Search results for: “volatility”

-

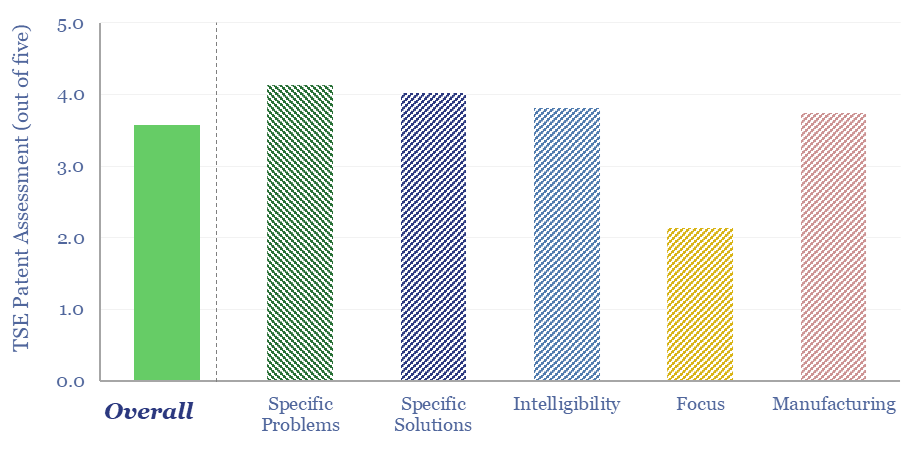

Kraken Technologies: smart grid breakthrough?

Kraken Technologies is an operating system, harnessing big data across the power value chain, from asset optimization, to grid balancing, to utility customer services. We reviewed ten patents, which all harness big data, of which 65% optimize aspects of the grid, and 40% are using AI. This supports the deployment of distributed energy, renewables and…

-

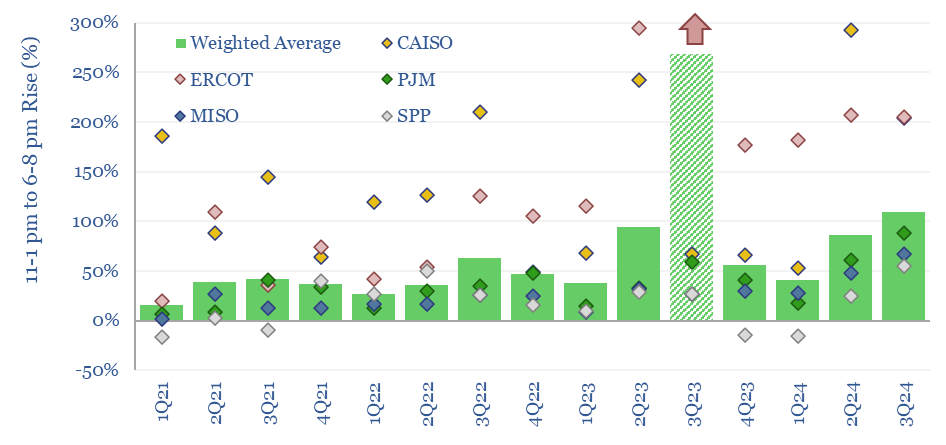

Duck curves: US power price duckiness over time?

In solar-heavy grids, power prices trough around mid-day, then ramp up rapidly as the sunset. This price distribution over time is known as the duck curve. US power prices are getting 25-30% more ducky each year, based on some forms of measurement. Power prices are clearly linked to the instantaneous share of wind/solar in grids.

-

AI and Power Grid Bottlenecks: TSE Presentation, June-2024

Energy transition is entering a new era of power grid bottlenecks linked to the rise of AI, rising volatility, and materials high-grading. These themes are kingmakers for gas, midstream, marketing, efficiency, metals and advanced materials. What matters most for AI is rapidly-available, scalable baseload, which could be decarbonized in the future,at low cost. Hence data-centers…

