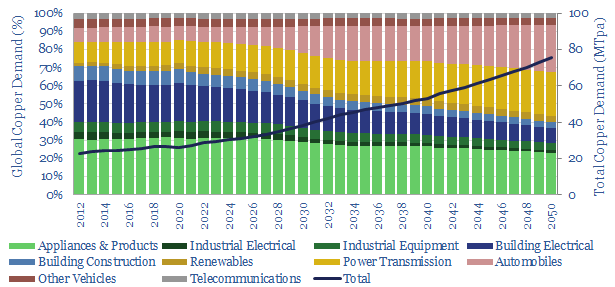

This data-file estimates global copper demand as part of the energy transition, rising from 28MTpa in 2022 to 70MTpa in our base case scenario. The largest contributor is the electrification of transport. You can stress test half-a-dozen key input variables in the model.

This data-file estimates the growth in global copper demand in the energy transition: specifically, the rise of renewables, electric vehicles and other new energies technologies.

Global copper demand stood at 28MTpa in 2022, and will most likely increase to 70MTpa by 2050, in our base case scenario.

The global copper market today comprises 32% appliances, 28% buildings, 14% power T&D, 13% vehicles, 10% industrial equipment and 4% renewables, according to data from the Copper Council.

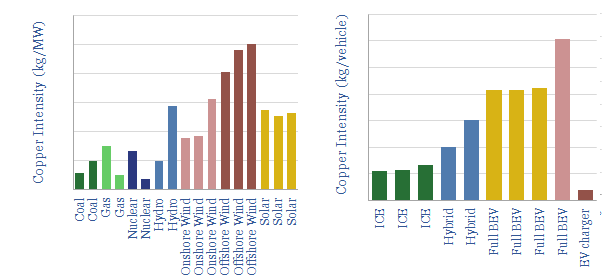

Copper demand intensity factors. Copper use in wind, copper use in solar, copper use in electric vehicles and copper use in power grids — transmission and distribution — are substantiated with industry data-points in the file.

The greatest source of growth is for electric vehicles, and automobile demand for copper can conceivably rise from 2MTpa to 20MTpa, as the world ramps up from producing 10M EVs and hybrids per year to 200M per year by 2050, or at least, this is the ascent projected in our oil demand forecasts.

A prior iteration of the model had copper demand ramping to 75MTpa, but we recently revised this lower, as we expected more thrifting and substitution towards aluminium as a lower-cost and lighter carrier for power transmission.

The data-file allows you to stress test different scenarios, varying the ultimate share of electric vehicles in the vehicle fleet, the rise of long-distance power transmission, global GDP growth, reductions in copper intensity, and the ultimate share of renewables in the grid. This is part of our broader research into metals and materials demand in the energy transition. Our other copper research is linked here.