Search results for: “shale”

-

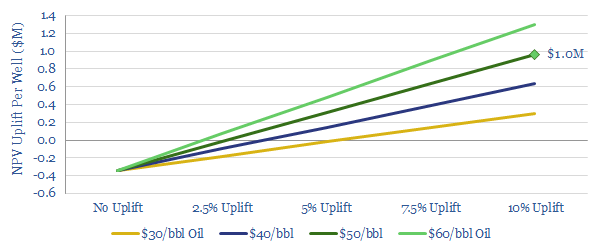

Do “digital” completions lift Permian IRRs?

We have modelled the economic uplift of extra digital instrumentation on a typical Permian well. At $50/bbl oil, c$0.4M of extra instrumentation costs, which add 10% to well-productivity, will raise overall NPV by $1M and IRR by 5pp per well.

-

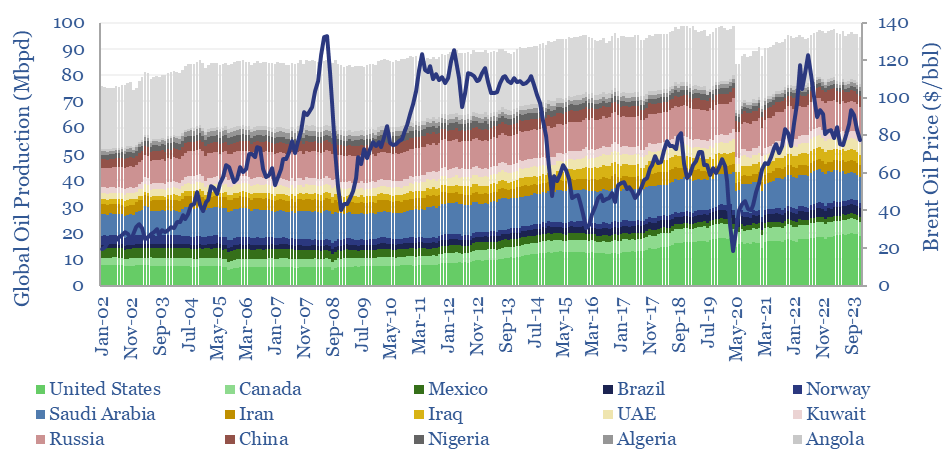

Global oil production by country?

Global oil production by country by month is aggregated across 35 countries that produce 80kbpd of crude, NGLs and condensate, explaining >96% of the global oil market. Production has grown by +1Mbpd/year in the past two-decades, led by the US, Iraq, Russia, Canada. Oil market volatility is usually low, at +/- 1.5% per year, of…

