-

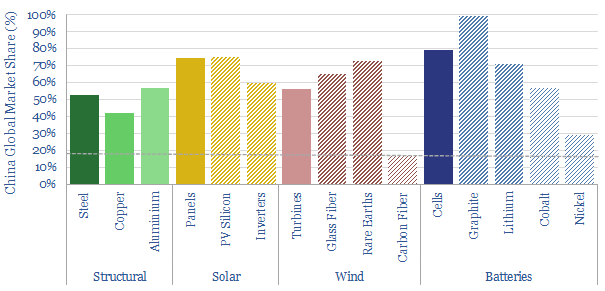

East to West: re-shoring the energy transition?

China is 18% of the world’s people and GDP. But it makes c50% of the world’s metals, 60% of its wind turbines, 70% of its solar panels and 80% of its lithium ion batteries. Re-shoring is likely to be a growing motivation after events of 2022. This 14-page note explores resultant opportunities.

-

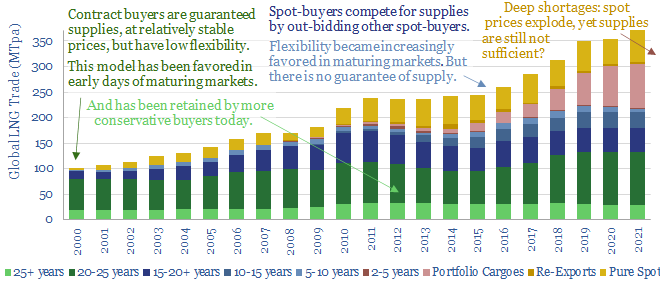

Energy security: the return of long-term contracts?

Spot markets have delivered more and more ‘commodities on demand’. But is this model fit for energy transition? Many markets are now short, causing explosive price rises. Sufficient volumes may still not be available at any price. This note considers a renaissance for long-term contracts.

-

US shale: our outlook in the energy transition?

This presentation covers our outlook for the US shale industry in the 2020s, and was presented at a recent investor conference. It covers the importance of shale oil supplies in balancing future oil markets, our outlook for 5% annual productivity growth, and the opportunity for carbon-neutrality to attract capital.

-

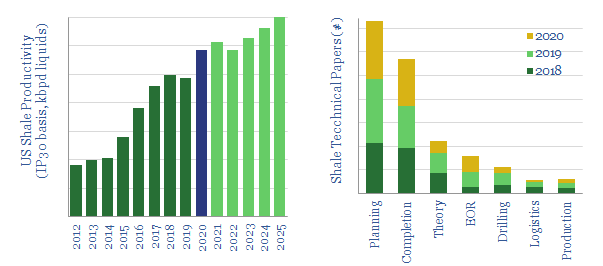

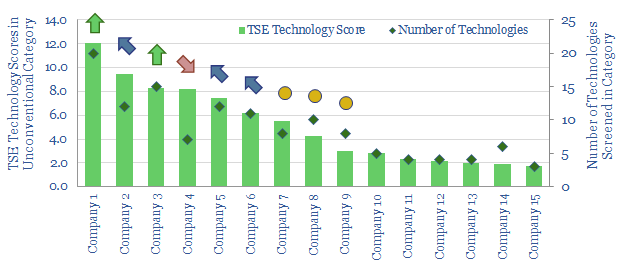

US Shale: the second coming?

US shale productivity can still rise at a 5% CAGR to 2025, based on evaluating 300 technical papers from 2020. The latest improvements are discussed in this 12-page note. Thus unconventionals could quench deeply under-supplied oil markets by 2025. Leading technologies are also becoming concentrated in the hands of fewer operators.

-

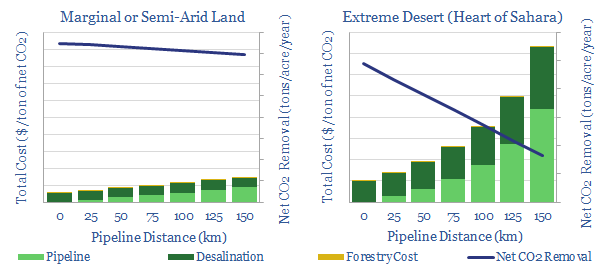

Green deserts: a final frontier for forest carbon?

Is there potential to afforest any of the world’s 11bn acres of arid and semi-arid lands, by desalinating and distributing seawater? Energy economics do not work in the most extreme deserts (e.g., the Sahara). Buy $60-120/ton CO2 prices may suffice in semi-arid climates. The best economics of all use waste water from oil and gas,…

-

US shale: the quick and the dead?

It is no longer possible to compete in the US shale industry without leading digital technologies. This 10-page note outlines best practices, based on 500 patents and 650 technical papers. Chevron, Conoco and ExxonMobil lead our screens. Disconcertingly absent from the leader-board is EOG, whose edge may have been eclipsed.

