-

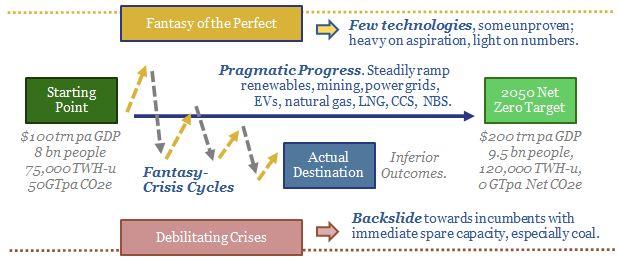

Energy transition: the fantasy of the perfect?

This 14-page note explores an alternative framework for energy transition: what if the fantasy of the perfect consistently de-rails good pragmatic progress; then the world back-slides to high-carbon energy amidst crises? We need to explore this scenario, as it yields very different outcomes, winners and losers compared with our roadmap to net zero.

-

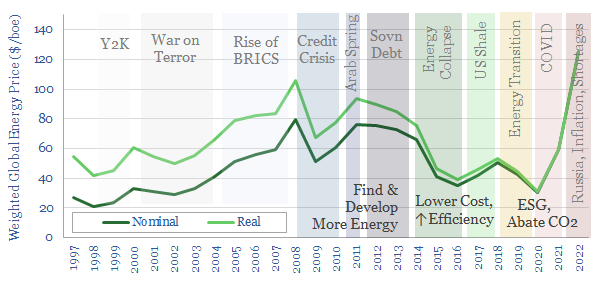

Energy transition: wheel of time?

This 15-page note reflects on the last 15-years of energy, the world and our own experiences. Mega-trends do not move in straight lines. The world has often changed direction, getting waylaid by unexpected crises. We wonder if energy transition goals, policies and solutions may be shifting?

-

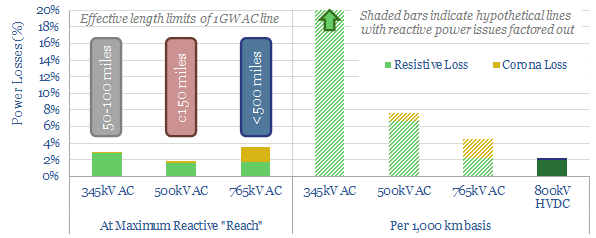

Power transmission: raising electrical potential?

Electricity transmission matters in the energy transition, integrating dispersed renewables over long distances to reach growing demand centers. This 15-page note argues future transmission needs will favor large HVDCs, costing 2-3c/kWh per 1,000km, which are materially lower-cost and more efficient than other alternatives.

-

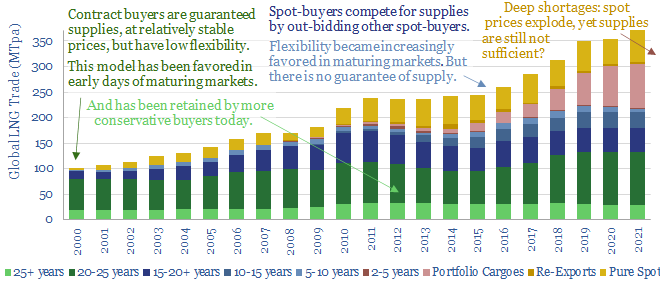

Energy security: the return of long-term contracts?

Spot markets have delivered more and more ‘commodities on demand’. But is this model fit for energy transition? Many markets are now short, causing explosive price rises. Sufficient volumes may still not be available at any price. This note considers a renaissance for long-term contracts.

-

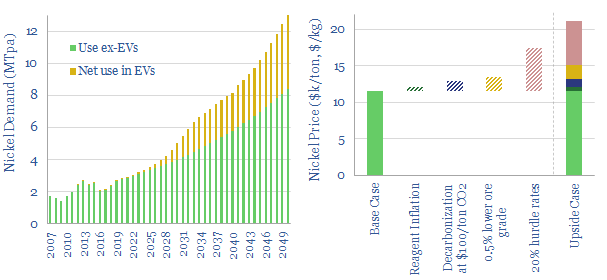

Nickel solutions: unblocking a battery bottleneck?

The global nickel market will grow from $30bn pa to $300bn in the energy transition, including a 5x increase in volumes and 2x increase in price. This 15-page note evaluates the nickel supply chain for electric vehicle battery cathodes. Deficits are looming. Hence we end by screening nickel names.

-

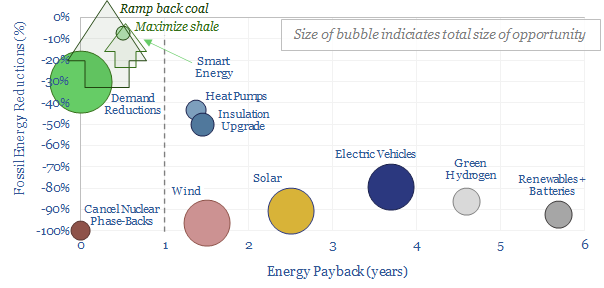

Energy transition: the world turned upside down?

