Search results for: “climate model”

-

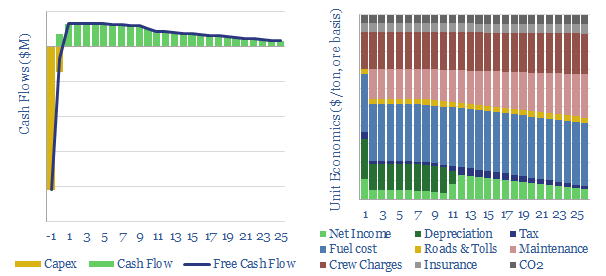

Synchronous condensers: the economics?

This data-file captures the costs of installing a synchronous condenser, downstream of a renewable power facility, to emulate the inertia, reactive power and short circuit power from conventional generators. 1.0 – 2.5 c/kWh of costs may be added to the power supplies flowing out of the SC.

-

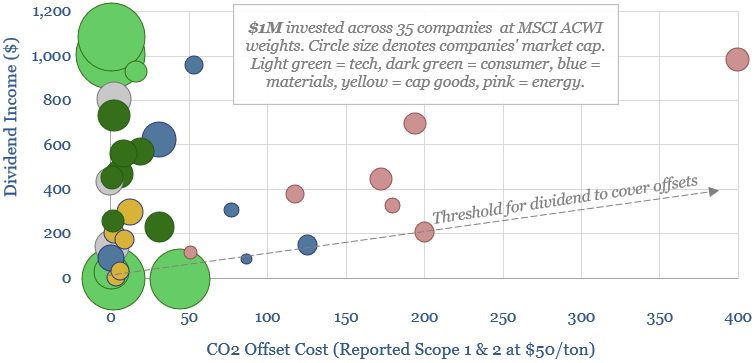

Carbon neutral investing: hedge funds, forest funds?

This 11-page note considers a new model of ‘carbon neutral’ investing. Look-through emissions of a portfolio are quantified (Scope 1 & 2 basis). Then accordingly, an allocation is made to high-quality, nature-based CO2 removals. Advantages and practicalities are discussed.

-

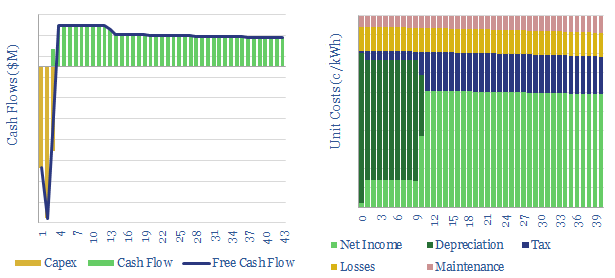

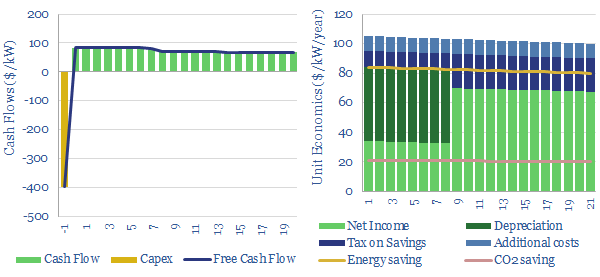

Variable frequency drives: the economics?

Variable frequency drives optimize the operating speeds of electric motors. Average energy saving are 34% and average costs are $250/kW. Hence our modelling calculates >15% IRRs installing a VFD at a typical industrial motor. This data-file captures the economics.

-

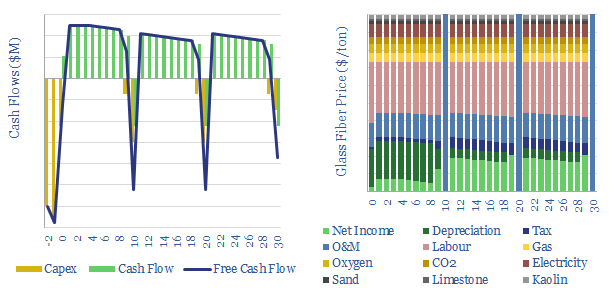

Glass fiber: the economics?

This data-file models the economics of producing glass fiber, the key component in fiberglass for wind turbines; but also a light-weight insulating material. Marginal cost is likely $2,000/ton, with a CO2 intensity of 1.5 tons/ton. Some Chinese product is 50% cheaper but 2x more CO2 intensive.

-

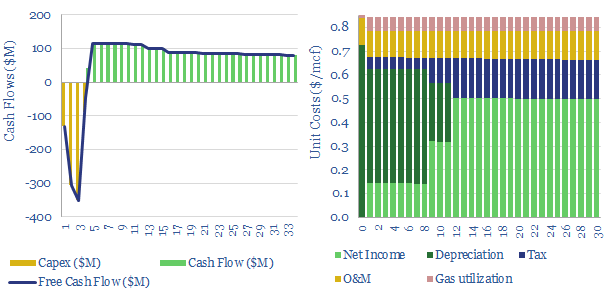

LNG regasification: the economics?

