-

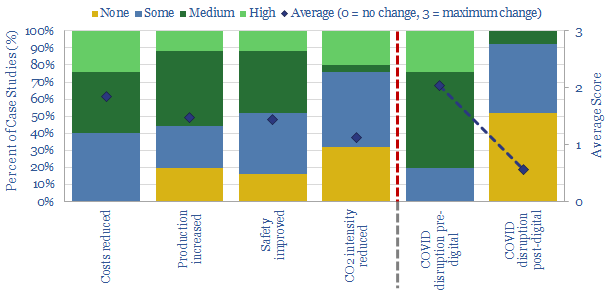

Digitization after the crisis: who benefits and how much?

Digitization improves economics and CO2 credentials. But now it will structurally accelerate due to higher resiliency: Just 8% of digitized industrial processes will be disrupted due to COVID-19, compared to 80% of non-digitized processes. This 22-page report outlines the theme and who will benefit.

-

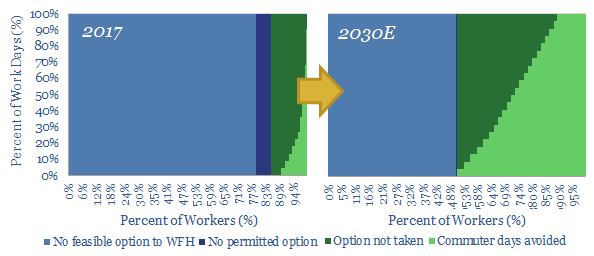

Remote possibilities: working from home?

The COVID-19 crisis will structurally accelerate remote working. The opportunity can save 30% of commuter journeys by 2030, avoiding 1bn tons of CO2 per year, for a net economic benefit of $5-16k per employee. This makes remote work materially more impactful than electric vehicles, as an opportunity in the energy transition.

-

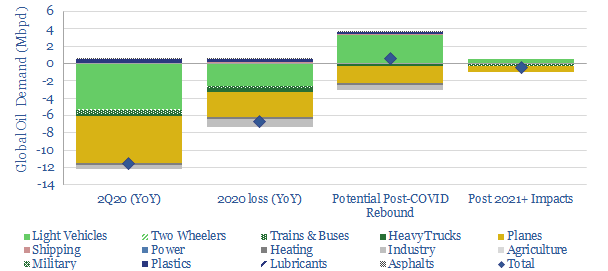

COVID-19: what have the oil markets missed?

This 15-page note outlines our top three conclusions about COVID-19, which the oil markets may have missed. Global oil demand could decline by -11.5Mbpd YoY in 2Q20. But gasoline demand could increase in the aftermath of the crisis. Finally, longer-term, structural changes will transform commuting, retail and travel.

-

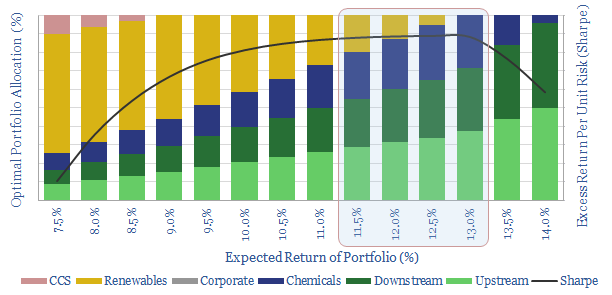

Ramp Renewables? Portfolio Perspectives.

It is often said that Oil Majors should become Energy Majors by transitioning to renewables. But what is the best balance based on portfolio theory? We constructed a mean-variance optimisation model and find a c5-13% weighting to renewables best increases risk-adjusted returns. Beyond 35%, returns decline rapidly.

-

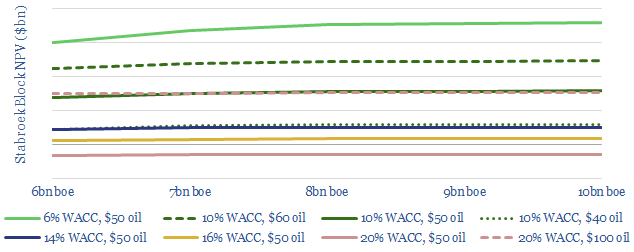

Guyana: carbon credentials & capital costs?

Prioritising low carbon barrels will matter increasingly to investors, as they can reduce total oil industry CO2 by 25%. Hence, these barrels should attract lower WACCs, whereas fears over the energy transition are elevating hurdle rates elsewhere and denting valuations. In Guyana’s case, the upshot could add $8-15bn of NAV, with a total CO2 intensity…

-

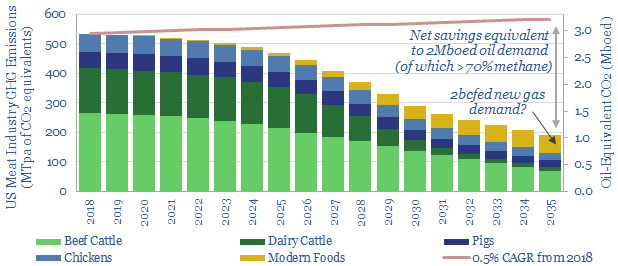

Disrupting Agriculture: Energy Opportunities?

