New energy policies will exacerbate inflation in the developed world, raising price levels by 20-30%. Or more, due to feedback loops. We find this inflation could also cause new energies costs to rise over time, not fall. As inflation concerns accelerate, policymakers may need to choose between delaying decarbonization or lower-cost transition pathways.

The importance of costs on the roadmap to net zero evokes a surprising amount of debate. We re-cap these debates, including our own roadmap on pages 2-3. Recently, organizations such as the IEA have published a roadmap, which we believe will be c10x more expensive.

The inflationary impacts of energy transition can be compared for different levels of abatement costs. Hence we discuss the concept of abatement costs, including two paradoxes, on pages 4-5.

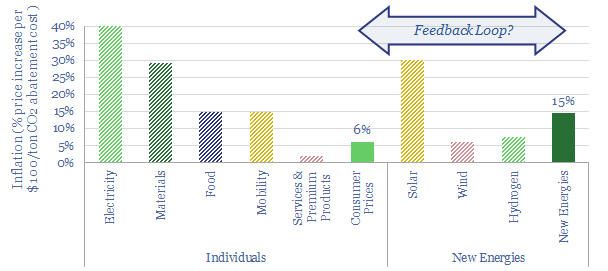

Top-down, we calculate that each $100/ton of CO2 abatement cost would likely lead to 6% aggregate price increases in the developed world, on page 6.

Bottom-up, we model that each $100/ton of CO2 abatement cost would lead to 2-70% price increases, across a basket of twenty different goods and commodities, on pages 7-8. The impacts are regressive and basic goods and staples rise more.

An additional source of inflation comes from supply-demand dynamics, as some materials will be dramatically under-supplied in the energy transition (page 9).

What does it mean for new energies? To answer this question, we bridge the impacts of all these cost increases in our models of wind, solar, hydrogen and batteries, on pages 10-12. There are surprising feedback loops, which could amplify inflation.

No brakes? We also find that the usual mechanism to slow inflation is blunted by the need for an energy transition, on pages 13-14. Hence if inflation accelerates, it could surprise by a wide margin.

Our conclusion is that policy-makers and companies should consider costs more closely, while there are measures for investors to inflation-proof portfolios.