Permian CO2-EOR: pushing the boundary?

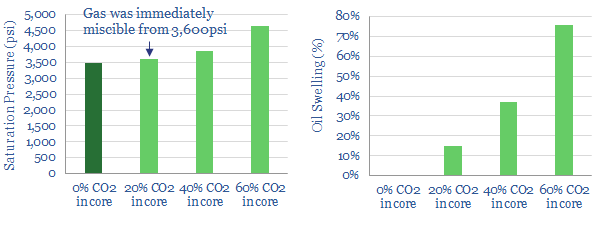

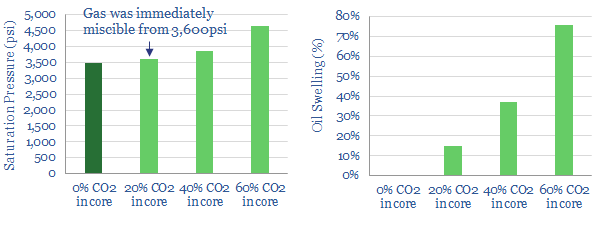

…mechanism and economics are covered in detail in our deep-dive note, Shale-EOR, Container Class. But what is happening at the leading edge, as companies try to seize the opportunity? To…

…mechanism and economics are covered in detail in our deep-dive note, Shale-EOR, Container Class. But what is happening at the leading edge, as companies try to seize the opportunity? To…

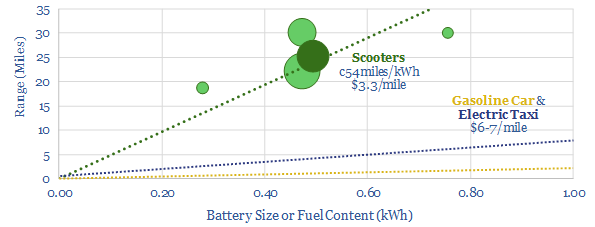

…commercialisation for quarter-of-a-century. Page 3 assesses the leading companies, all of which launched in late-2017 or early-2018, and have since raised $1.5bn. Pages 4-5 compares the energy-economics of electric scooters…

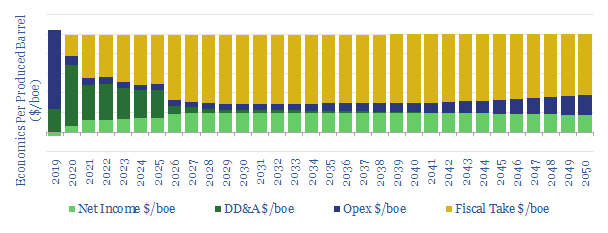

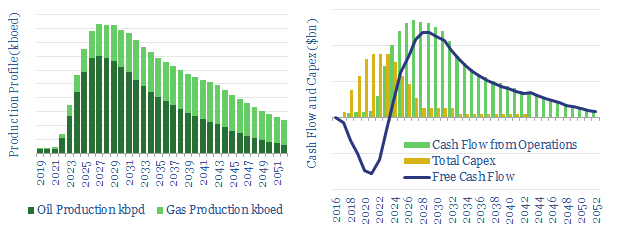

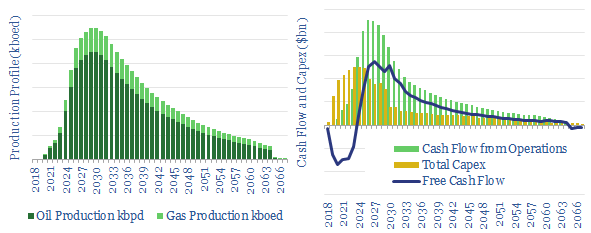

We have modelled the economics of Equinor’s Johan Sverdrup oilfield, using public disclosures and own estimates. Our model spans >250 lines of inputs and outputs, so you can flex key…

We have modeled the economics of the Mero oilfield (formerly known as Libra), using public disclosures and our own estimates. Our model spans >250 lines of inputs and outputs, so…

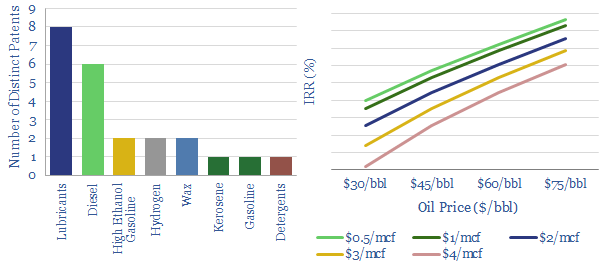

…emanating from the Permian; and produce these advantaged products. It would also help reduce the risk of US LNG projects glutting the market. We therefore model the economics in this…

…progressing pre- and post-FID LNG projects. LNG liquefaction economics are modeled here. In turn, this hands upside to incumbent LNG producers. We also see upside for spot cargoes in a…

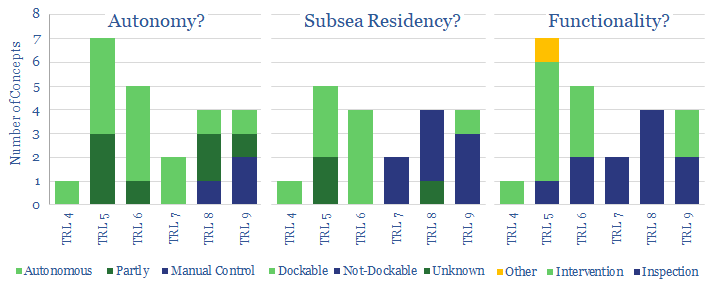

…solutions could be very material for offshore economics, improving oilfield decline rates and maintenance costs. Innovations include: Residing subsea for c1-year at a time, by re-charging in subsea “docking” stations….

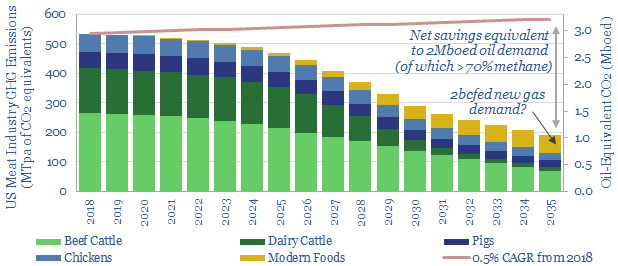

…annum US livestock industry. We recommend the report. It is linked here. Thunder Said Energy Re-Thinks Food and Agriculture Energy PF energy economics are transformative. The rumen of cow is…

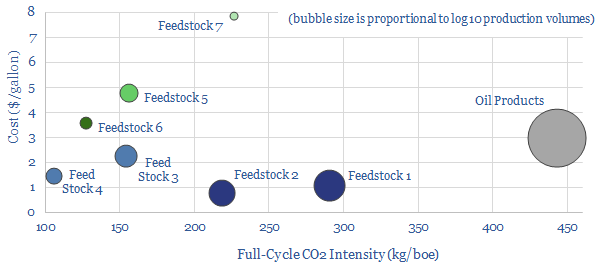

…CO2 intensities and yields per acre. While biofuels can be lower carbon than fossil fuels, they are not zero-carbon, hence continued progress is needed to improve both their economics and…

…expectation for the block’s ultimate value, resources, production volumes, cash flows, capex and per-barrel economics. Sensitivities can modeled as a function of oil prices, WACCs, resource volumes and other costs….