Search results for: “gas”

-

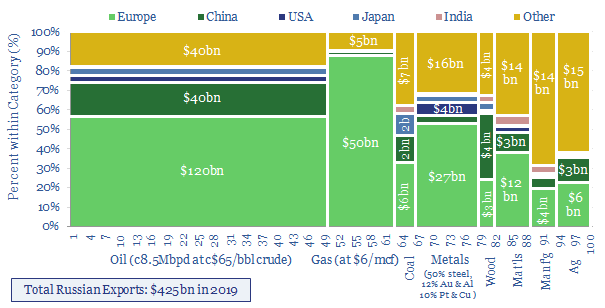

Russia: a breakdown of export revenues?

Russia’s total total exports ran at $425bn in 2019, comprising $225bn of oil, $55bn of gas, $50bn of metals, $20bn of coal, $30bn basic materials and $25bn of ag products. 55% of the total goes to Europe. This data-file gives a breakdown for 100 products across 200 countries, to allow for stress-testing.

-

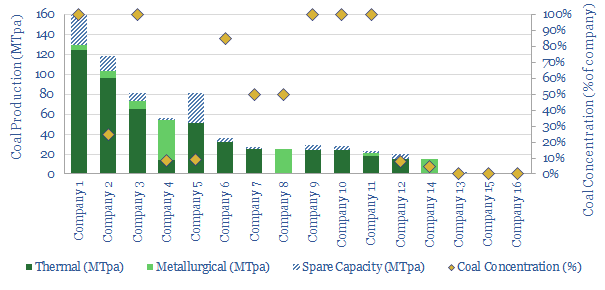

Coal miners: a screen of Western companies?

In 2022-25, bizarrely, we could be in a market where deployment of important energy transition technologies is being held back by energy shortages and metals shortages, which both pull on the demand for coal. This data-file screens fifteen of the largest Western coal producers.

-

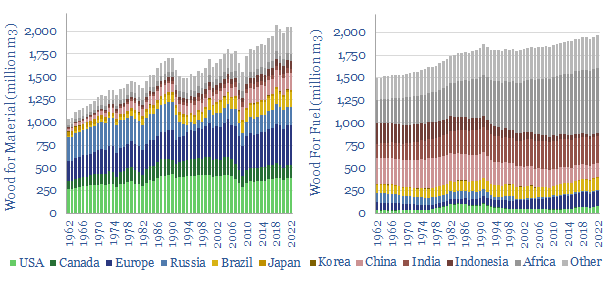

Global wood production: supply by country by year?

This data-file quantifies global wood production, country-by-country, back to 1960, across energy, pulp and longer-lasting materials. Overall, wood energy has declined from 11% of the world’s primary energy mix in 1960 to c4% today, but it remains stubbornly high in less-developed countries, amplifying deforestation.

-

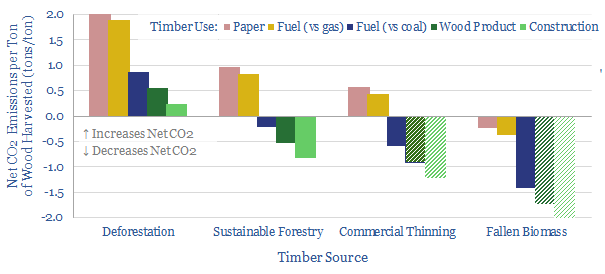

CO2 intensity of wood: context by context?

This data-file calculates the CO2 intensity of wood in the energy transition. Context matters, and can sway the net climate impacts from -2 tons of emissions reductions per ton of wood through to +2 tons of incremental emissions per ton of wood. Calculations can be stress-tested in the data-file.

-

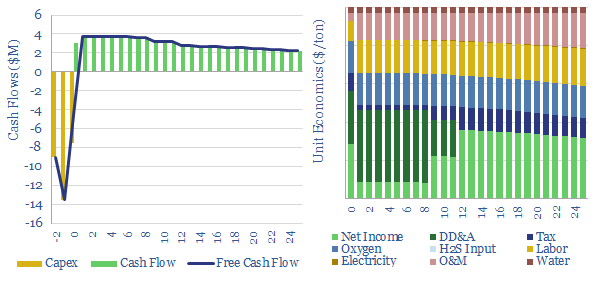

Sulphur recovery units: Claus process economics?

This data-file captures the economics of producing sulphur from H2S via the Claus process, yielding an important input for phosphate fertilizers and metals. Cash costs are $40-60/ton and marginal costs are $100/ton. CO2 intensity is low at 0.1 tons/ton. Data-file explores shortages in energy transition?

-

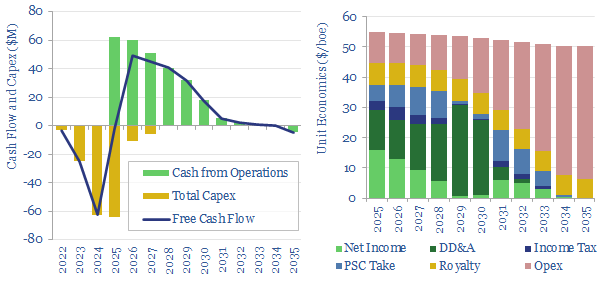

Offshore oil: marginal cost?

What is the marginal cost of offshore oil and gas? This data-file captures a small project, off Africa, with $15/boe development cost, $15/boe opex, 70% fiscal take. Break-even is at $35-45/bbl. But a $90/bbl forward curve may be needed for definitive go-ahead.