-

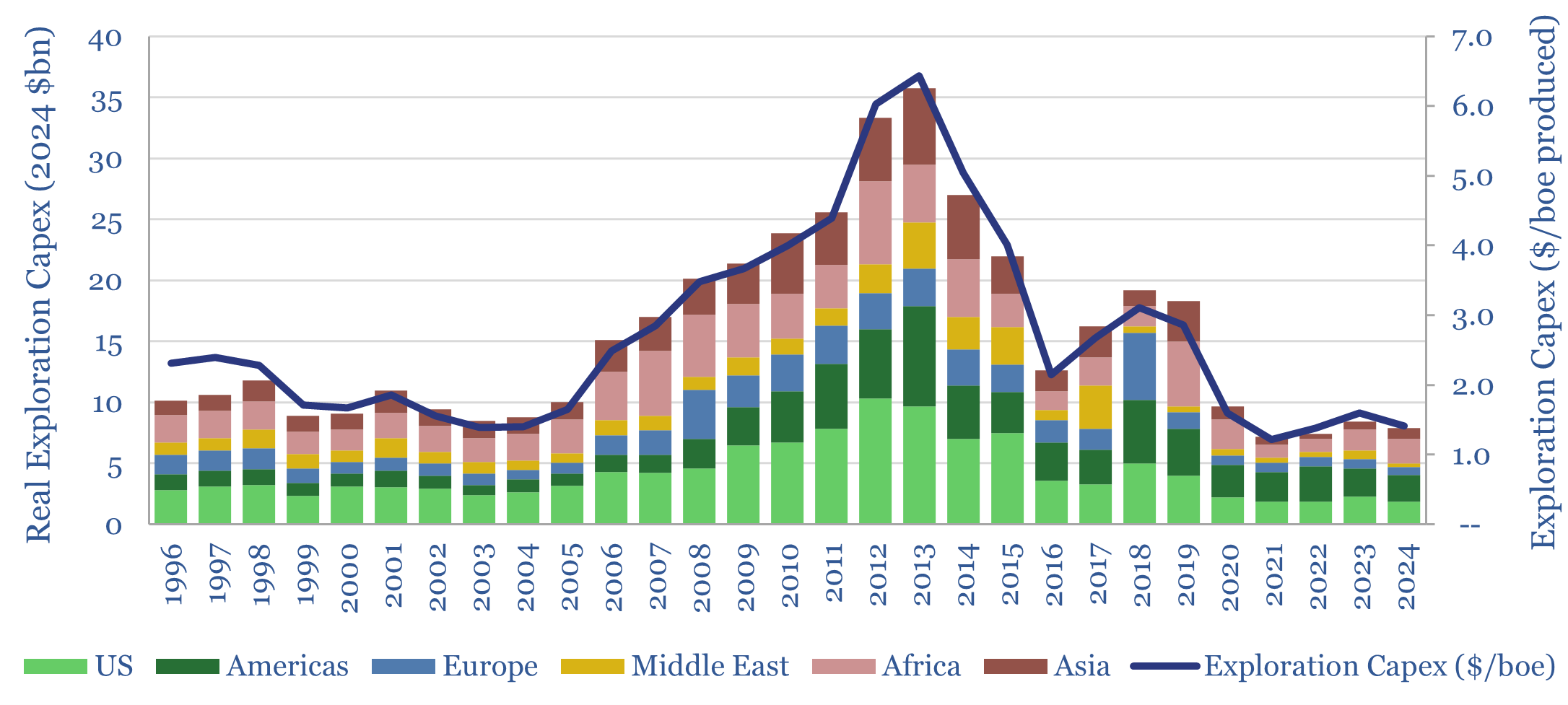

Exploration capex: long-term spending from Oil Majors?

This data-file tabulates the Oil Majors’ exploration capex from the mid-1990s, in headline terms (in billions of dollars) and in per-barrel terms (in $/boe of production). Exploration spending quadrupled from $1/boe in 1995-2005 to $4/boe in 2005-19, and has since collapsed like a warm Easter Egg. Exploration has been de-prioritized. Perhaps wrongly?

-

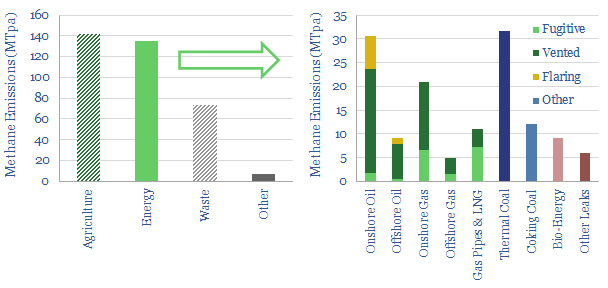

CH4 context: the largest methane leaks of all time?

Global methane emissions run to 360MTpa. 40% is agriculture, 40% is the energy industry and 20% is landfills. Within energy, over 30% of the leaks are from coal, 30% are from oil, 27% are from gas. This short note quantifies some of the largest methane leaks of all time, and provides context for the recent…

-

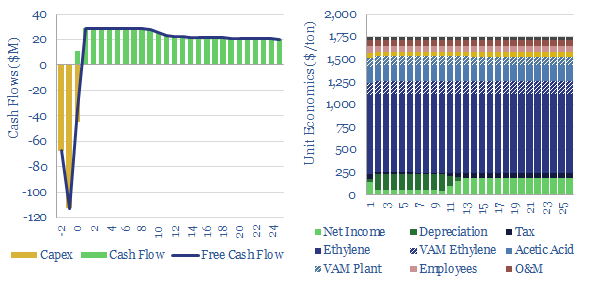

Ethylene vinyl acetate: production costs?

