-

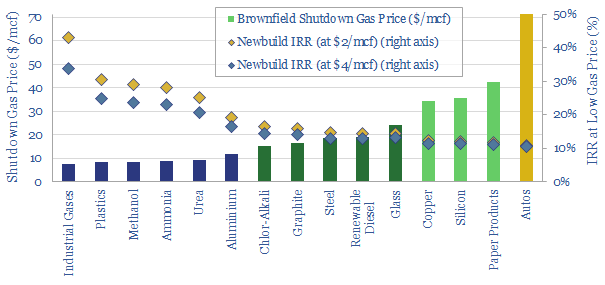

Gas diffusion: how will record prices resolve?

Dispersion in global gas prices has hit new highs in 2022. Hence this 17-page note evaluates two possible solutions. Building more LNG plants achieves 15-20% IRRs. But shuttering some of Europe’s gas-consuming industry then re-locating it in gas-rich countries can achieve 20-40% IRRs, lower net CO2 and lower risk? Both solutions should step up. What…

-

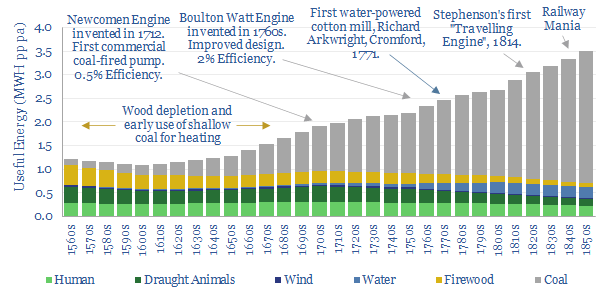

Britain’s industrial revolution: what happened to energy demand?

Britain’s remarkable industrialization in the 18th and 19th centuries was part of the world’s first great energy transition. In this short note, we have aggregated data, estimated the end uses of different energy sources in the Industrial Revolution, and drawn five key conclusions for the current Energy Transition.

-

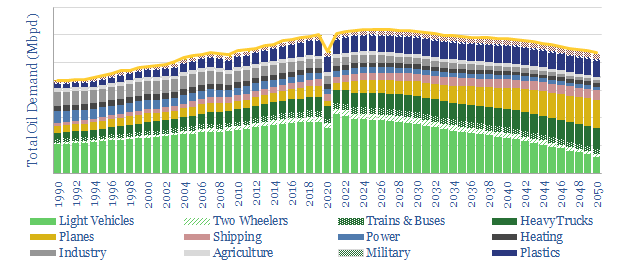

On the road: long-run oil demand after COVID-19?

Another impact of COVID-19 may still lie ahead: a 1-2Mbpd upwards jolt in global oil demand. This 17-page note upgrades our 2022-30 oil demand forecasts by 1-2Mbpd above our pre-COVID forecasts. The increase is from road fuels, reflecting lower mass transit, lower load factors and resultant traffic congestion.

-

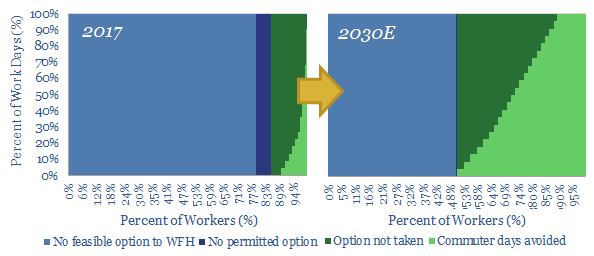

Remote possibilities: working from home?

The COVID-19 crisis will structurally accelerate remote working. The opportunity can save 30% of commuter journeys by 2030, avoiding 1bn tons of CO2 per year, for a net economic benefit of $5-16k per employee. This makes remote work materially more impactful than electric vehicles, as an opportunity in the energy transition.

-

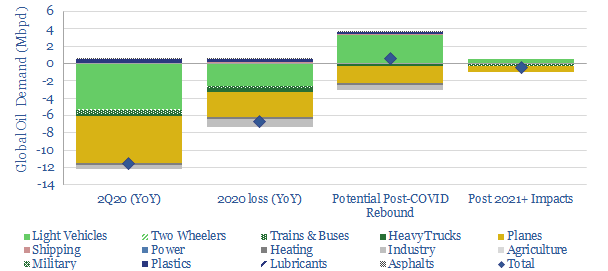

COVID-19: what have the oil markets missed?

This 15-page note outlines our top three conclusions about COVID-19, which the oil markets may have missed. Global oil demand could decline by -11.5Mbpd YoY in 2Q20. But gasoline demand could increase in the aftermath of the crisis. Finally, longer-term, structural changes will transform commuting, retail and travel.

