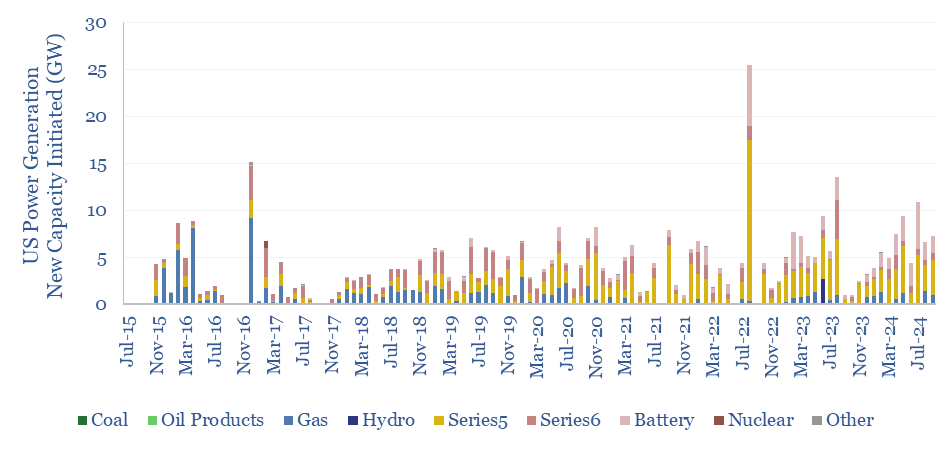

Over the past decade, an average of 4 GW of new power generation projects have been added to the queue each month. 1 GW of previously proposed projects have been abandoned each month. And another 2.2 GW of projects have been completed each month. Hence, the overall project queue has grown 0.8 GW larger per month, rising from 90 GW in September-2015 to 183 GW in September-2024 (charts above).

Fears over power grid bottlenecks and rising interconnection times are strongly supported by the data. 75% of the increase in the overall pipeline size is in projects that have not yet commenced construction and are thus effectively sitting in a queue.

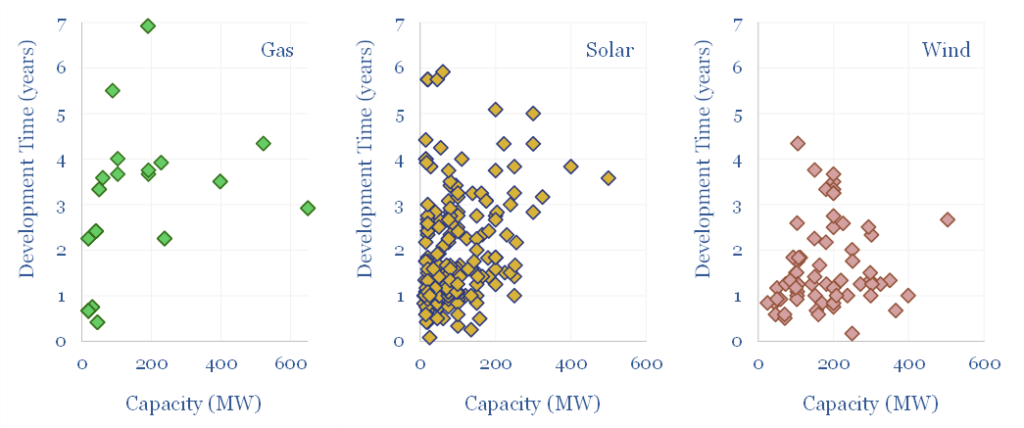

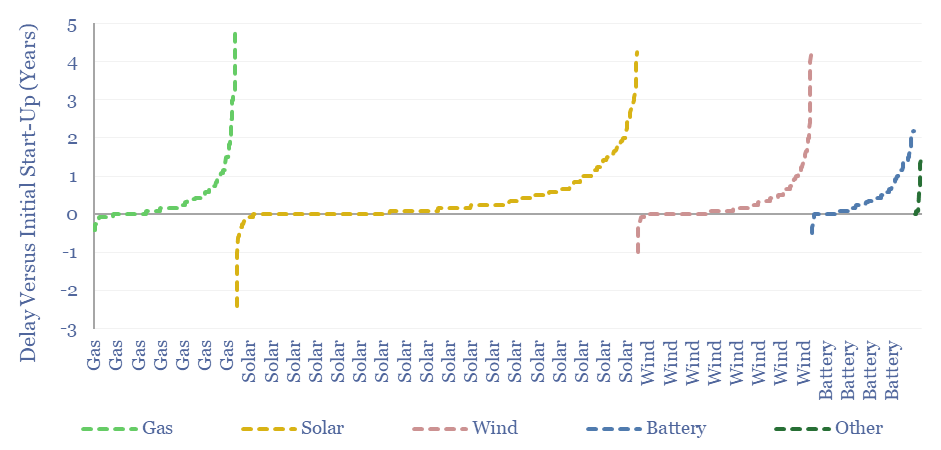

Development times have not changed materially, although they have always been quite variable. In the data-file, we have tracked 1,715 projects from the time they were first proposed, to the time when they were completed. Their average construction time was 0.8 years, with an average delay of 0.4 years versus initial estimates. These are shorter than the development times for other energy infrastructure.

Looking across the life-cycle of projects that entered the 860M reports during the planning stage (rather than later), the average development time was 2.1 years, including 0.9 years of planning, 0.3 years of permitting, 0.8 years of construction, and an average delay of 0.6 years versus initial estimates. Larger projects tend to take longer.

Delays in constructing power generation facilities are also heavily skewed, as 10% of the projects comprise 50% of the delays.

In 2024, renewables momentum has slowed, gas has re-accelerated, but grid-scale battery activity is accelerating fastest and now making an all-time peak, based on tracking new projects being added to the EIA’s 860M filings. Numbers are in the data-file for TSE clients.

Again this supports the notion that bottlenecked power grids are hindering the ramp of wind and solar, while we specifically see battery co-deployments as a route to expedite bottlenecked projects. The re-acceleration of natural gas projects also supports our outlook on US natural gas and our outlook on gas turbines. We will continue updating this data-file over time.