-

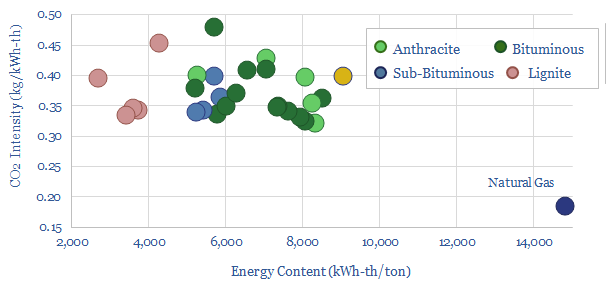

Coal grades: what CO2 intensity?

The CO2 intensity of coal is estimated at 0.37kg/kWh of thermal energy, at a typical coal grade comprising 63% carbon and 6,250 kWh/ton of energy content. This is the average across 25 samples in our data-file, while moisture, ash and sulphur are also appraised. Coal is 2x more CO2 intensive than natural gas.

-

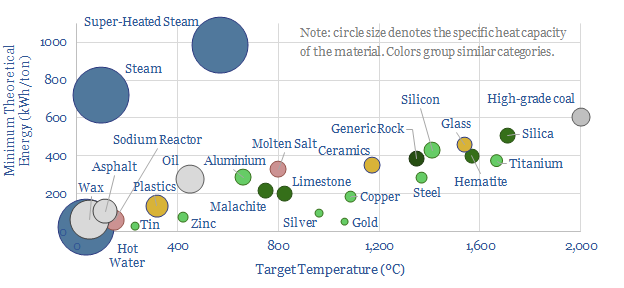

Heating-melting: how much energy is needed?

How do we quantify the minimum energy needed to heat materials and melt materials? This data-file calculates values, in kWh/ton, from first principles, based on target temperatures, specific heat capacities and latent heat capacities. A good rule of thumb is 25 kWh of useful energy to heat each ton of material by each 100ºC.

-

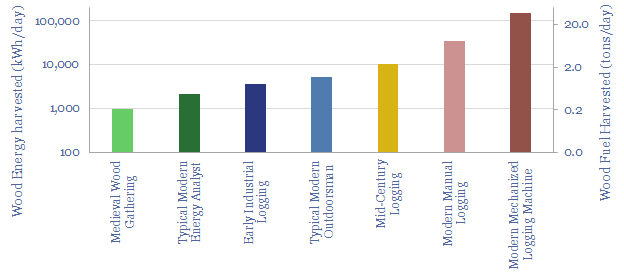

Energy history: how much wood can be cut in a day?

How much wood can be cut in a day? We review 500-years of industrial history. In medieval times, a manorial tenant might have gathered 250kg of fallen branches in a day. A modern feller-buncher is 150x more productive. But a modern energy analyst is little better than a medieval peasant, and harvesting wood as a…

-

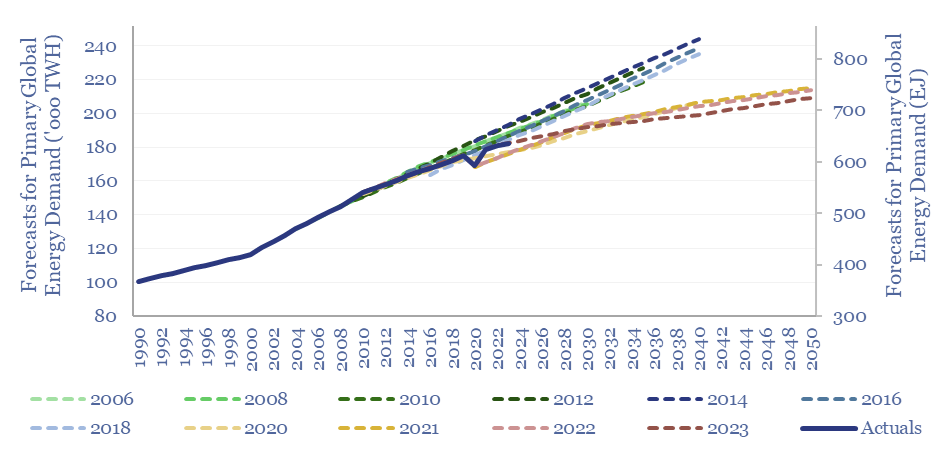

Energy demand forecasts: making predictions about the future?

How accurate are energy demand forecasts? Long-term forecasts for total global energy demand can easily be wrong by +/- 10%. Oil market forecasts tend to be amiss by 0.6% x the number of years away. Oil and coal seem to have been consistently under-estimated since 2020. Solar and wind were consistently underestimated in 2010-20, but…

Content by Category

- Batteries (89)

- Biofuels (44)

- Carbon Intensity (49)

- CCS (63)

- CO2 Removals (9)

- Coal (38)

- Company Diligence (95)

- Data Models (840)

- Decarbonization (160)

- Demand (110)

- Digital (60)

- Downstream (44)

- Economic Model (205)

- Energy Efficiency (75)

- Hydrogen (63)

- Industry Data (279)

- LNG (48)

- Materials (82)

- Metals (80)

- Midstream (43)

- Natural Gas (149)

- Nature (76)

- Nuclear (23)

- Oil (164)

- Patents (38)

- Plastics (44)

- Power Grids (130)

- Renewables (149)

- Screen (117)

- Semiconductors (32)

- Shale (51)

- Solar (68)

- Supply-Demand (45)

- Vehicles (90)

- Wind (44)

- Written Research (354)