-

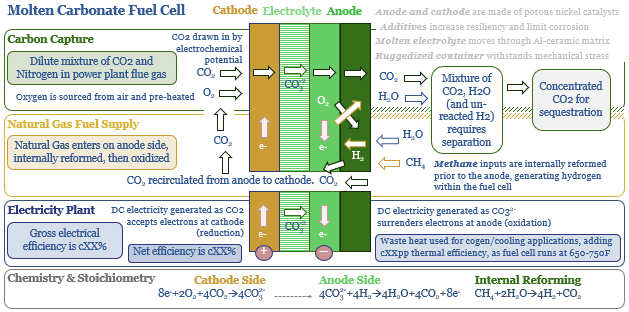

MCFCs: what if carbon capture generated electricity?

Molten carbonate fuel cells (MCFCs) could be a game-changer for CCS and fossil fuels. They capture CO2 from combustion facilities; while at the same time, generating electricity from natural gas. The first pilot plant is being tested in 1Q20, by ExxonMobil and FuelCell Energy. Economics range from passable to phenomenal.

-

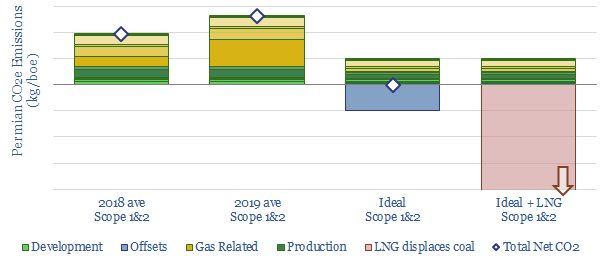

Shale growth: what if the Permian went CO2-neutral?

Shale growth has been slowing due to fears over the energy transition, as Permian upstream CO2 emissions reached a new high in 2019. We disaggregate the CO2 across 14 causes. It could be eliminated by improved technologies, making Permian production carbon neutral: uplifting NPVs by c$4-7/boe, re-attracting a vast wave of capital and growth. This…

-

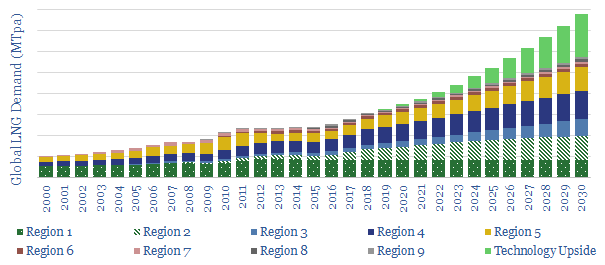

The Ascent of LNG?

This note outlines 200MTpa of potential upside to consensus LNG demand, due to emerging technologies, in power and transportation. LNG use could thus compound at an 8% CAGR to 800MTpa by 2030, justifying greater investment in unsanctioned LNG projects.

-

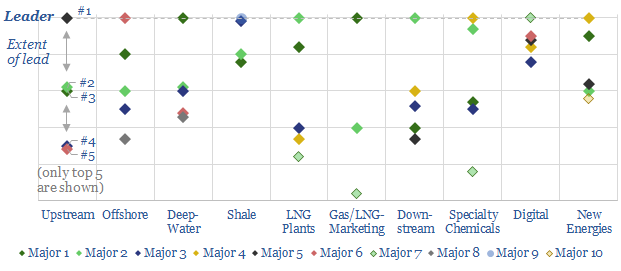

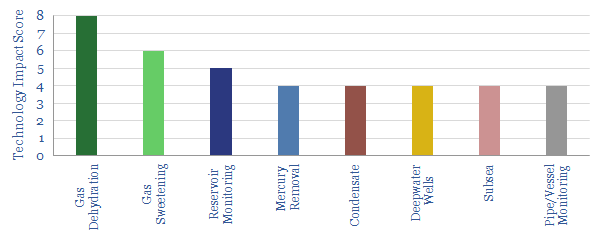

Patent Leaders in Energy

Technology leadership is crucial in energy. It drives costs, returns and future resiliency. Hence, we have reviewed 3,000 recent patent filings, across the 25 largest energy companies. Our 34-page report outlines the “Top 10 Technology Leaders” in energy, ranging across each sub-sector.

-

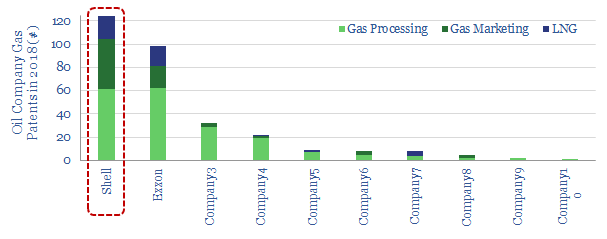

Shell drives LNG in transport?

