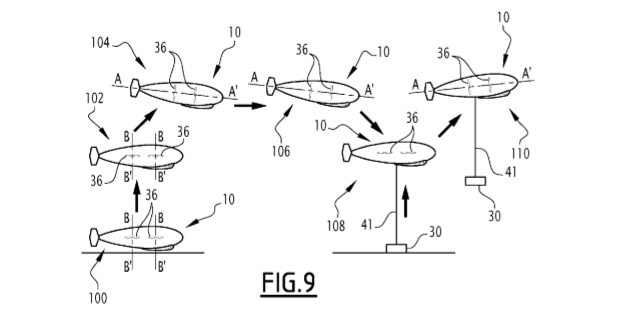

In 2019, TOTAL co-filed two patents with an airship-technology company, Flying Whales, aiming to lower the logistical costs of moving capital equipment into remote areas. An example is shown above. The LCA60T is envisaged to carry up to 60T of cargo (c4x the capacity of a truck), with a range of 100-1,000km. This short note assesses the opportunity, and whether these new airships could displace trucks, or lower diesel demand. We are most excited by the impact for onshore wind.

[restrict]

Flying Whales is a French company, originally supported by the French Public Forest Office, to progress transportation technologies that could help evacuate timber. It has since raised €200M, including from BPI and Chinese backers.

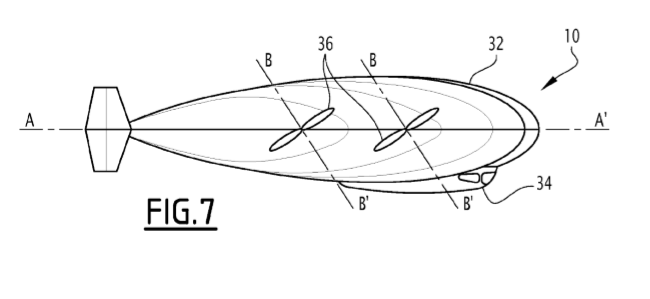

Designs for the LCA60T are shown below, from TOTAL and Flying Whales’ patent. The ship is 154m x 68m, constructed from rigid carbon-fiber composite, generating aerostatic lift from 10, unpressurised cells of helium.

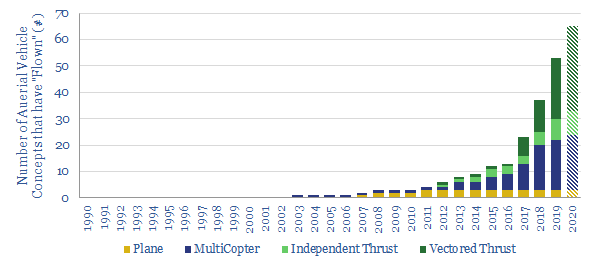

Its distributed electric propulsors are similar to those in the flying car concepts that excite us. We recently re-assessed our rankings of different flying car concepts here.

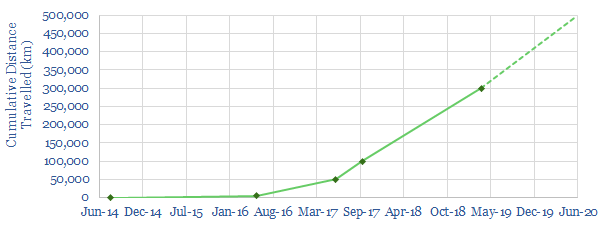

Technical Readiness is at Level 5-6, but rapid progress is foreseen: Wind-tunnel testing in 2019, the first test phase in 2020, the first prototype flight in 2021. Flying Whales company plans to construct a plant in Bordeaux, for €90M, to produce 12 airships per year by 2022, ramping up to €5bn of sales within 10-years, from constructing 150 airships in France and China.

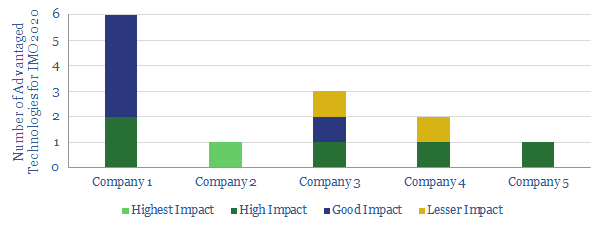

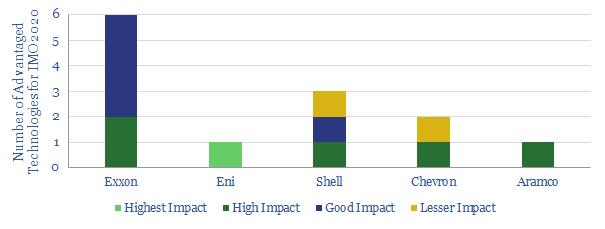

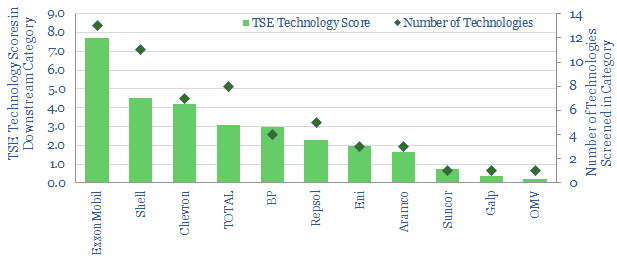

What Advantages?

Airships can rapidly reach places that trucks cannot, particularly in remote areas without naviable roads. They are helped by vertical take-off and landing (VTOL), and a system of a dozen winches, that can lower cargoes.

Airships can also carry large loads, up to 60T, at speeds up to 100kmph. For comparison, a typical truck carries c14T, a Sikorsky S-64 SkyCrane carries 9T and the largest Russian Mil Mi-26 helicopters can carry 20T.

