Search results for: “gas”

-

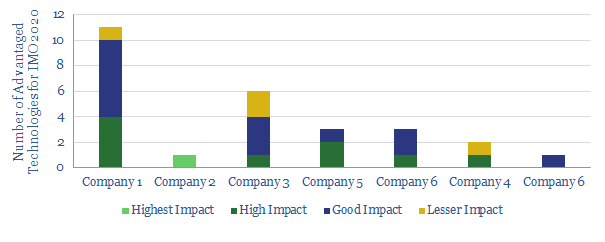

Our Top Technologies for IMO 2020

We review the top, proprietary technologies that we have seen from analysing patents and technical papers, to capitalise on IMO 2020 sulphur regulation, across the world’s leading integrated oil companies.

-

Shale EOR: Container Class

Is Shale-EOR the next wave of unconventional upside? The topic jumped into the ‘Top 10’ most researched shale themes last year. Stranded in-basin gas will improve the economics. Production per well can rise by 1.5-2x. The theme could add 2.5Mbpd to YE25 output.

-

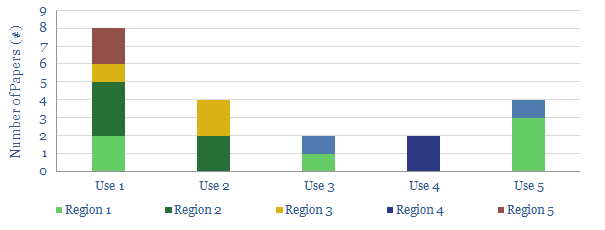

Inflow Control: Our Top 20 Papers from 2019

This data-file summarises twenty recent papers using inflow control devices: an exciting digital technology to optimise horizontal wells by limiting production from zones that are susceptible to flowing water or gas. Each paper is categorized by company, country, field and focus. Also included are our ‘Top 10’ facts from the technical literature.

-

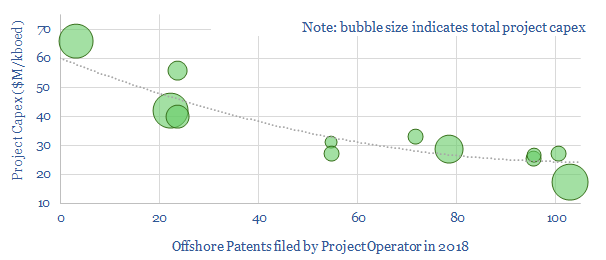

Offshore Capex for Technology Leaders?

The lowest-cost offshore projects are not “easy oil”. They are the ones being developed with leading technologies. This data-file measures a -88% correlation coefficient between different Major’s offshore patent filings in 2018 and their most recent projects’ capex costs.

-

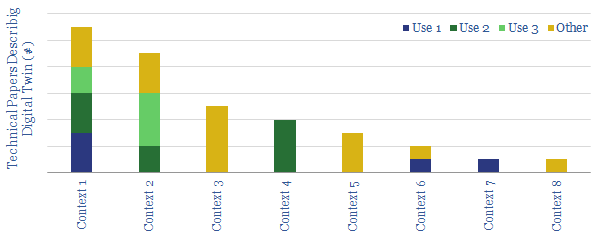

Deploying the Digital Twin

This data-file tabulates 36 recent technical papers into “digital twins” since 2017, in order to understand how the technology is being deployed around the upstream oil and gas industry: principally to improve platform uptime, prevent rig downtime and inspect subsea infrastructure.

-

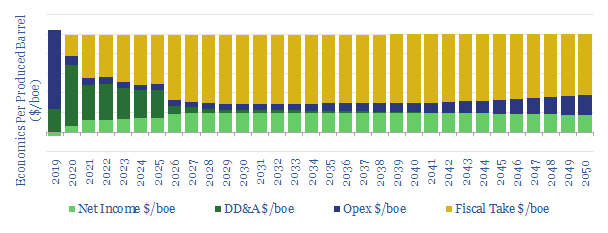

Johan Sverdrup: Economic Model

We have modelled the economics of Equinor’s Johan Sverdrup oilfield. Our model spans >250 lines of inputs and outputs, so you can flex key assumptions. In particular, we have tested the impact of different decline rates and recovery factors on the field’s ultimate value.

-

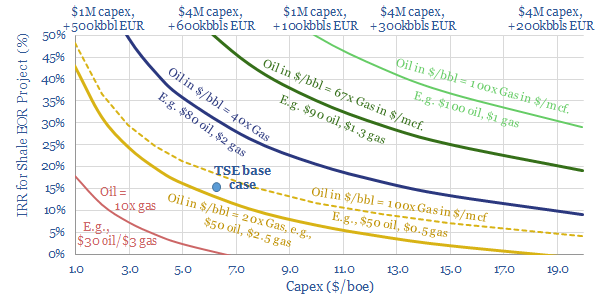

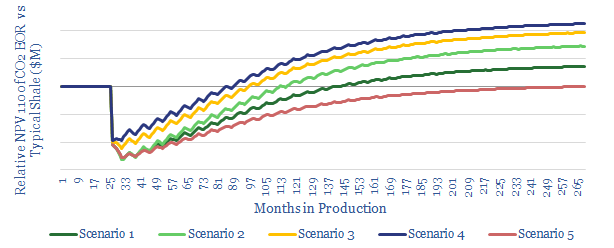

CO2-EOR in Shale: the economics

We model the economics for CO2-EOR in shales, after interest in this topic spiked 2.3x YoY in the 2019 technical literature. We see 15% IRRs in our base case, creating $1.6M of incremental value per well, uplifting type curves by 1.75x. Greater upside is readily possible. Most exciting is the prospect for Permian EOR to…

