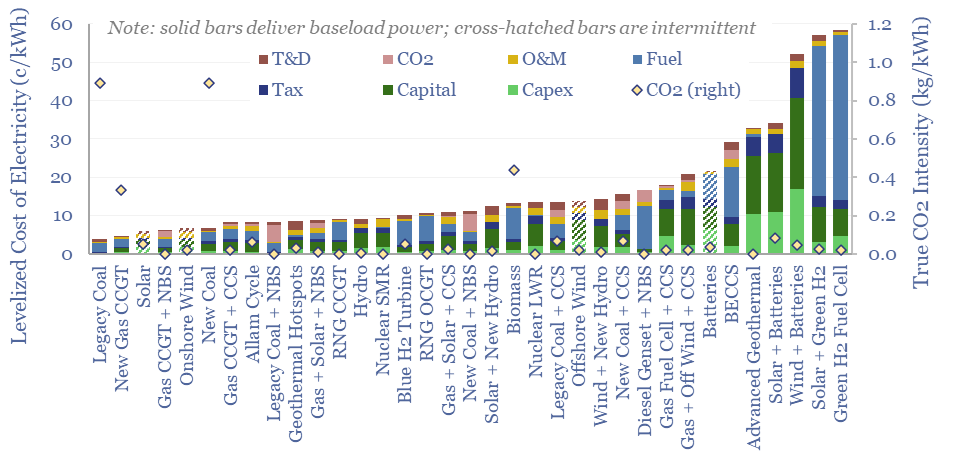

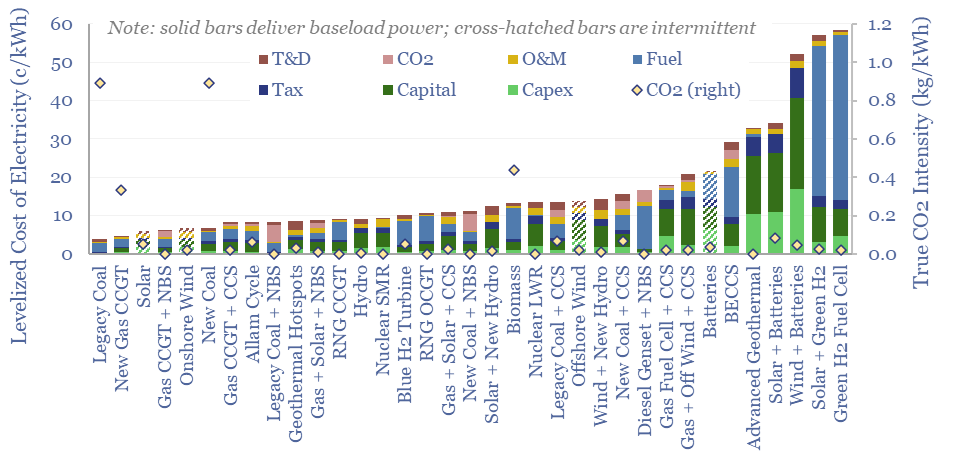

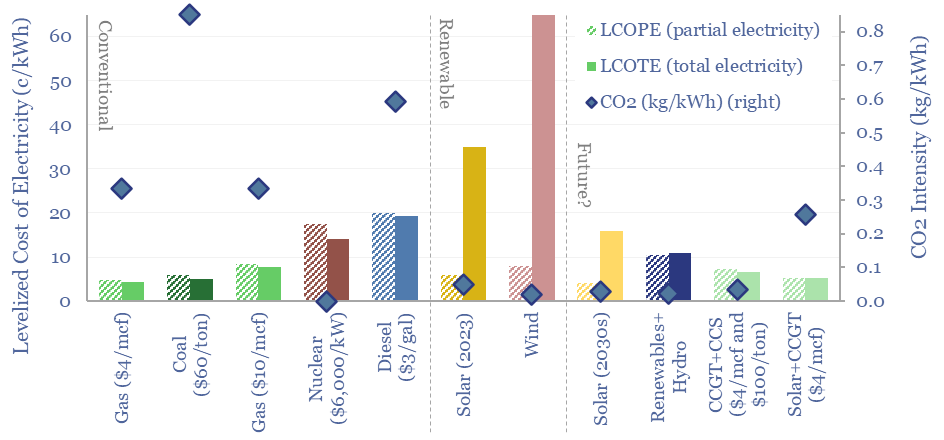

Levelized cost of electricity: stress-testing LCOE?