-

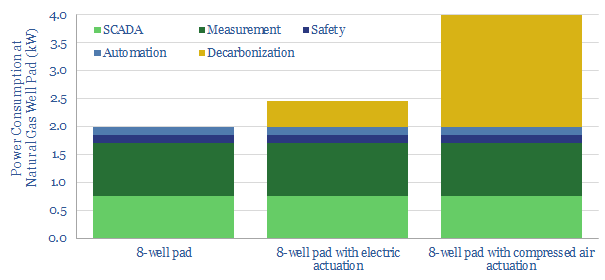

Qnergy: reliable remote power to mitigate methane?

This short note profiles Qnergy, the leading manufacturer of Stirling-design engines, which generate 1-10 kW of power, in remote areas, where a grid connection is not available. The units are particularly economical for mitigating methane emissions, with a potential abatement cost of $20/ton.

-

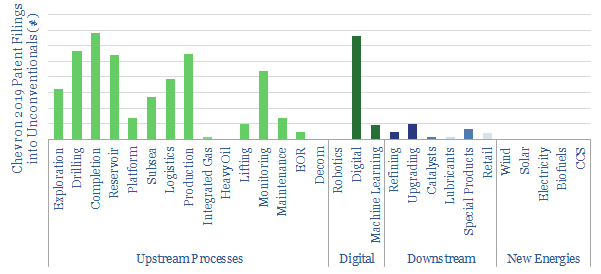

Chevron: SuperMajor Shale in 2020?

SuperMajors’ shale developments are assumed to differ from E&Ps’ mainly in their scale and access to capital. Superior technologies are rarely discussed. But new evidence is emerging. This 11-page note assesses 40 of Chevron’s shale patents from 2019, showing a vast array of data-driven technologies, to optimize every aspect of shale.

-

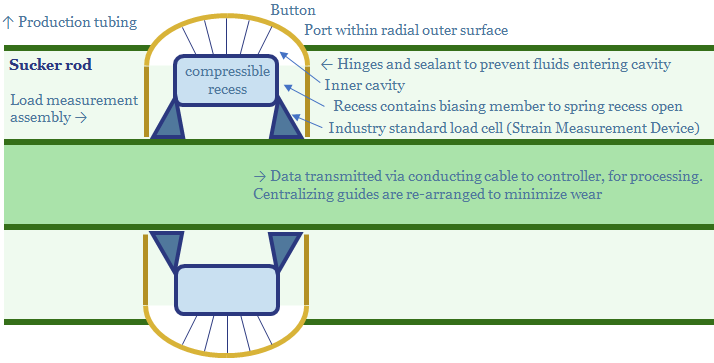

EOG’s Digitization: Pumped-Up?

EOG patented a new digital technology in 2019: a load assembly which can be built into its rod pumps: to raise efficiency, lower costs and lower energy consumption. This 8-page note reviews the patent, illustrating how EOG is working to further digitize its processes, maximise productivity and minimise CO2 intensity.

-

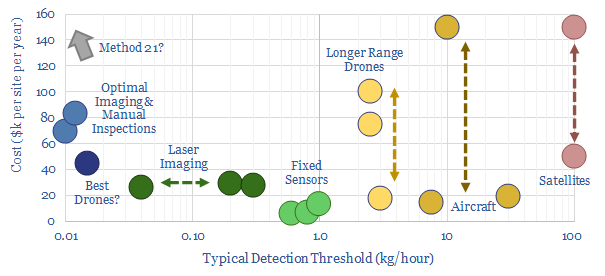

Global gas: catch methane if you can?

Scaling up natural gas is among the largest decarbonisation opportunities. But this requires minimising methane leaks. Exciting new technologies are emerging. This 28-page note ranks producers, positions for new policies and advocates developing more LNG. To seize the opportunity, we also identify 35 companies geared to the theme. Global gas demand will not be derailed…

Content by Category

- Batteries (89)

- Biofuels (44)

- Carbon Intensity (49)

- CCS (63)

- CO2 Removals (9)

- Coal (38)

- Company Diligence (94)

- Data Models (838)

- Decarbonization (160)

- Demand (110)

- Digital (59)

- Downstream (44)

- Economic Model (204)

- Energy Efficiency (75)

- Hydrogen (63)

- Industry Data (279)

- LNG (48)

- Materials (82)

- Metals (80)

- Midstream (43)

- Natural Gas (148)

- Nature (76)

- Nuclear (23)

- Oil (164)

- Patents (38)

- Plastics (44)

- Power Grids (130)

- Renewables (149)

- Screen (117)

- Semiconductors (32)

- Shale (51)

- Solar (68)

- Supply-Demand (45)

- Vehicles (90)

- Wind (44)

- Written Research (354)