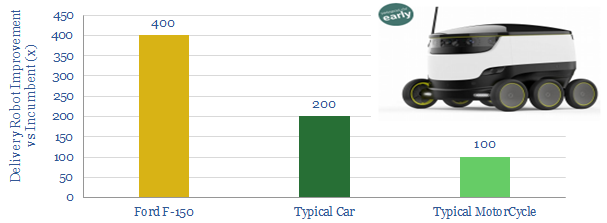

Economics are better than helicopters. Flying Whales estimates that its deliveries could be 20x less expensive than helicopters, which can cost c$1M/day or at least $11,000/hour. The Flying Whales should cost c$50,000/day, which perhaps translates into c$5,000/hour. This is still much more pricey than a truck ($60-200/hour), making Flying Whales best suited to large loads in remote locations. The technology is unlikely to replace trucks on highways.

Wind turbines? Where these capabilities may best come together is in the delivery of wind turbine blades, where the logistics can be notoriously challenging (chart below). All three turbine blades could in principle be delivered as a single Flying Whales Cargo, slashing the c$30,000-100,000 delivery costs per turbine, that can be incurred in the onshore wind industry.

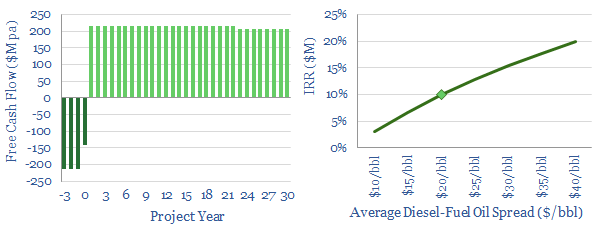

What Energy Economics?

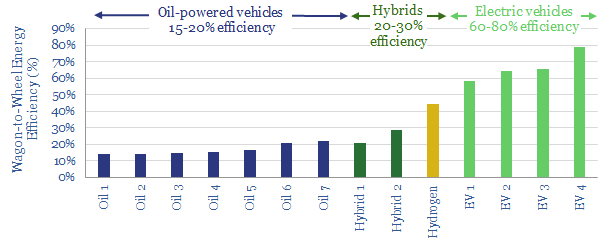

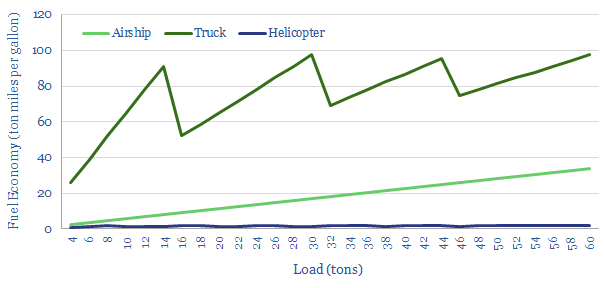

The energy economics of Flying Whales’ airships should be a great improvement on helicopters, but still fall short of trucks, we estimate.

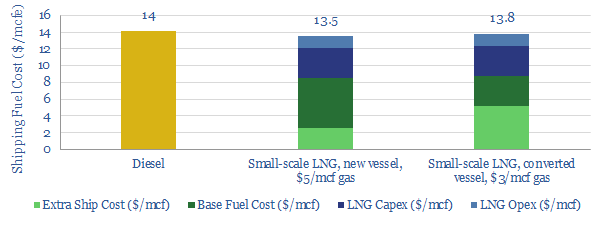

Specifically, the Flying Whales airships consume 1.5MW at peak cruise speeds around 100kmph. This power consumption is equivalent to c100 gallons of diesel per hour, fed into a diesel generator, which in turn feeds the propulsion units. Total fuel economy thus runs at 30 ton-miles per gallon (chart below).

By contrast, we estimate helicopters consume c5,000 gallons of jet fuel per hour, for fuel economies of 1.5 ton-miles per hour.

But trucks consume only c10 gallons of diesel per hour, for a fuel economy of c67 ton-miles per gallon.

Fuel consumption may also be higher for large airships, during strong gusts of wind. To stabilize the Airships, they will contain 3MW ultracapacitors, to provide bursts of energy.

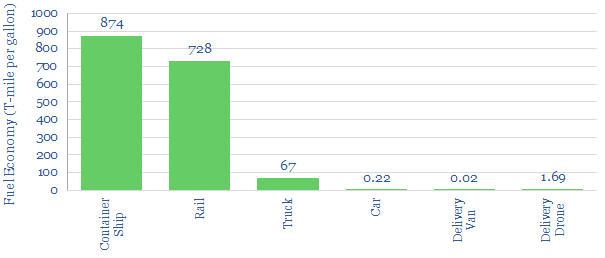

The most efficient freight delivery method remains via container ships and trucks, according to our data-file (chart below), which now also includes the calculations above for Airships.

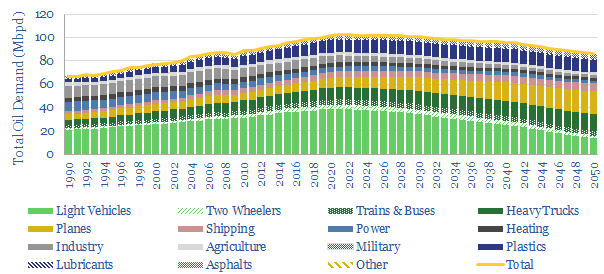

We conclude that new airships may help deflate delivery costs in remote locations: particularly for onshore oil and gas, onshore wind and niches in the construction sector. But they are unlikely to displace materialy volumes of diesel demand, which remain in our models of long-run oil demand (chart below).

Source: Kuhlmann, H. F., (2019). Method for Transporting a Payload to a Target Location and Related Hybrid Airship, Patent WO2019092471A1

[/restrict]