-

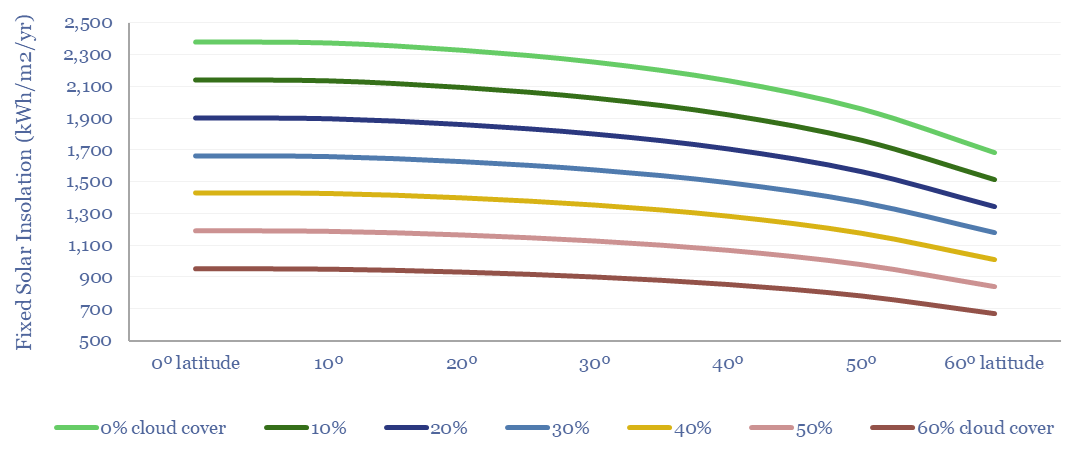

Solar insolation: by latitude, season, date, time and tilt?

Solar insolation varies from 600-2,500 kWh/m2/year at different locations on Earth, depending on their latitude, altitude, cloudiness, panel tilt and panel azimuth. This means the economics of solar can also vary by a factor of 4x. Seasonality is a key challenge at higher latitudes. Active strategies are emerging for orienting solar modules.

-

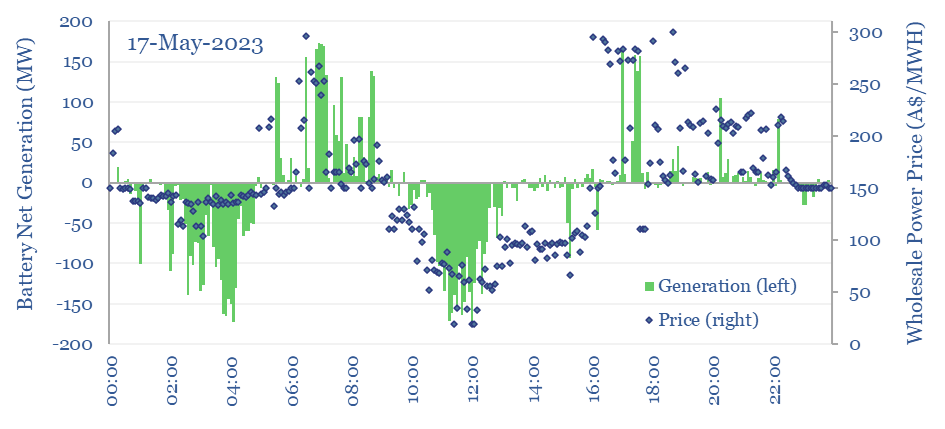

Grid-scale battery operation: a case study?

Grid-scale batteries are not simply operated to store up excess renewables and move them to non-windy and non-sunny moments, in order to increase reneawble penetration rates. Their key practical rationale is providing short-term grid stability to increasingly volatile grids that need ‘synthetic inertia’. Their key economic rationale is arbitrage. Numbers are borne out by our…

-

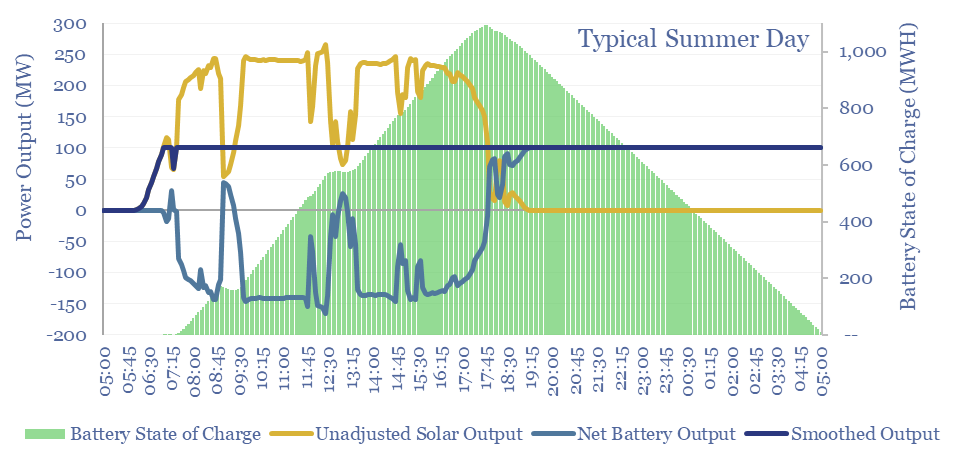

Solar+battery co-deployments: output profiles?