-

Ten Themes for Energy in the 2020s

We presented our ‘Top Ten Themes for Energy in the 2020s’ to an audience at Yale SOM, in February-2020. The audio recording is available below. The slides are available to TSE clients.

-

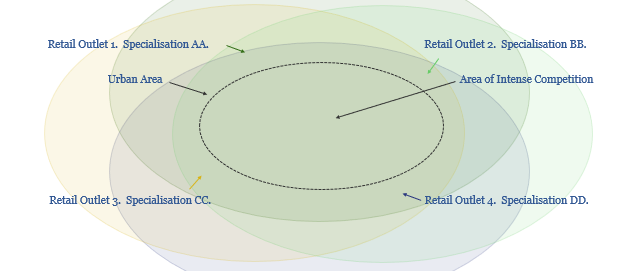

Drones & droids: deliver us from e-commerce

Autonomous, electric delivery vehicles are emerging. They are game-changers: rapidly delivering online purchases to customers, creating vast new economic possibilities, but also driving the energy transition. They could eliminate 500MTpa of CO2, 3.5Mboed of fossil fuels and c$3trn pa of consumer spending across the OECD. The mechanism is a re-shaping of urban consumption habits, retail…

-

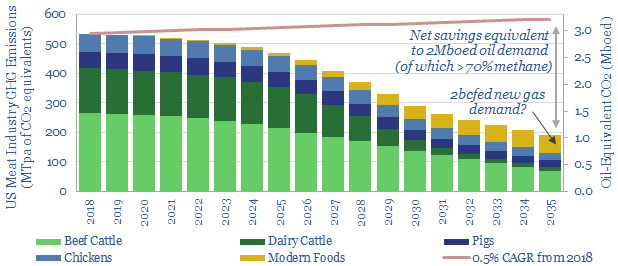

Disrupting Agriculture: Energy Opportunities?

Precision-engineered proteins are on the cusp of disrupting the agriculture industry. The science is improving rapidly, to create meat-substitutes with vastly superior nutrition, taste and costs. We explore the energy consequences of “replacing cows”, with potential for 2bcfd upside to US gas demand, to offset the CO2 of all US oil demand, increase US biofuels…

-

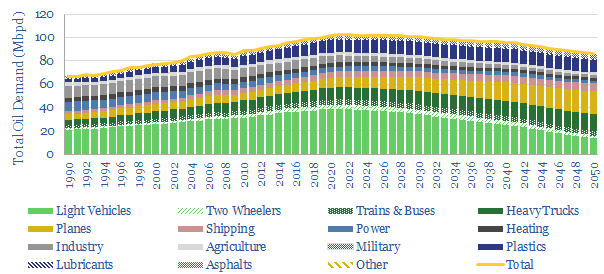

2050 oil markets: opportunities in peak demand?

Our new, 20-page note reviews seven technology themes that can eliminate 45Mbpd of long-term oil demand by 2050. We therefore find oil demand would plateau at 103Mbpd in the early-2020s, before declining gradually. Opportunities greatly outnumber risks for leading companies amidst this transition.

-

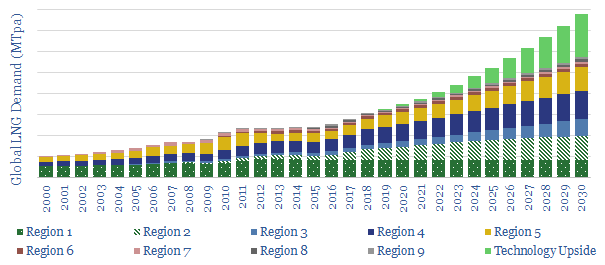

The Ascent of LNG?

This note outlines 200MTpa of potential upside to consensus LNG demand, due to emerging technologies, in power and transportation. LNG use could thus compound at an 8% CAGR to 800MTpa by 2030, justifying greater investment in unsanctioned LNG projects.

Content by Category

- Batteries (87)

- Biofuels (42)

- Carbon Intensity (49)

- CCS (63)

- CO2 Removals (9)

- Coal (38)

- Company Diligence (90)

- Data Models (816)

- Decarbonization (159)

- Demand (108)

- Digital (56)

- Downstream (44)

- Economic Model (197)

- Energy Efficiency (75)

- Hydrogen (63)

- Industry Data (273)

- LNG (48)

- Materials (79)

- Metals (71)

- Midstream (43)

- Natural Gas (146)

- Nature (76)

- Nuclear (22)

- Oil (162)

- Patents (38)

- Plastics (44)

- Power Grids (123)

- Renewables (149)

- Screen (112)

- Semiconductors (30)

- Shale (51)

- Solar (67)

- Supply-Demand (45)

- Vehicles (90)

- Wind (43)

- Written Research (345)