Ethylene vinyl acetate is produced by reacting ethylene with vinyl acetate monomer. This data-file estimates production costs, with a marginal cost between $1,500-2,000/ton, and a total embedded CO2 intensity of 3.0 tons/ton. EVA comprises 5% of the mass of a solar panel and could be an important solar bottleneck.

-

Cost of North Sea gas: project economics?

Marginal costs of a HPHT project in the UK North Sea are captured via modeling Shell’s 40kboed Jackdaw project, FID’ed in 2022. A $7/mcf marginal cost results mostly from high hurdle rates associated with project complexity. CO2 intensity has been lowered to c14kg/boe, we think.

-

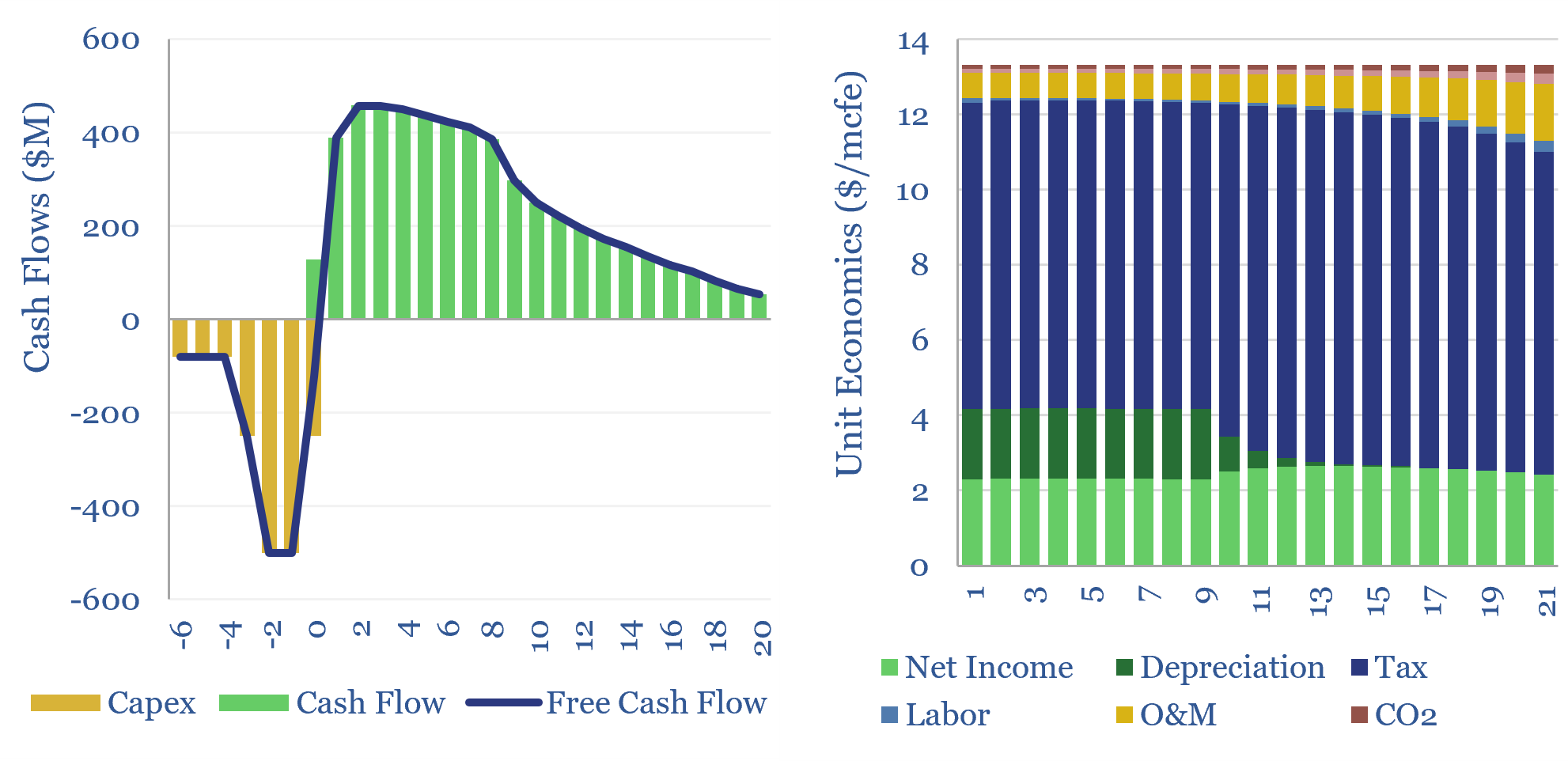

CO2 intensity of materials: an overview?

This data-file tabulates the energy intensity and CO2 intensity of materials, in tons/ton of CO2, kWh/ton of electricity and kWh/ton of total energy use per ton of material. The build-ups are based on 160 economic models that we have constructed to date, and simply intended as a helpful summary reference. Our key conclusions on CO2…

-

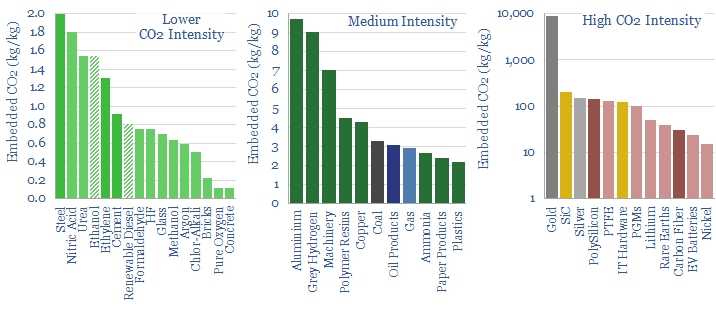

Carbon capture and storage: research conclusions?

Carbon capture and storage (CCS) prevents CO2 from entering the atmosphere. Options include the amine process, blue hydrogen, novel combustion technologies and cutting edge sorbents and membranes. Total CCS costs range from $80-130/ton, while blue value chains seem to be accelerating rapidly in the US. This article summarizes the top conclusions from our carbon capture…

