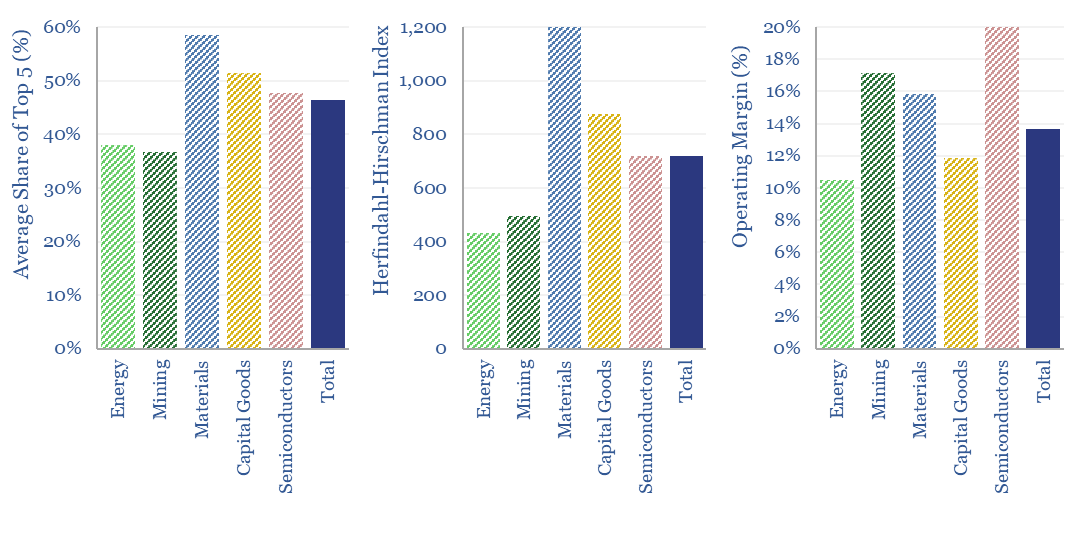

…US E&P, US refining, Western coal, LNG shipping. Mining sectors covered include aluminium, copper, cobalt, lithium, nickel, uranium, silica and silver. Correlation between market concentration and operating margins in energy…

