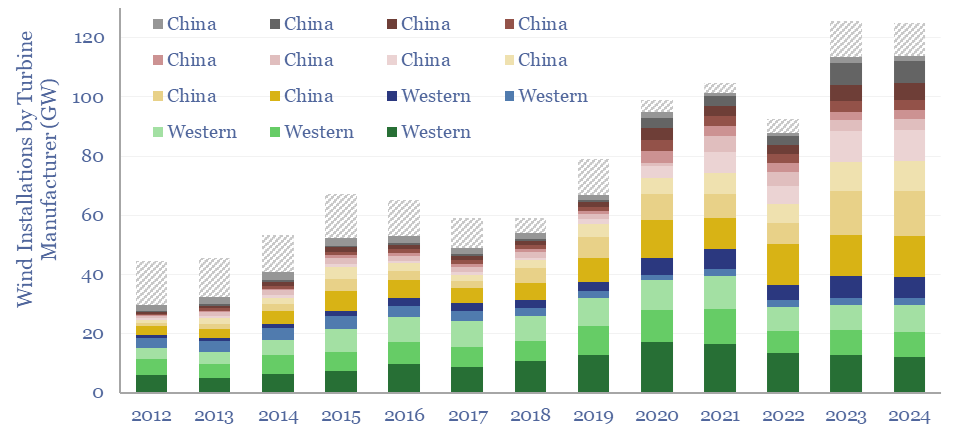

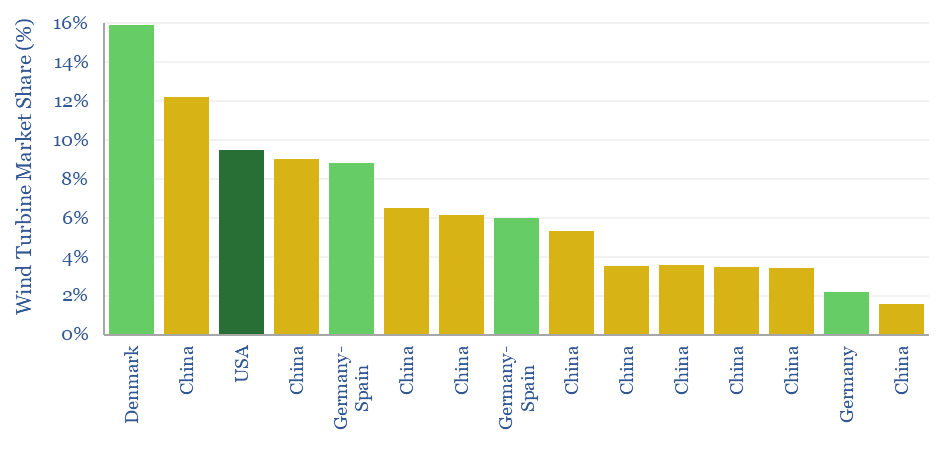

This data-file tracks wind turbine manufacturers, their market shares and their margins over time. By 2024, fifteen companies account for 95% of global wind turbine installations. This includes large Western incumbents, and a growing share for Chinese entrants, which now comprise over half of the total market, limiting sector-wide operating margins to c3%.

By 2024, fifteen companies account for 95% of global wind turbine installations. This includes large Western incumbents, and a growing share for Chinese entrants, which now comprise over half of the total market.

The wind turbine market is relatively concentrated, with a Herfindahl Hirschman Index of c725. The market share of the top five wind turbine manufacturers is 50%.

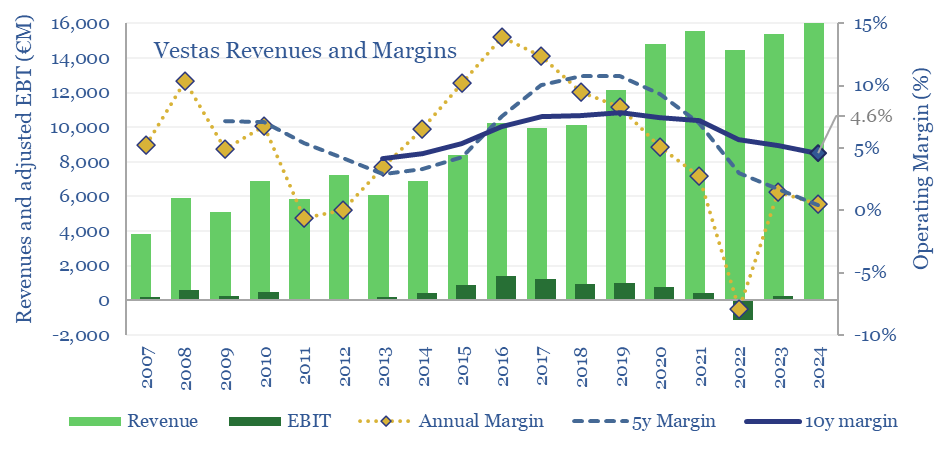

However competition, price pressure and cost pressure have kept margins low, averaging 5.7% over the past decade for Vestas, the largest turbine manufacturer in the world (chart below). We have produced similar charts for other turbine manufacturers as well.

Global wind turbine installations are seen holding flat at 125GW in 2024, but Chinese suppliers have now reached 60% market share, up from 30% in 2017. Lower labor rates give a 30% cost advantage, as it takes c2,700 man-hours to make a 100m blade, at c$50/hour in the West, c$7/hour in China. It then costs c$20k to ship a blade from China to Europe in a $200k/day vessel, less than 4% of the cost of manufacturing the blade.

Other margin drivers? Wind is less economically competitive than solar and more prone to cost re-inflation (note here). The industry has also had to reinvent itself every 2-3 years with ever larger turbines, which creates ever greater engineering issues (note here).

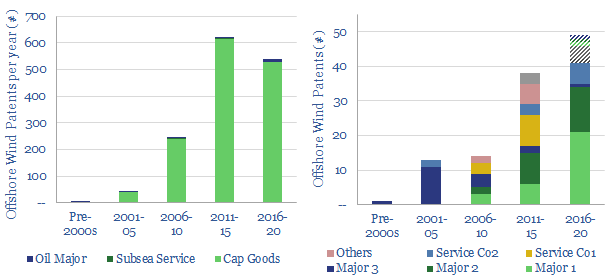

Patent filings from traditional energy companies looking to break into the offshore wind sector are also tabulated in the final tab. This includes ABB, Aker, Alstom, Aramco, BP, Cameron, Chevron, Eni, Equinor, ExxonMobil, GE, OneSubsea, Saipem, Shell, Siemens, Subsea 7, Technip, TOTAL and Vestas.

Across our broader research, we have also screened patents from Siemens Gamesa, from Goldwind, and compiled other wind research, data-files and models.