Search results for: “climate model”

-

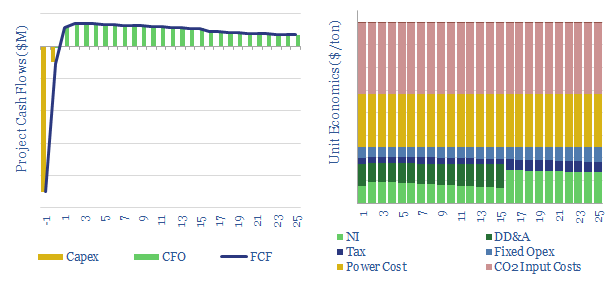

CO2 electrolysis: the economics?

Carbon monoxide is an important chemical input for metals, materials and fuels. Could it be produced by capturing CO2 from the atmosphere or using the amine process, then electrolysing the CO2 into CO and oxygen? We find 10% IRRs could be achievable at $800/ton, competitive with conventional syngas.

-

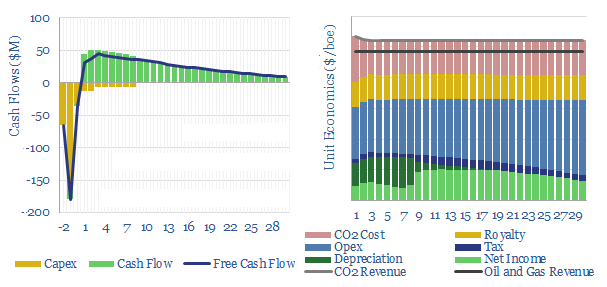

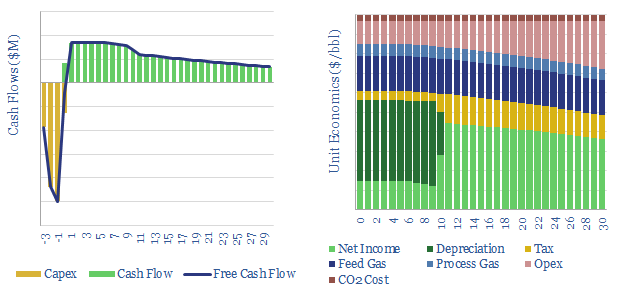

CO2-EOR: the economics?

This data-file is captures the costs of CO2-enhanced oil recovery, which can lower the total CO2 intensity across the oil industry by 50-100%, while economically storing CO2. We calculate 10% IRRs are attainable under our base case assumptions at $50/bbl oil prices and $20/ton CO2 prices. The work includes a full cost breakdown.

-

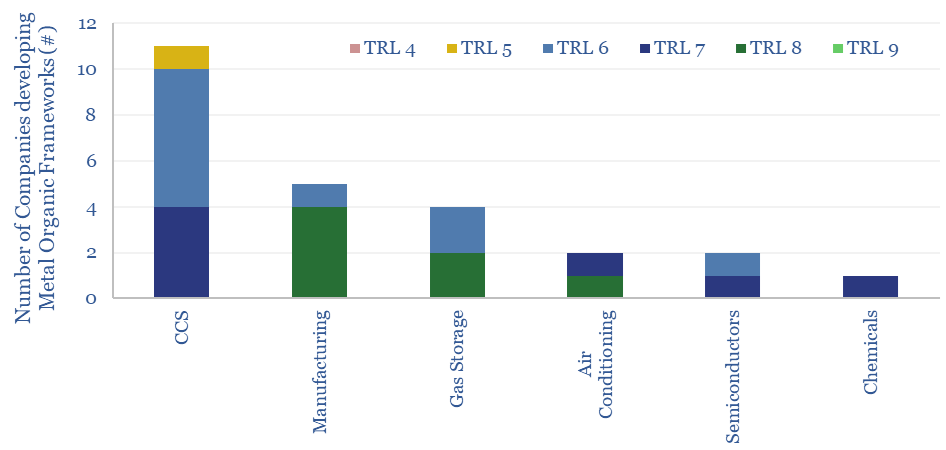

Metal organic frameworks: challenges and opportunities?

Metal organic frameworks (MOFs) are an exciting class of materials, which could reduce the energy penalties of CO2-separation by c80%, and reduce the cost of carbon capture to $20-40. This data-file screens companies developing metal organic frameworks, where activity has been accelerating rapidly, especially for CCS applications.

-

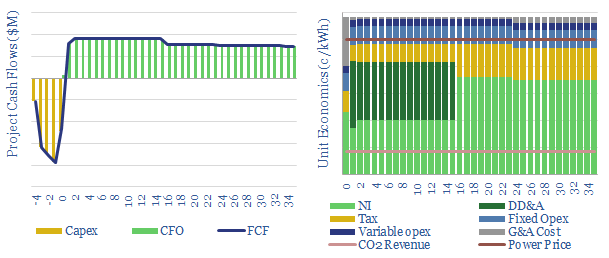

Hydro electric power: the economics?