Shell is the most active Major in driving new LNG demand. In 2019, it patented a new sub-cooler to improve the ascent of LNG in transportation. Our note explains the challenges of boil-off and gas-weathering, how they are addressed by Shell’s new technology, and eight resulting advantages.

-

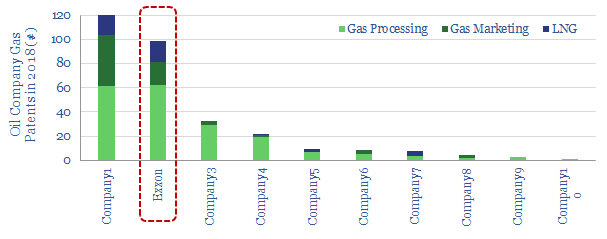

Greenfield LNG: Does Exxon have an edge?

ExxonMobil has developed industry-leading technology for greenfield LNG cosntruction, particularly in remote geographies. This conclusion follows from reviewing 3,000 patents. We analyse its edge the and resultant opportunities, as new projects progress in Mozambique, PNG and on the US Gulf Coast.

-

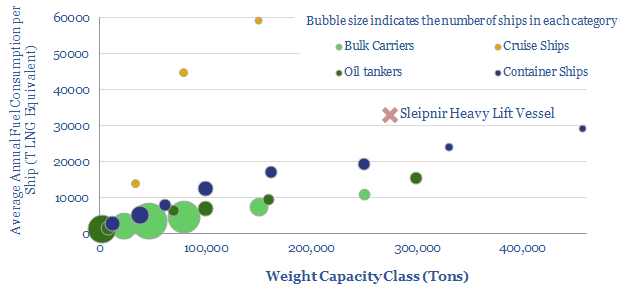

LNG Ships: a new record-setter?

Multiple records have just been broken for an LNG-powered ship, as construction completed at Heerema’s “Sleipnir” crane-lift vessel. It is a remarkable, LNG-powered machine, substantiating the 40-60MTpa upside we see for LNG demand, from fuel-intensive ships, after IMO 2020.

-

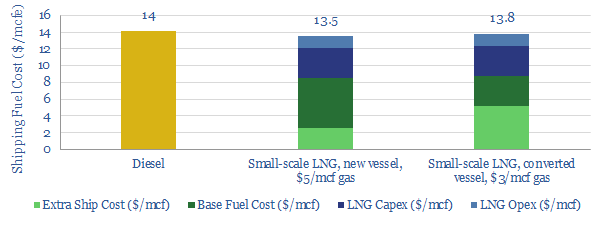

LNG in transport: scaling up by scaling down?

Next-generation technology in small-scale LNG has potential to reshape the global shipping-fuels industry. Especially after IMO 2020 sulphur regulations, LNG should compete with diesel. Opportunities in trucking and shale are less clear-cut.

-

Mozambique LNG: Can Chevron create more value?

It would be unwise to under-estimate the complexity of creating a new LNG province, with a 50MTpa prize ultimately on the table in Mozambique. Hence we have tabulated our ‘top ten’ examples of Chevron’s LNG-relevant technologies, from reviewing over 200 of the company’s patents so far.

-

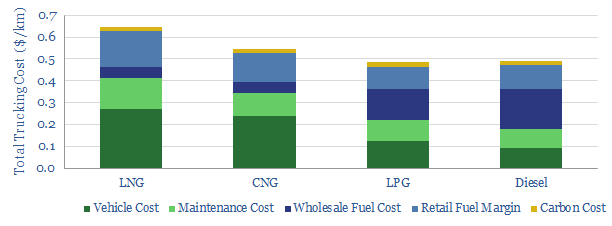

Is gas a competitive truck-fuel?

We have assessed whether gas is a competitive trucking fuel, comparing LNG and CNG head-to-head against diesel, across 35 different metrics (from the environmental to the economic). Total costs per km are still 10-30% higher for natural gas, even based on $3/mcf Henry Hub, which is 5x cheaper than US diesel.

Content by Category

- Batteries (87)

- Biofuels (42)

- Carbon Intensity (49)

- CCS (63)

- CO2 Removals (9)

- Coal (38)

- Company Diligence (92)

- Data Models (822)

- Decarbonization (159)

- Demand (110)

- Digital (58)

- Downstream (44)

- Economic Model (200)

- Energy Efficiency (75)

- Hydrogen (63)

- Industry Data (275)

- LNG (48)

- Materials (81)

- Metals (74)

- Midstream (43)

- Natural Gas (146)

- Nature (76)

- Nuclear (23)

- Oil (162)

- Patents (38)

- Plastics (44)

- Power Grids (124)

- Renewables (149)

- Screen (112)

- Semiconductors (30)

- Shale (51)

- Solar (67)

- Supply-Demand (45)

- Vehicles (90)

- Wind (43)

- Written Research (347)