Precision-engineered proteins are on the cusp of disrupting the agriculture industry. The science is improving rapidly, to create meat-substitutes with vastly superior nutrition, taste and costs. We explore the energy consequences of “replacing cows”, with potential for 2bcfd upside to US gas demand, to offset the CO2 of all US oil demand, increase US biofuels…

-

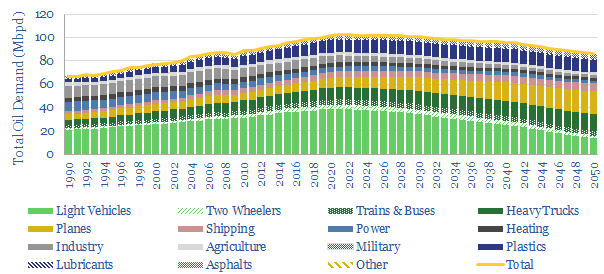

2050 oil markets: opportunities in peak demand?

Our new, 20-page note reviews seven technology themes that can eliminate 45Mbpd of long-term oil demand by 2050. We therefore find oil demand would plateau at 103Mbpd in the early-2020s, before declining gradually. Opportunities greatly outnumber risks for leading companies amidst this transition.

-

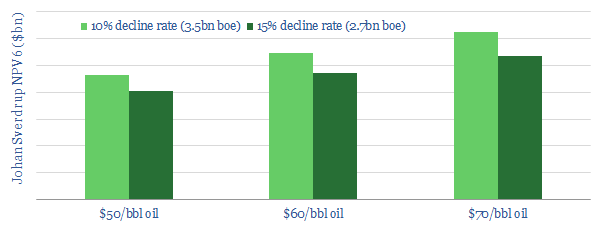

Johan Sverdrup: Don’t Decline?

Equinor is deploying three world-class technologies to mitigate Johan Sverdrup’s decline rates, based on reviewing c115 of the company’s patents and dozens of technical papers. Our 15-page note outlines how its efforts may unlock an incremental $3-5bn of value, as production surprises to the upside.

-

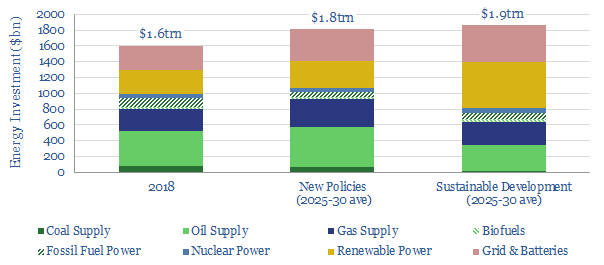

Is the world investing enough in energy?

The IEA has cautioned that global energy investment may be falling short. Spending of $1.6trn in 2018 may need to rise $220-270bn pa by 2025-30. We argue the best way to attract this capital is through the opportunities in better energy technology.

-

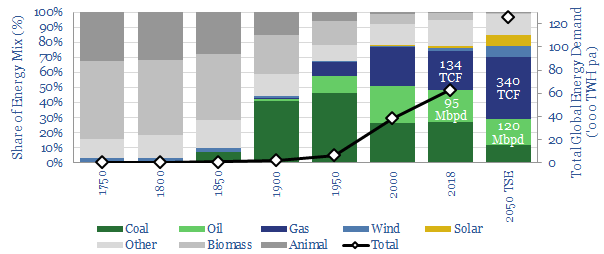

Why the Thunder Said?

Energy transition is underway. Or more specifically, five energy transitions are underway at the same time. They include the rise of renewables, shale oil, digital technologies, environmental improvements and new forms of energy demand. This is our rationale for establishing a new research consultancy, Thunder Said Energy, at the nexus of energy-technology and energy-economics.

Content by Category

- Batteries (87)

- Biofuels (42)

- Carbon Intensity (49)

- CCS (63)

- CO2 Removals (9)

- Coal (38)

- Company Diligence (90)

- Data Models (816)

- Decarbonization (159)

- Demand (108)

- Digital (56)

- Downstream (44)

- Economic Model (197)

- Energy Efficiency (75)

- Hydrogen (63)

- Industry Data (273)

- LNG (48)

- Materials (79)

- Metals (71)

- Midstream (43)

- Natural Gas (146)

- Nature (76)

- Nuclear (22)

- Oil (162)

- Patents (38)

- Plastics (44)

- Power Grids (123)

- Renewables (149)

- Screen (112)

- Semiconductors (30)

- Shale (51)

- Solar (67)

- Supply-Demand (45)

- Vehicles (90)

- Wind (43)

- Written Research (345)