-

Energy Recovery Inc: pressure exchanger technology?

Pressure exchangers transfer energy from a high-pressure fluid stream to a low-pressure fluid stream, and can save up to 60% input energy. Energy Recovery Inc is a leading provider of pressure exchangers, especially for the desalination industry, and increasingly for refrigeration, air conditioners, heat pump and industrial applications. Our technology review finds a moat.

-

Origen Carbon: DAC breakthrough?

Origen Carbon Solutions is developing a novel DAC technology, producing CaO sorbent via the oxy-fuelled calcining of limestone with no net CO2 emissions. It is similar to the NET Power cycle, but adapted for a limestone kiln. The concept is very interesting. Our base case costs are $200-300/ton of CO2. This data-file contains our Origen…

Content by Category

- Batteries (89)

- Biofuels (44)

- Carbon Intensity (49)

- CCS (63)

- CO2 Removals (9)

- Coal (38)

- Company Diligence (95)

- Data Models (840)

- Decarbonization (160)

- Demand (110)

- Digital (60)

- Downstream (44)

- Economic Model (205)

- Energy Efficiency (75)

- Hydrogen (63)

- Industry Data (279)

- LNG (48)

- Materials (82)

- Metals (80)

- Midstream (43)

- Natural Gas (149)

- Nature (76)

- Nuclear (23)

- Oil (164)

- Patents (38)

- Plastics (44)

- Power Grids (130)

- Renewables (149)

- Screen (117)

- Semiconductors (32)

- Shale (51)

- Solar (68)

- Supply-Demand (45)

- Vehicles (90)

- Wind (44)

- Written Research (354)