-

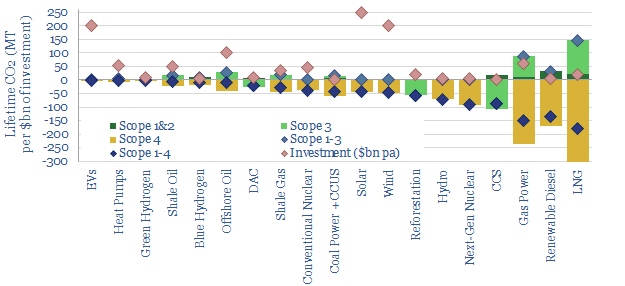

Scope 4 emissions: avoided CO2 has value?

Scope 4 CO2 emissions reflect the CO2 avoided by an activity. This 11-page note argues the metric warrants more attention. It yields an ‘all of the above’ approach to energy transition, shows where each investment dollar achieves most decarbonization and maximizes the impact of renewables.

-

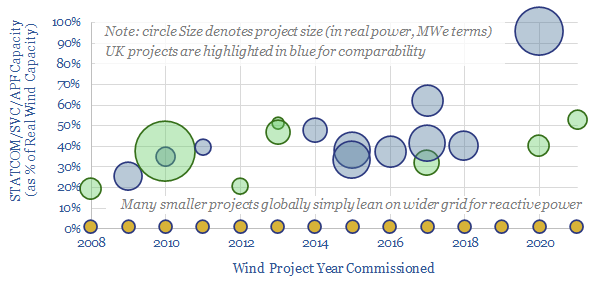

FACTS of life: upside for STATCOMs & SVCs?

Wind and solar have so far leaned upon conventional power grids. But larger deployments will increasingly need to produce their own reactive power; controllably, dynamically. Demand for STATCOMs & SVCs may thus rise 30x, to over $25-50bn pa. This 20-page note outlines the opportunity and who benefits?

-

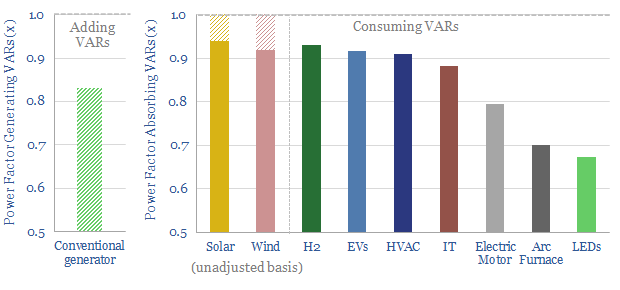

Capacitor banks: raising power factors?

Power factor corrections could save 0.5% of global electricity, with $20/ton CO2 abatement costs in normal times, and 30% pure IRRs during energy shortages. They will also be needed to integrate more new energies into power grids. This note outlines the opportunity in capacitor banks, their economics and leading companies.

-

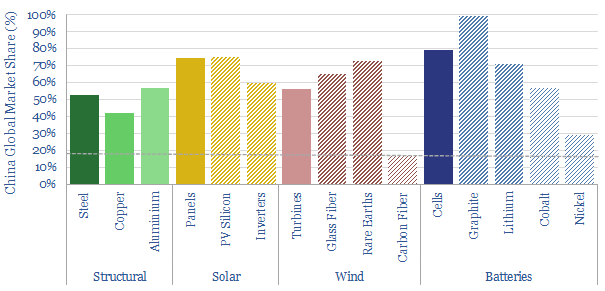

East to West: re-shoring the energy transition?

China is 18% of the world’s people and GDP. But it makes c50% of the world’s metals, 60% of its wind turbines, 70% of its solar panels and 80% of its lithium ion batteries. Re-shoring is likely to be a growing motivation after events of 2022. This 14-page note explores resultant opportunities.

-

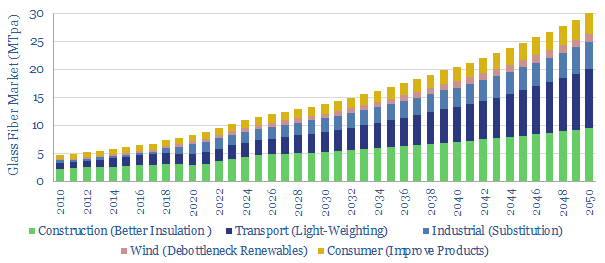

Glass fiber: what upside in the energy transition?

Glass fiber makes up 50% of a wind turbine blade, lightens vehicles and insulates homes for 30-70% energy savings. Hence we see demand rising 3.5x in the energy transition. To appraise the opportunity, this 13-page note assesses the market, costs, CO2 intensity and leading companies.

