Search results for: “climate model”

-

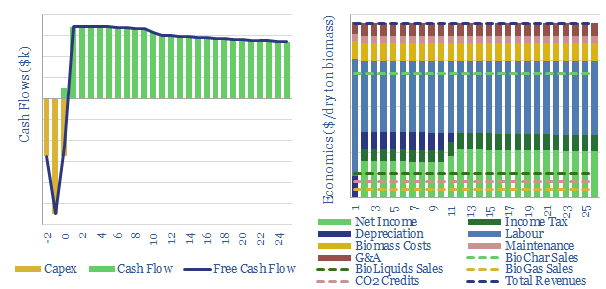

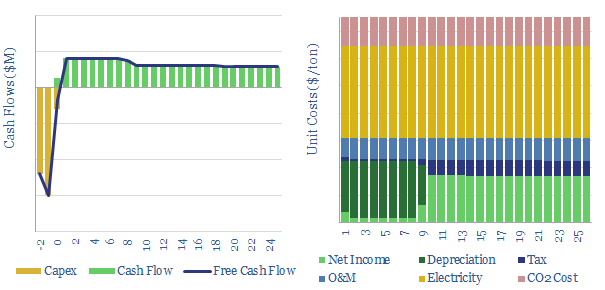

Biomass to biochar: the economics?

Biochar is a carbon negative material, according to our accounting, locking as much as 0.5kg of CO2 into soils per kg of dry biomass inputs. It can also be highly economical, with a base case IRR of 25%. Our full model allows you to stress-test input assumptions.

-

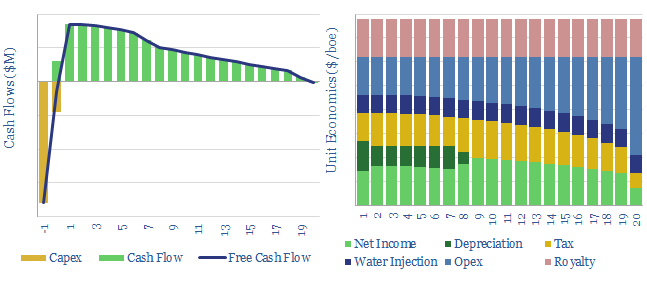

Water injection at oil fields: the economics?

This model captures the economics of a conventional waterflood project, in order to maintain reservoir pressure at maturing oilfields. Our base case calculations suggest 30% IRRs at $40/bbl oil, on a project costing $2.5/boe in capex and $1/bbl of incremental opex costs.

-

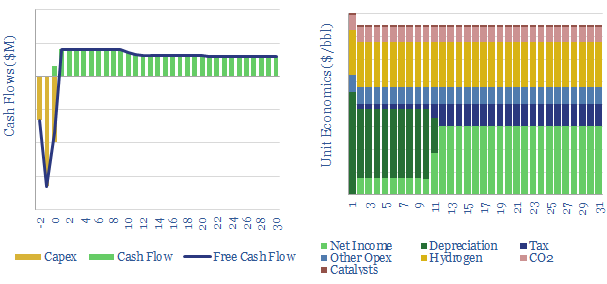

Hydroprocessing: the economics?

This model requires a $7.5/bbl upgrade spread to earn a 10% IRR across a new hydrocracking or hydrotreating unit. CO2 emissions are around 25kg/bbl. Green hydrogen could be used for decarbonization, but it would require 3x higher upgrading spreads to remain economical.

-

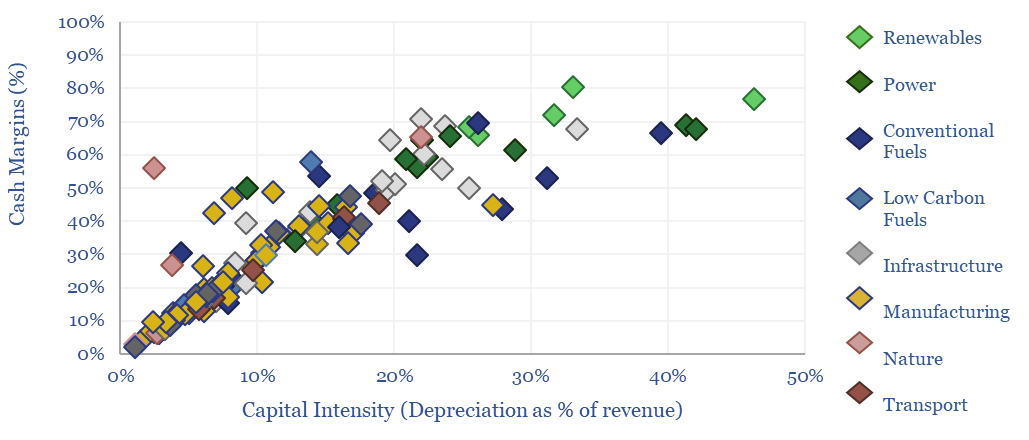

Energy economics: an overview?