Energy shortages are now the second largest problem in the world. Hence this 14-page note evaluates short- and medium-term options to alleviate them. Despite a lot of posturing, we see ‘new energies’ slowing down in 2022-23. The world is upside down and somehow coal is going to be an unexpected savior.

-

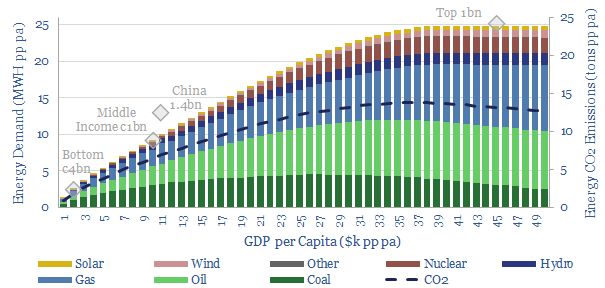

Energy shortages: priced out of the world?

Deepening energy shortages in 2022-30 could devastate low-income countries, geopolitically isolate the West, and de-rail decarbonization. This 13-page note evaluates the linkage between energy consumption and income over the past half century and quantifies what a ‘just transition’ would look like.

-

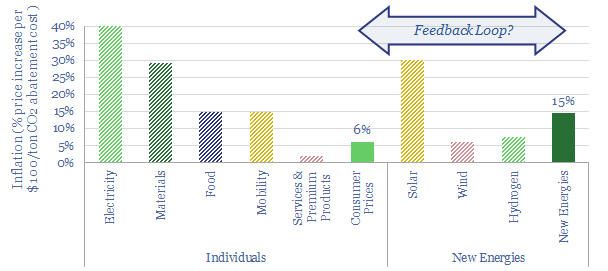

Inflation: will it de-rail the energy transition?

New energy policies will exacerbate inflation in the developed world, raising price levels by 20-30%. Or more, due to feedback loops. We find this inflation could also cause new energies costs to rise over time, not fall. As inflation concerns accelerate, policymakers may need to choose between delaying decarbonization or lower-cost transition pathways.

-

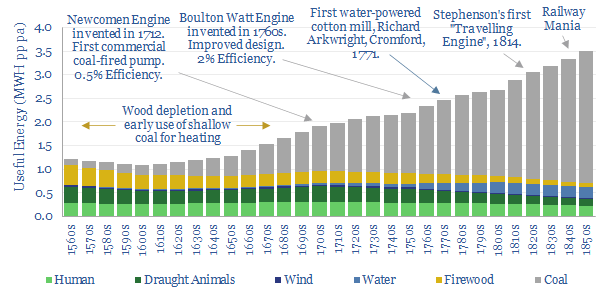

Britain’s industrial revolution: what happened to energy demand?

Britain’s remarkable industrialization in the 18th and 19th centuries was part of the world’s first great energy transition. In this short note, we have aggregated data, estimated the end uses of different energy sources in the Industrial Revolution, and drawn five key conclusions for the current Energy Transition.

-

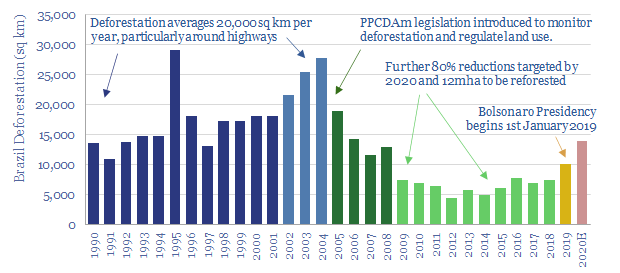

The Amazon tipping point theory?

Another 2-10% deforestation could make the Amazon rainforest too dry to sustain itself. 80GT of Carbon could thus be released, inflating atmospheric CO2 above 450ppm. This matters as Amazon deforestation rates have already doubled under Jair Bolsonaro’s presidency. We explore policy implications.

Content by Category

- Batteries (89)

- Biofuels (44)

- Carbon Intensity (49)

- CCS (63)

- CO2 Removals (9)

- Coal (38)

- Company Diligence (95)

- Data Models (840)

- Decarbonization (160)

- Demand (110)

- Digital (60)

- Downstream (44)

- Economic Model (205)

- Energy Efficiency (75)

- Hydrogen (63)

- Industry Data (279)

- LNG (48)

- Materials (82)

- Metals (80)

- Midstream (43)

- Natural Gas (149)

- Nature (76)

- Nuclear (23)

- Oil (164)

- Patents (38)

- Plastics (44)

- Power Grids (130)

- Renewables (149)

- Screen (117)

- Semiconductors (32)

- Shale (51)

- Solar (68)

- Supply-Demand (45)

- Vehicles (90)

- Wind (44)

- Written Research (354)