This data-file captures the economics for a typical LNG regas facility. We estimate that a fixed plant with 75-80% utilization requires a spread near to $0.5-0.8/mcf on its gas imports, in order to earn a 5-10% IRR. But there is asymmetric upside amidst gas shortages.

-

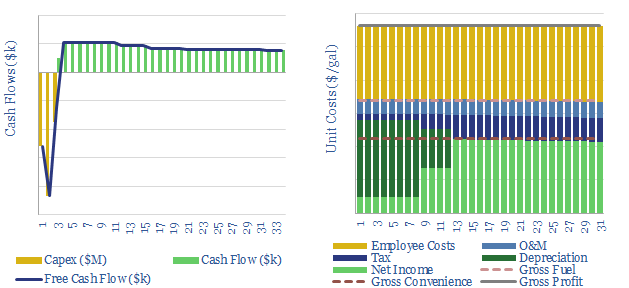

Fuel retail: economics of a petrol station?

This data-file captures the economics for a fuel-retailing “petrol station” to earn a 10% IRR. A typical EBIT margin is 17c/gallon; with a c6% margin on direct fuel sales; plus 10-20% of revenues from convenience retail at a higher, c25-30% margin.

-

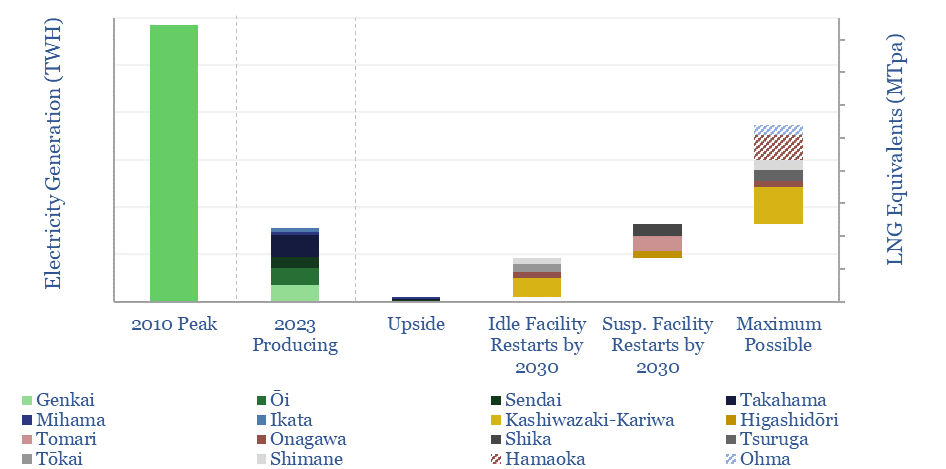

Japan: nuclear restart tracker?

This data-file on looks through 17 major nuclear plants in Japan with 45GW of operable capacity, covering the key parameters and re-start news on each facility. Japan’s nuclear restart had ramped output back to 78TWH pa by 2023, and may rise by a further 100 TWH by 2030, to meet targets for 20% nuclear in…

-

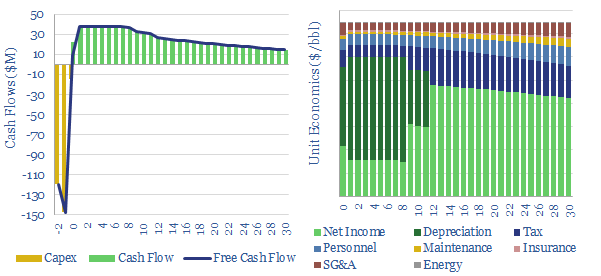

Oil storage terminals: the economics?

This data-file captures the economics of constructing an oil storage terminal (aka a “tank farm”). A typical facility needs to charge a $1.5/bbl storage spread to earn a 10% IRR over a 30-year life. Capex costs per kWh of energy are 97% lower than grid-scale batteries. It may become more challenging to finance new facilities…

Content by Category

- Batteries (89)

- Biofuels (44)

- Carbon Intensity (49)

- CCS (63)

- CO2 Removals (9)

- Coal (38)

- Company Diligence (95)

- Data Models (840)

- Decarbonization (160)

- Demand (110)

- Digital (60)

- Downstream (44)

- Economic Model (205)

- Energy Efficiency (75)

- Hydrogen (63)

- Industry Data (279)

- LNG (48)

- Materials (82)

- Metals (80)

- Midstream (43)

- Natural Gas (149)

- Nature (76)

- Nuclear (23)

- Oil (164)

- Patents (38)

- Plastics (44)

- Power Grids (131)

- Renewables (149)

- Screen (117)

- Semiconductors (32)

- Shale (51)

- Solar (68)

- Supply-Demand (45)

- Vehicles (90)

- Wind (44)

- Written Research (356)