This data-file provides an overview of energy economics, across 175 different economic models constructed by Thunder Said Energy, in order to put numbers in context. This helps to compare marginal costs, capex costs, energy intensity, interest rate sensitivity, and other key parameters that matter in the energy transition.

-

Polymers and higher olefins: the economics?

Our base case for producing high density polyethylene (HDPE) from ethylene requires pricing of $1,250/ton for a 10% IRR on a new greenfield plant. CO2 intensity is 0.3 kg/kg. However temperatures and pressures can vary vastly for different polymers, moving energy economics accordingly.

-

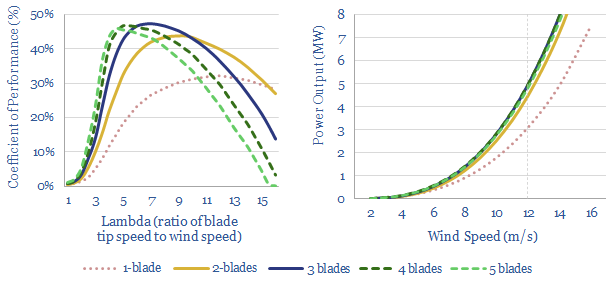

Windy physics: how is power of a wind turbine calculated?

This data-file is an overview of wind power physics. Specifically, how is the power of a wind turbine calculated, in MW, as a function of wind speed, blade length, blade number, rotational speed (in RPM) and other efficiency factors (lambda). A large, modern offshore wind turbine will have 100m blades and surpass 10MW power outputs.

-

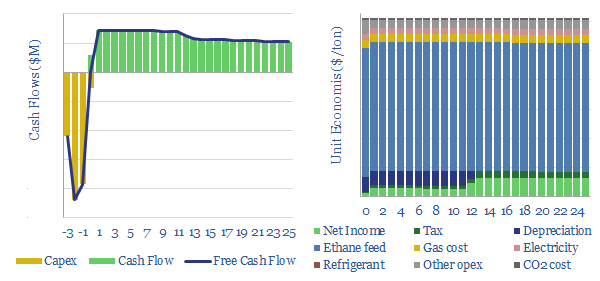

CO2 liquefaction: the economics?

This data-file captures the costs of liquefying CO2 for transportation in a ship, rail car or truck, to promote smaller-scale CCS. Our baseline is a cost of $15/ton, using c100kWh of energy per ton of CO2, which is approximately equivalent to a c3% energy penalty. There is scope for optimization.

-

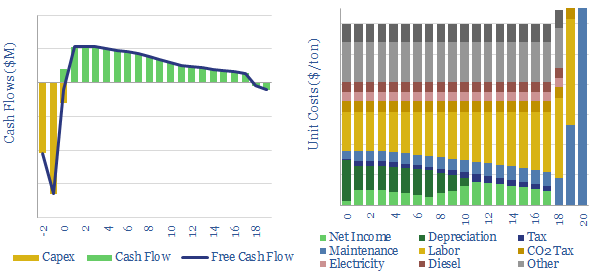

Coal mining: the economics?

Coal is ridiculously cheap, providing thermal energy at around 1c/kWh while also generating a 10% IRR on new investment. But CO2 intensity is also very high at 0.55kg/kWh (thermal basis). Capex, opex and cost breakdowns are in the data-file.

Content by Category

- Batteries (89)

- Biofuels (44)

- Carbon Intensity (49)

- CCS (63)

- CO2 Removals (9)

- Coal (38)

- Company Diligence (95)

- Data Models (840)

- Decarbonization (160)

- Demand (110)

- Digital (60)

- Downstream (44)

- Economic Model (205)

- Energy Efficiency (75)

- Hydrogen (63)

- Industry Data (279)

- LNG (48)

- Materials (82)

- Metals (80)

- Midstream (43)

- Natural Gas (149)

- Nature (76)

- Nuclear (23)

- Oil (164)

- Patents (38)

- Plastics (44)

- Power Grids (130)

- Renewables (149)

- Screen (117)

- Semiconductors (32)

- Shale (51)

- Solar (68)

- Supply-Demand (45)

- Vehicles (90)

- Wind (44)

- Written Research (354)