…value of money, decline curves, and volatility. Tax costs come on top of after-tax income. For simplicity, our models assume a 25% corporate tax rate across the board, but not…

…value of money, decline curves, and volatility. Tax costs come on top of after-tax income. For simplicity, our models assume a 25% corporate tax rate across the board, but not…

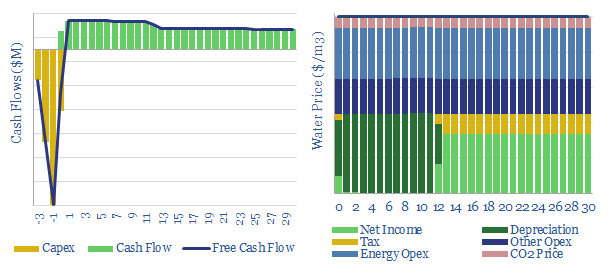

…angle that excites over desalination costs is the possibility for demand shifting, as electricity is a major cost line, and desalination pumps can be run flexibly to backstop renewables’ volatility….

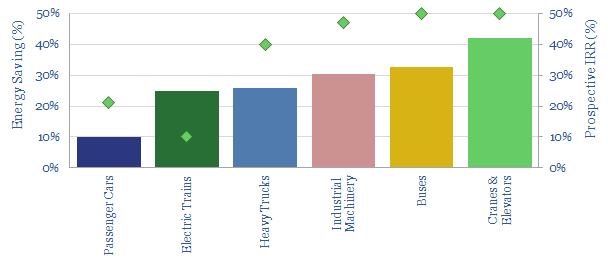

…This report specifically focuses on the use of supercapacitors in transport and industry. Although more recently, we have been getting excited about supercapacitors as a means of smothing short-term volatility….

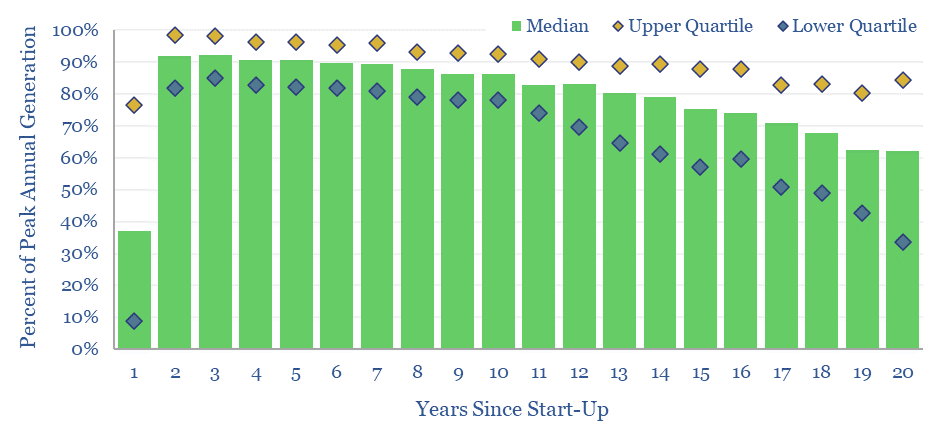

…to 20. However, the data are highly variable, as shown by the examples plotted below. Volatility does matter for the costs of integrating renewables, the ultimate share of renewables and…