Solar+battery co-deployments allow a large and volatile solar asset to produce a moderate-sized and non-volatile power output, during 40-50% of all the hours throughout a calendar year. The smooth output is easier to integrate with power grids, including with a smaller grid connection. The battery will realistically cycle 100-300 times per year.

-

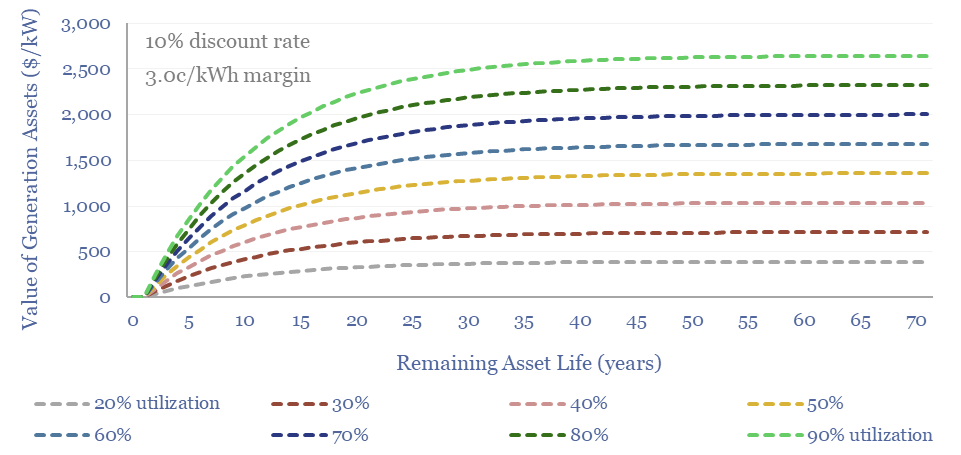

Purchasing power: what are generation assets worth?

There has never been more controversy over the fair values of power generation assets, which hinge on their remaining life, utilization, flexibility, power prices, rising grid volatility and CO2 credentials. This 16-page guide covers the fair values of generation assets, hidden opportunities and potential pitfalls.

-

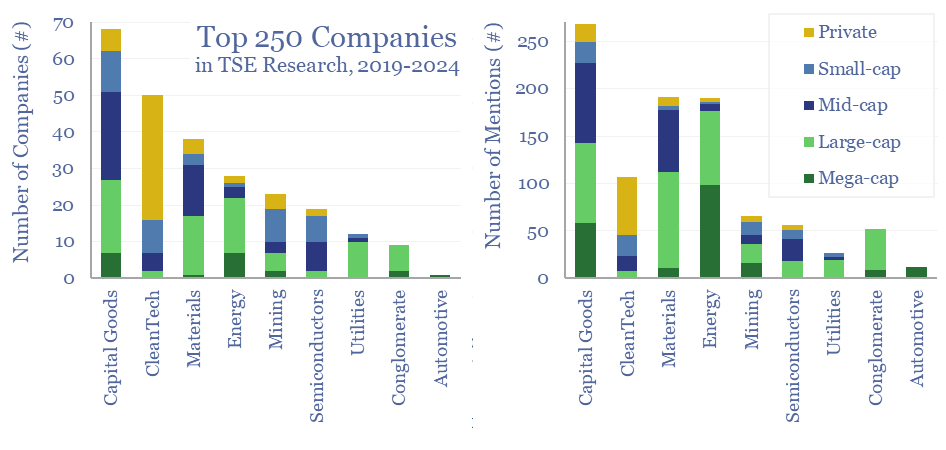

Energy transition: key conclusions from 1Q24?

This note summarizes the key conclusions from our energy transition research in 1Q24 and across 1,400 companies in total. Volatility is rising. Power grids are bottlenecked. Hence what stands out in capital goods, clean-tech, solar, gas value chains and materials? And what is most overlooked?

