-

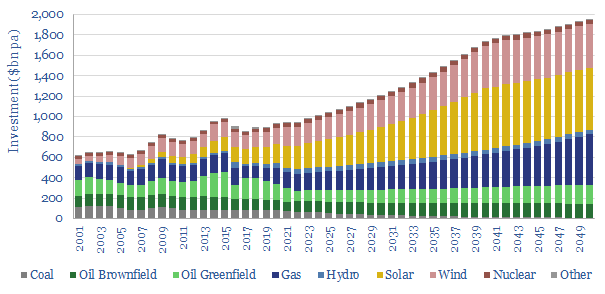

Is the world investing enough in energy?

Global energy investment in 2020-21 has been running 10% below the level needed on our roadmap to net zero. Under-investment is steepest for solar, wind and gas. Under-appreciated is that each $1 dis-invested from fossil fuels must be replaced with $25 in renewables. Future capex needs are vast.

-

Integrated energy: a new model?

This 14-page note lays out a new model to supply fully carbon-neutral energy to a cluster of commercial and industrial consumers, via an integrated package of renewables, low-carbon gas back-ups and nature based carbon removals. This is remarkable for three reasons: low cost, high stability, and full technical readiness.

-

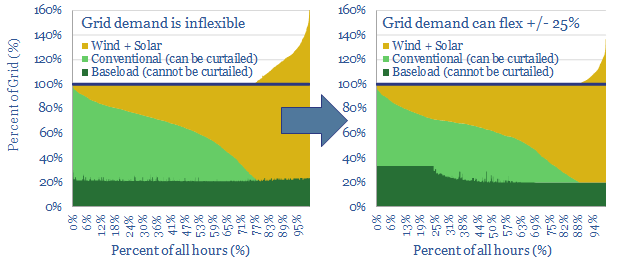

Shifting demand: can renewables reach 50% of grids?

25% of the power grid could realistically become ‘flexible’, shifting its demand across days, even weeks. This is the lowest cost and most thermodynamically efficient route to fit more wind and solar into power grids. We are upgrading our renewables ceilings from 40% to 50%. This 22-page note outlines the opportunity.

-

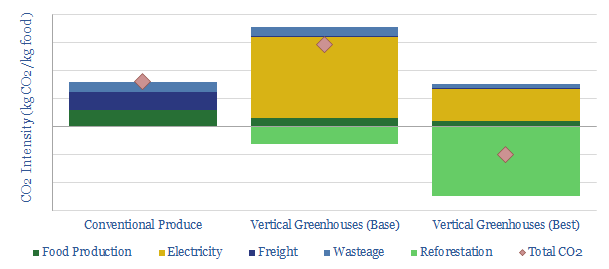

Vertical greenhouses: what future in the transition?

Vertical greenhouses achieve 10-400x greater yields per acre than field-growing, stacking layers of plants indoors, and illuminating each layer with LEDs. Economics are exciting. CO2 intensity varies. But it can be carbon-negative if powered by renewables. This 17-page case study outlines the opportunity.

-

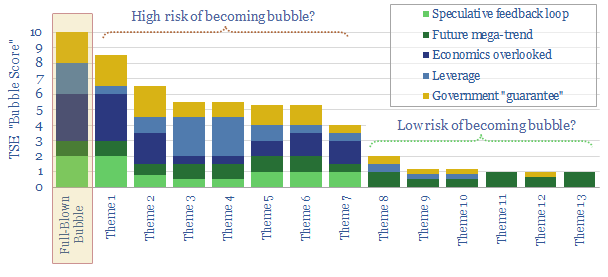

Energy transition: is it becoming a bubble?

Investment bubbles in history typically take 4-years to build and 2-years to burst, as asset prices rise c815% then collapse by 75%. There is now a frightening resemblance between energy transition technologies and prior investment bubbles. This 19-page note aims to pinpoint the risks and help you defray them.

-

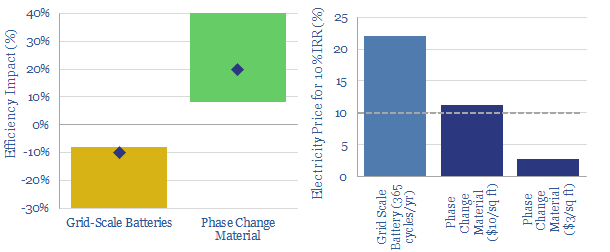

Backstopping renewables: cold storage beats battery storage?

Phase change materials could be a game-changer for energy storage. They can earn double digit IRRs unlocking c20% efficiency gains in freezers and refrigerators, which make up 9% of US electricity. This is superior to batteries which add costs and incur 8-30% efficiency losses. We review 5,800 patents and identify leading companies.