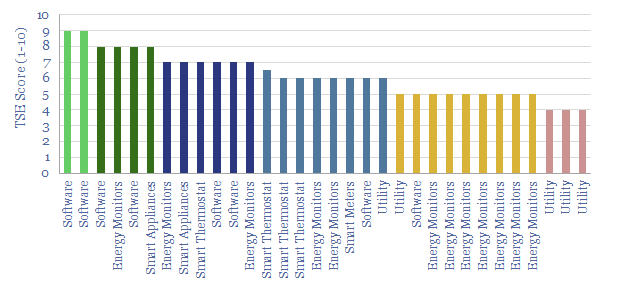

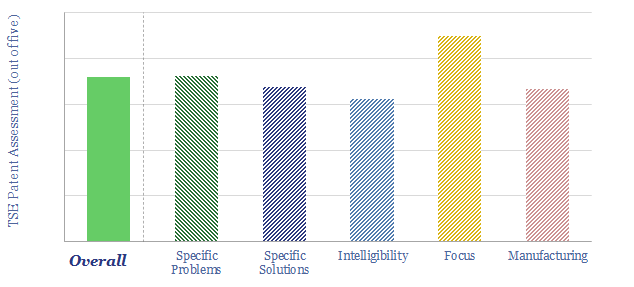

…We also tabulate their patent filings. We find most of the offerings will lower end energy demand (by an average of 7%), assist with smoothing grid-volatility, provide appliance-by-appliance demand disaggregations…

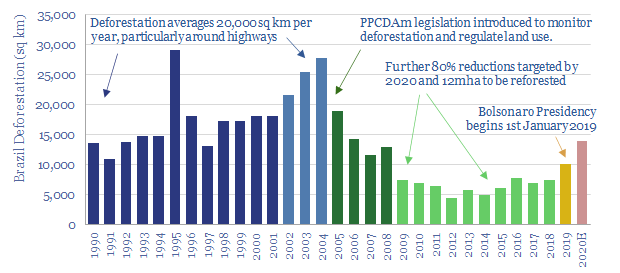

…burning down forests and start re-planting them. This does not require electrolysing water molecules into hydrogen, smoothing volatility in renewable-heavy grids, or developing next-generation batteries. It requires something much harder:…

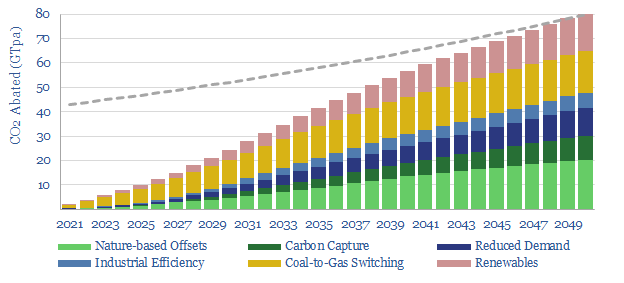

…comparing our latest decarbonization roadmap, in December-2020, with the roadmap we laid out in December-2019. The outlook has improved most for nature-based solutions, efficiency technologies and backing up renewables’ volatility….

…natural gas is going to emerge as the most pragmatic and cost-effective backstop for the volatility in renewable-heavy grids. Hence gas is going to ‘surprise’ by entrenching at a 30-50%…

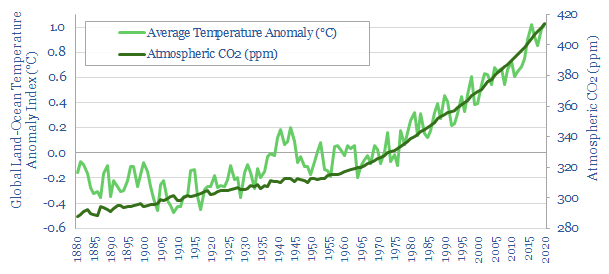

…sole modulator of global temperature. El Nino, solar cycles and ‘weather’ also play a role. And despite the annual volatility, the recent and most accurate data from 1970+ rise in…

…than hardware (c20%). What surprised us about the patents is that they are mostly focused on smoothing short-term, second-by-second, minute-by-minute volatility caused by increasing renewables deployment (70%). Not moving excess…