-

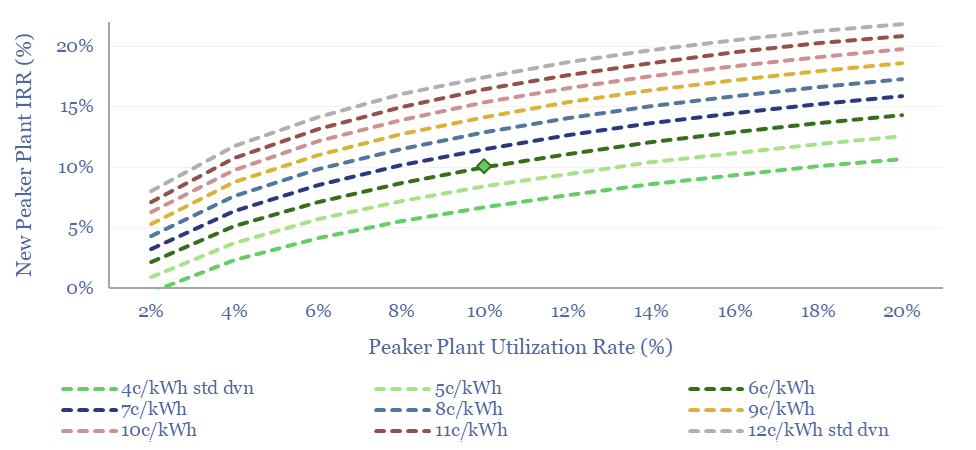

Peaker plants: finding the balance?

Today’s power grids fire up peaker plants to meet peak demand. But the grid is changing rapidly. Hence this 17-page report outlines the economics of gas peaker plants. Rising volatility will increase earnings and returns by 40-50%, before grid-scale batteries come into the money for peaking?

-

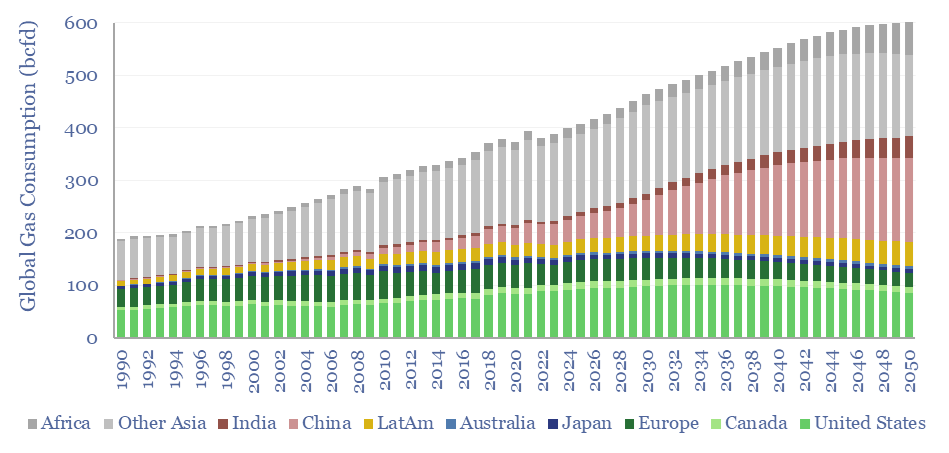

Global gas supply-demand in energy transition?

Global gas supply-demand is predicted to rise from 400bcfd in 2023 to 600bcfd by 2050, in our outlook, while achieving net zero would require ramping gas even further to 800bcfd, as a complement to wind, solar, nuclear and other low-carbon energy. This data-file quantifies global gas demand and supply by country.

Content by Category

- Batteries (85)

- Biofuels (42)

- Carbon Intensity (49)

- CCS (63)

- CO2 Removals (9)

- Coal (38)

- Company Diligence (87)

- Data Models (801)

- Decarbonization (156)

- Demand (106)

- Digital (51)

- Downstream (44)

- Economic Model (196)

- Energy Efficiency (75)

- Hydrogen (63)

- Industry Data (266)

- LNG (48)

- Materials (79)

- Metals (70)

- Midstream (43)

- Natural Gas (144)

- Nature (75)

- Nuclear (22)

- Oil (161)

- Patents (38)

- Plastics (44)

- Power Grids (118)

- Renewables (148)

- Screen (109)

- Semiconductors (30)

- Shale (50)

- Solar (67)

- Supply-Demand (45)

- Vehicles (90)

- Wind (41)

- Written Research (339)