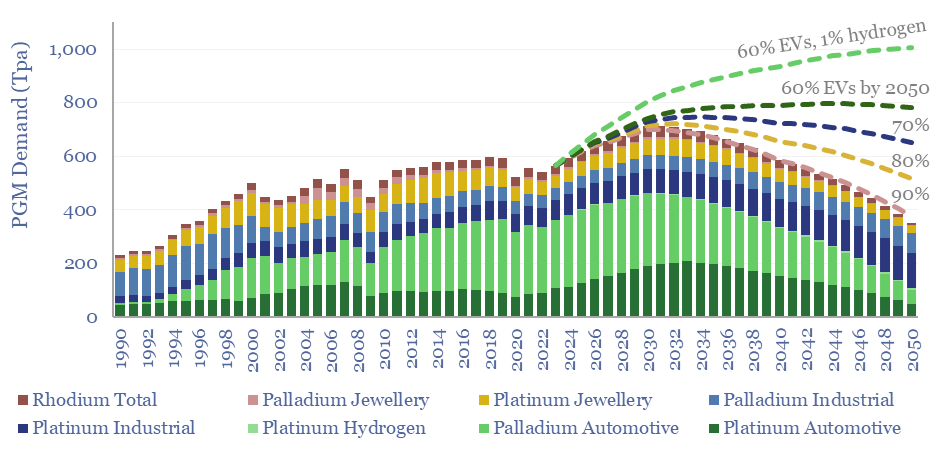

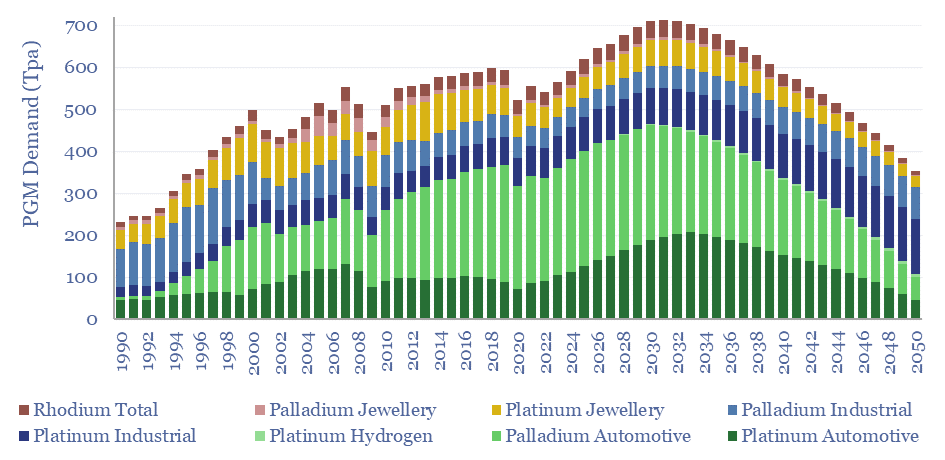

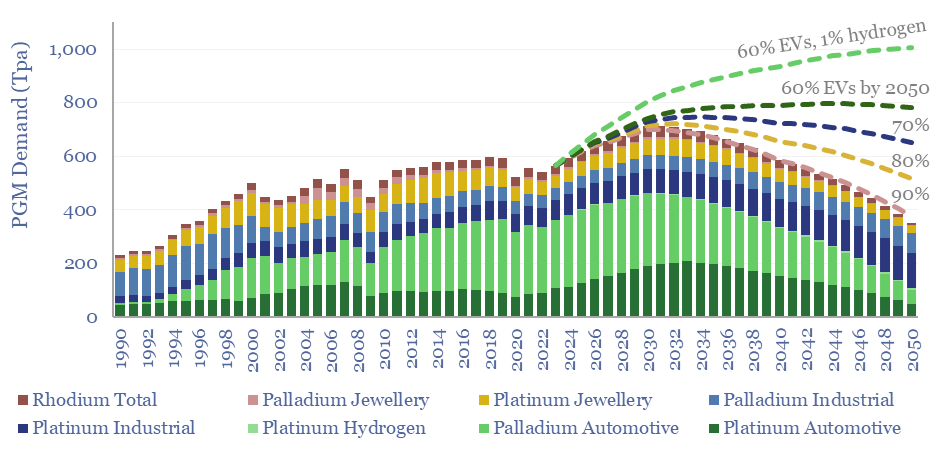

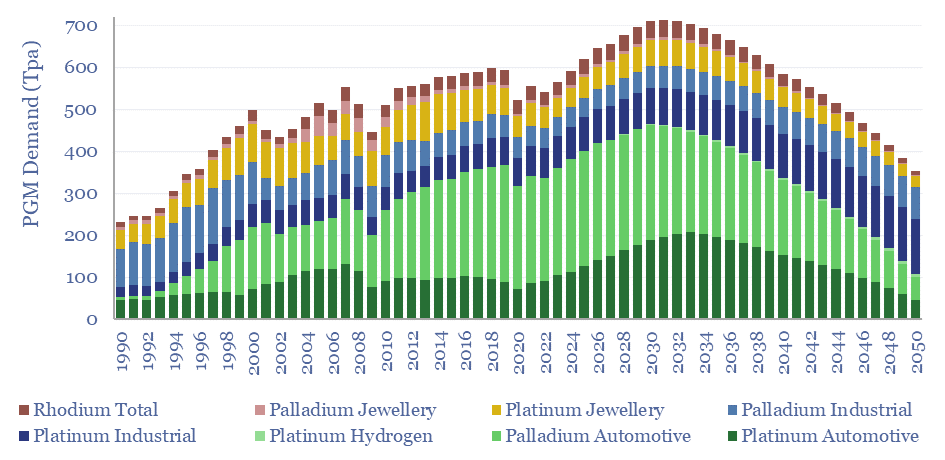

…change the outlook for PGMs in energy transition? PGMs comprise six silver-white metals, which co-occur in nature and have remarkable catalytic properties: platinum, palladium, rhodium, ruthenium, iridium and osmium. To…