A typical hydro project requires a 10c/kWh power price and a $50/ton CO2 price to generate an unlevered IRR of 10%. 80% of the cost is capex. Hence at a 6% hurdle rate, the incentive price falls to 6c/kWh. Cash opex is 2c/kWh. CO2 intensity is effectively nil, even after reflecting the construction energy.

-

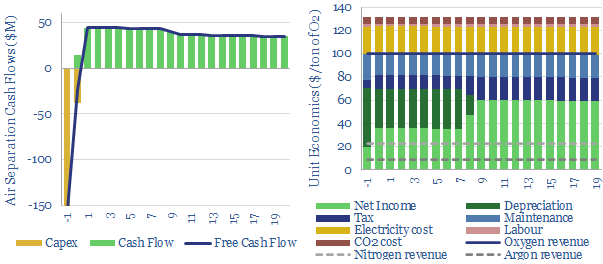

Cryogenic air separation: costs and energy economics?

This data-file calculates the costs of cryogenic air separation units, which are important in the production of industrial gases, ammonia, metals, materials, medical applications and new energy technologies such as blue hydrogen. Good base cases are $100/ton oxygen, $20/ton nitrogen, $200/Tpa capex and 60kWh/ton of electricity (on an input air basis).

-

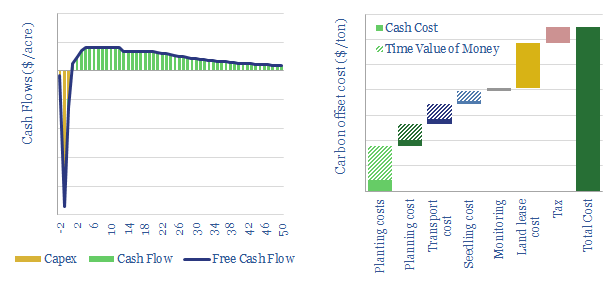

Mangrove restoration: what costs for carbon offsets?

A CO2 price of $130/ton is needed to earn a 10% IRR on a US mangrove restoration project. c30% is the cost of labor and c30% is land leasing. But costs in the emerging world are lower, at $15-35/ton. They can be as low as $3/ton in the best cases, if restoring nature is treated…

-

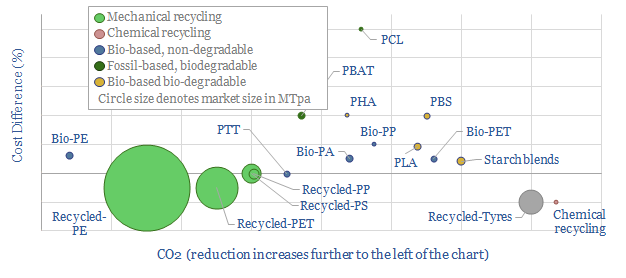

Next-generation plastics: bioplastic, biodegradable, recycled?

This data-file captures 17 plastic products derived from mechanical recycling, biologically-sourced feedstocks or that is bio-degradable. The ‘greenest” plastics are c30% lower in CO2 than conventional plastics, but around 2x more costly.

-

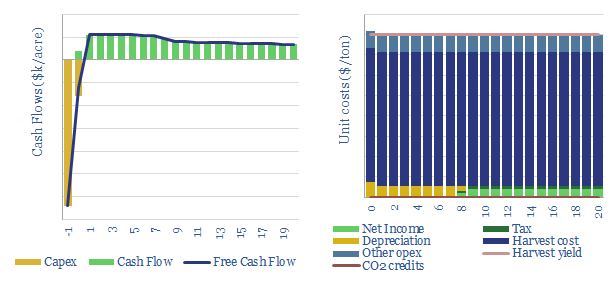

Seaweed aquaculture: farming kelp and CO2?

This data-file captures the economics of ocean carbon sequestration using seaweeds and kelps, which generate 20T of dry biomass per acre per year, of which c10% is naturally sequestered in the deep ocean. $400/ton revenues are needed for 10% IRRs, but dry kelp realizations are 10x more important than CO2 prices.

-

Gas-to-liquids: the economics?

This data-file captures the economics of gas-to-liquids via Fischer-Tropsch. Our base case requires $100/bbl realizations for a 10% IRR on a US project. You can stress-test the economics as a function of gas prices, capex costs, thermal efficiencies, et al, in the data-file.

Content by Category

- Batteries (89)

- Biofuels (44)

- Carbon Intensity (49)

- CCS (63)

- CO2 Removals (9)

- Coal (38)

- Company Diligence (95)

- Data Models (840)

- Decarbonization (160)

- Demand (110)

- Digital (60)

- Downstream (44)

- Economic Model (205)

- Energy Efficiency (75)

- Hydrogen (63)

- Industry Data (279)

- LNG (48)

- Materials (82)

- Metals (80)

- Midstream (43)

- Natural Gas (149)

- Nature (76)

- Nuclear (23)

- Oil (164)

- Patents (38)

- Plastics (44)

- Power Grids (130)

- Renewables (149)

- Screen (117)

- Semiconductors (32)

- Shale (51)

- Solar (68)

- Supply-Demand (45)

- Vehicles (90)

- Wind (44)

- Written Research (354)