-

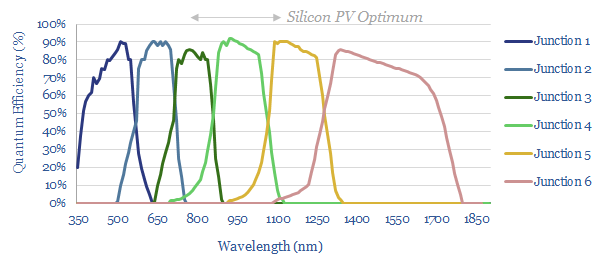

Solar energy: is 50% efficiency now attainable?

A new record has been published in 2020, achieving 47.1% conversion efficiency in a solar cell, using “a monolithic, series-connected, six-junction inverted metamorphic structure under 143 suns concentration”. Our goal in this note is to explain the achievement and its implications.

-

Ten Themes for Energy in the 2020s

We presented our ‘Top Ten Themes for Energy in the 2020s’ to an audience at Yale SOM, in February-2020. The audio recording is available below. The slides are available to TSE clients.

-

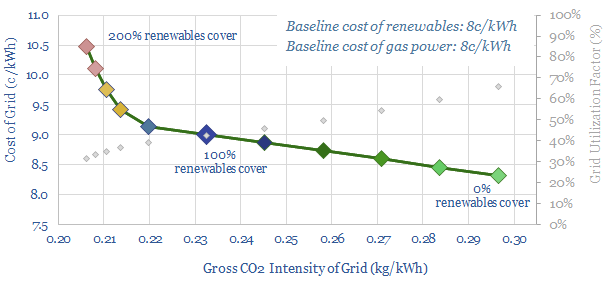

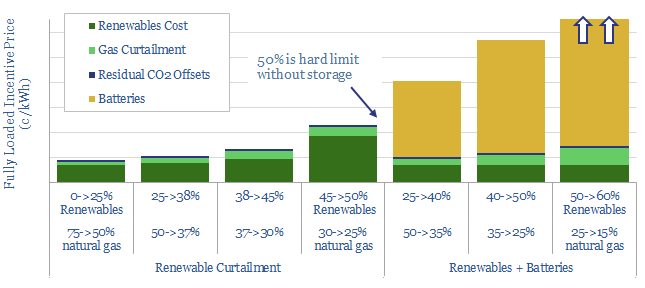

Decarbonized power: how much wind and solar fit the optimal grid?

What is the optimal mix of wind and solar in a low-cost, zero-carbon power grid? We find renewables cannot surpass 45-50% due to curtailment, which trebles prices. Batteries help little, under grid conditions. Decarbonized gas is the best backstop. A grid of 50% decarbonized gas, 25% renewables and 25% nuclear has the lowest incentive price,…

-

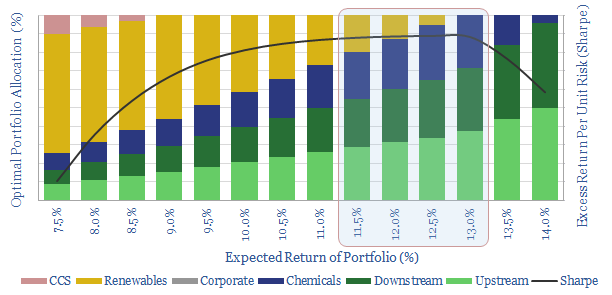

Ramp Renewables? Portfolio Perspectives.

It is often said that Oil Majors should become Energy Majors by transitioning to renewables. But what is the best balance based on portfolio theory? We constructed a mean-variance optimisation model and find a c5-13% weighting to renewables best increases risk-adjusted returns. Beyond 35%, returns decline rapidly.

Content by Category

- Batteries (89)

- Biofuels (44)

- Carbon Intensity (49)

- CCS (63)

- CO2 Removals (9)

- Coal (38)

- Company Diligence (95)

- Data Models (840)

- Decarbonization (160)

- Demand (110)

- Digital (60)

- Downstream (44)

- Economic Model (205)

- Energy Efficiency (75)

- Hydrogen (63)

- Industry Data (279)

- LNG (48)

- Materials (82)

- Metals (80)

- Midstream (43)

- Natural Gas (149)

- Nature (76)

- Nuclear (23)

- Oil (164)

- Patents (38)

- Plastics (44)

- Power Grids (130)

- Renewables (149)

- Screen (117)

- Semiconductors (32)

- Shale (51)

- Solar (68)

- Supply-Demand (45)

- Vehicles (90)

- Wind (44)

- Written Research (354)