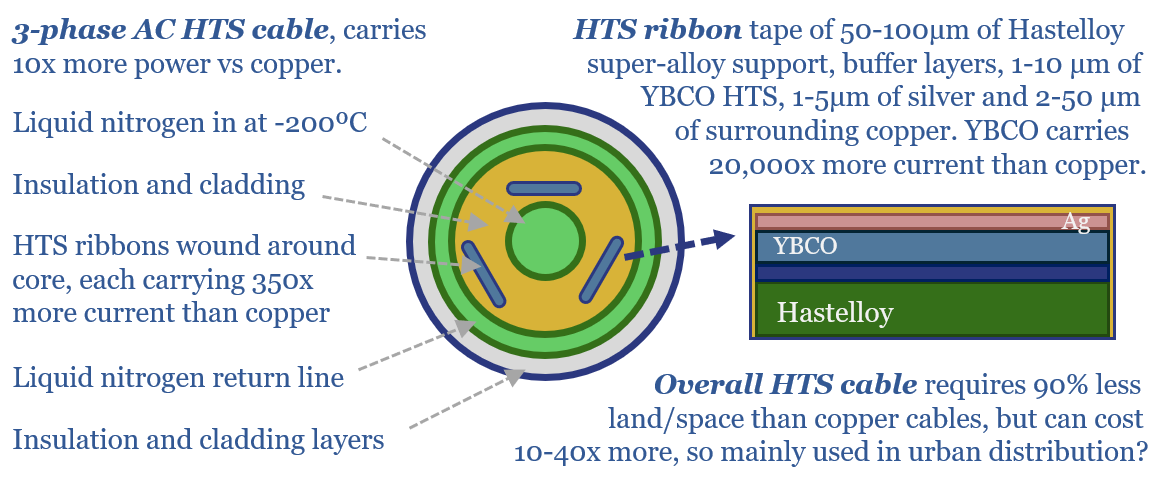

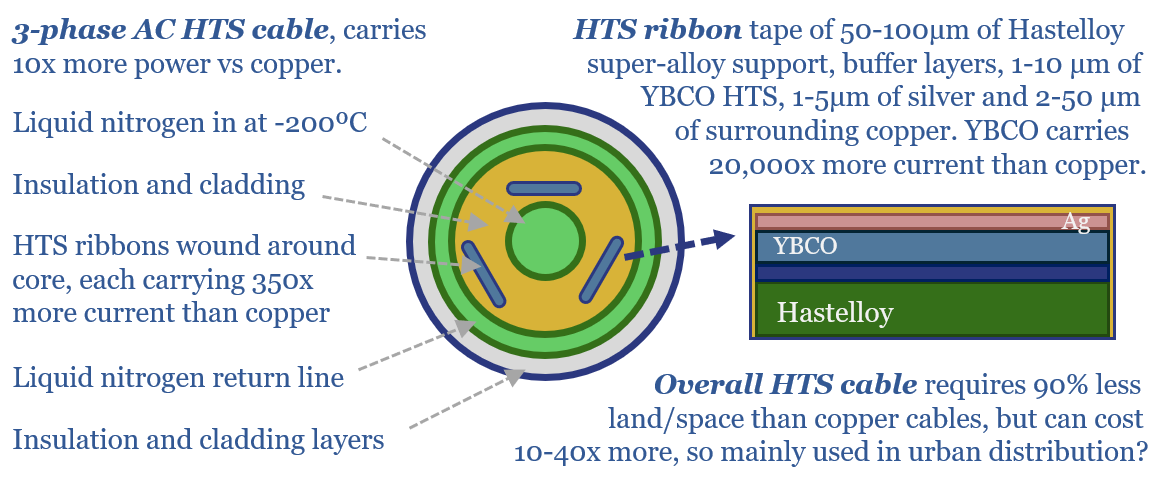

…Material implications of high-temperature superconductors are also explored, for materials such as silver, superalloys, yttrium, helium and for displacing copper on page 13. Leading companies in superconductors include six large…

…this model. $699.00 – Purchase Checkout Added to cart PGMs comprise six silver-white metals, which co-occur in nature and have remarkable catalytic properties: platinum, palladium, rhodium, ruthenium, iridium and osmium. They function…

…time, given the complex chemistry of the electro-ceramic cells: e.g., doped cerium oxide electrolyte, sintered lanthanum strontium cobalite electrodes covered with silver. (4) System sufficiency. In some high-intensity conditions —…