-

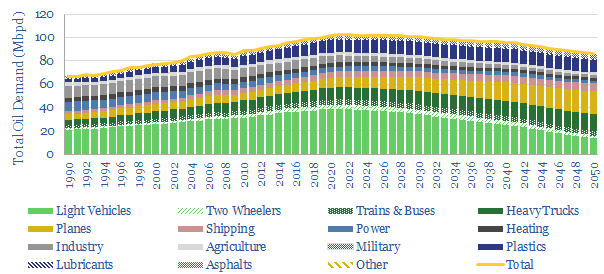

2050 oil markets: opportunities in peak demand?

Seven technology themes can save 45Mbpd of long-term oil demand. They make the difference between 2050 oil consumption surpassing 130Mbpd and our own forecasts: for a plateau in the 2020s, then a gradual descent to 87Mbpd in 2050. This is still an enormous market, equivalent to 1,000 bbls of oil consumed per second. Opportunities abound…

-

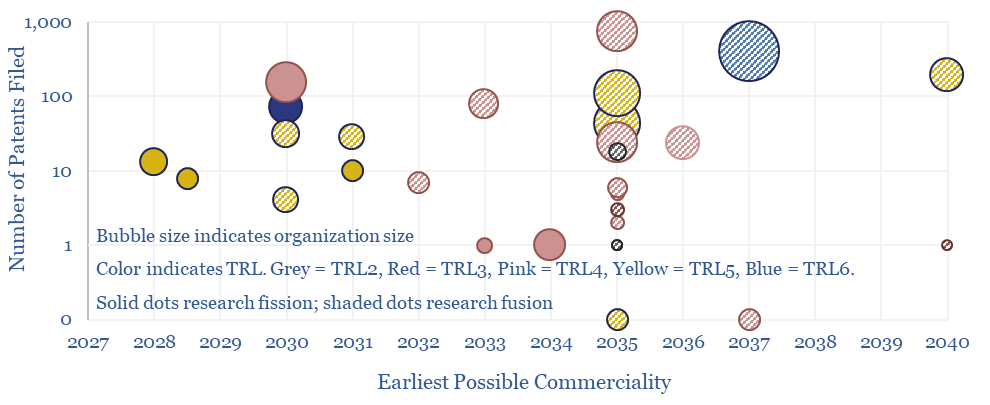

Next-generation nuclear companies: future fission and fusion?

This data-file screens c30 next-generation nuclear companies at the cutting edge of fission and fusion technology. The median one employs 100 people, is developing a 150MWe reactor, and could reach commerciality by 2035. But how has this landscape of companies progressed in the past few years?

-

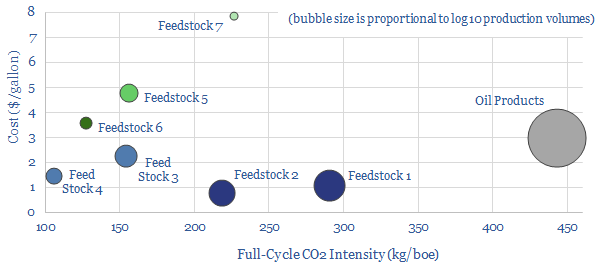

Biofuel technologies: an overview?

Biofuels are currently displacing 3.5Mboed of oil and gas. But they are not carbon-free, and their weighted average CO2 emissions are only c50% lower. This data-file breaks down the biofuels market across seven key feedstocks, to help identify which opportunities can scale for the lowest costs and CO2, versus others that require further technical progress.

Content by Category

- Batteries (89)

- Biofuels (44)

- Carbon Intensity (49)

- CCS (63)

- CO2 Removals (9)

- Coal (38)

- Company Diligence (95)

- Data Models (840)

- Decarbonization (160)

- Demand (110)

- Digital (60)

- Downstream (44)

- Economic Model (205)

- Energy Efficiency (75)

- Hydrogen (63)

- Industry Data (279)

- LNG (48)

- Materials (82)

- Metals (80)

- Midstream (43)

- Natural Gas (149)

- Nature (76)

- Nuclear (23)

- Oil (164)

- Patents (38)

- Plastics (44)

- Power Grids (130)

- Renewables (149)

- Screen (117)

- Semiconductors (32)

- Shale (51)

- Solar (68)

- Supply-Demand (45)

- Vehicles (90)

- Wind (44)

- Written Research (354)