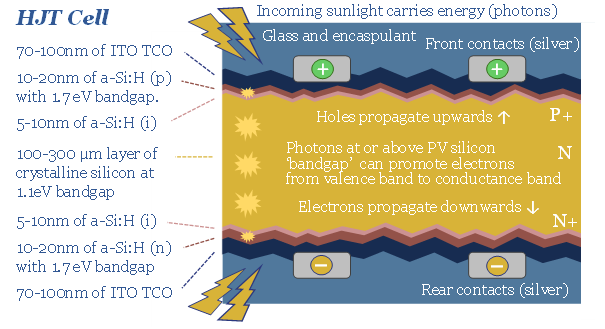

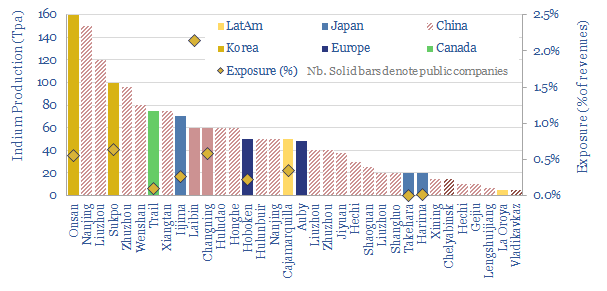

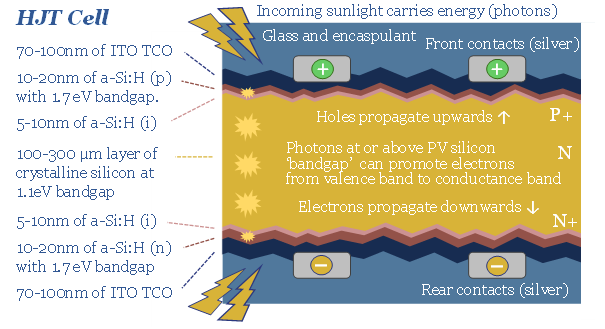

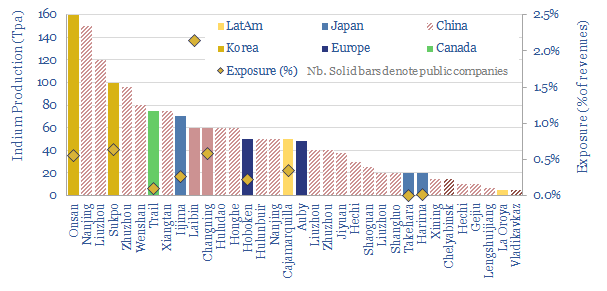

…solar cells is compared with other bottlenecks in our solar bill of materials, quadrupling global demand for Indium, while using double the silver of incumbent solar cells. Bottlenecks are contrasted…

…decision makers to explore. Many are also exposed to metal value chains such as silver and battery recycling, which matter in the energy transition. For each indium producing company in…

…spaces. But often, it takes some energy economics to determine how much material you can thrift. https://thundersaidenergy.com/2023/01/26/solar-surface-silver-thrifting/ https://thundersaidenergy.com/downloads/power-cables-how-much-copper-and-aluminium/ Does that company’s technology work? We like to answer this question by…

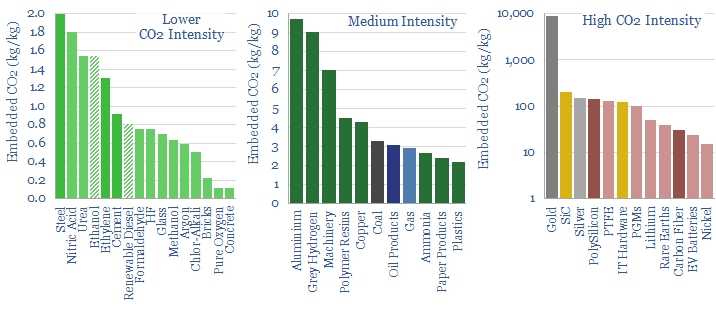

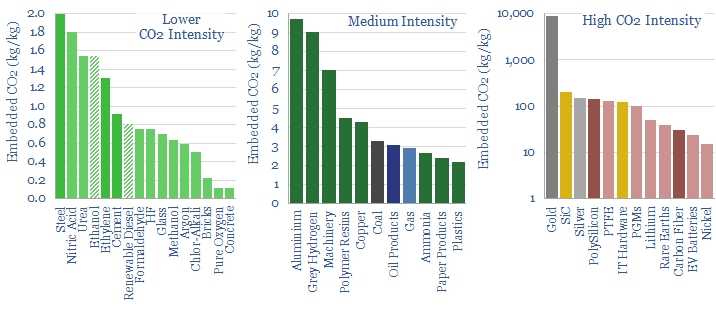

…value chains that truly are CO2 intensive (i.e., emissions are above 20 tons/ton or even 100 tons/ton). This includes PV silicon and silver for solar panels; carbon fiber and rare…

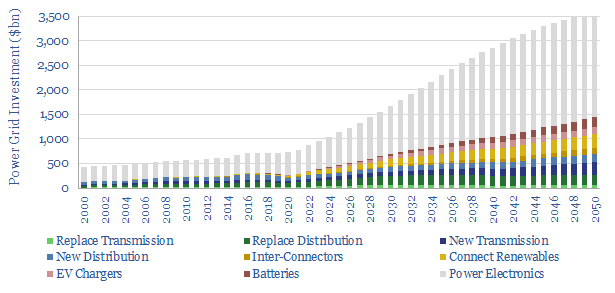

…or 5-7% upside (note here). But we are more worried about bottlenecks in copper (where total global demand trebles) and silver. (8) Transformers and specialized switchgear are needed to step…