-

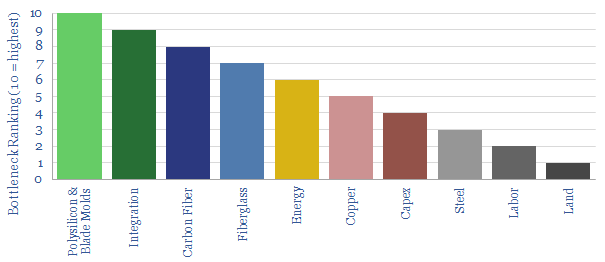

Renewables: can they ramp up faster?

How fast can wind and solar accelerate, especially if energy shortages persist? This 11-page note reviews the top ten bottlenecks. Seven value chains will tighten enormously in the coming years. Paradoxically, however, ramping renewables could exacerbate near-term energy shortages.

-

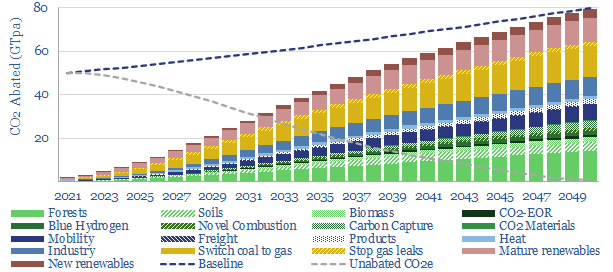

Decarbonizing global energy: the route to net zero?

This 18-page report revises our roadmap for the world to reach ‘net zero’ by 2050. The average cost is still $40/ton of CO2, with an upper bound of $120/ton, but this masks material mix-shifts. New opportunities are largest in efficiency gains, under-supplied commodities, power-electronics, conventional CCUS and nature-based CO2 removals.

-

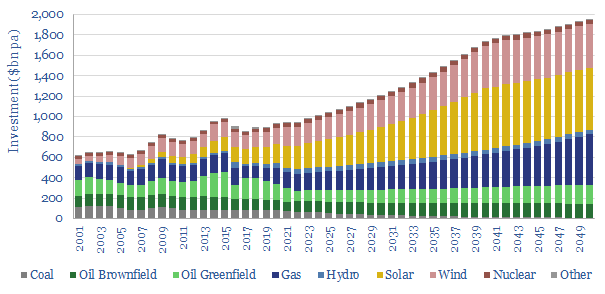

Is the world investing enough in energy?

Global energy investment in 2020-21 has been running 10% below the level needed on our roadmap to net zero. Under-investment is steepest for solar, wind and gas. Under-appreciated is that each $1 dis-invested from fossil fuels must be replaced with $25 in renewables. Future capex needs are vast.

-

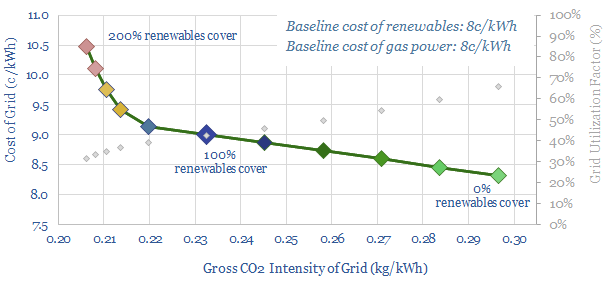

Integrated energy: a new model?

This 14-page note lays out a new model to supply fully carbon-neutral energy to a cluster of commercial and industrial consumers, via an integrated package of renewables, low-carbon gas back-ups and nature based carbon removals. This is remarkable for three reasons: low cost, high stability, and full technical readiness.

-

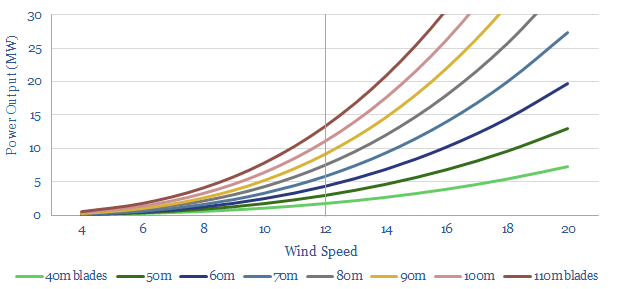

Offshore wind: will costs follow Moore’s Law?

Some commentators expect the levelized costs of offshore wind to fall another two-thirds by 2050. The justification is some eolian equivalent of Moore’s Law. Our 16-page report draws five contrasts. Wind costs are most likely to move sideways, even as the industry builds larger turbines. Implications are explored for companies.

Content by Category

- Batteries (89)

- Biofuels (44)

- Carbon Intensity (49)

- CCS (63)

- CO2 Removals (9)

- Coal (38)

- Company Diligence (95)

- Data Models (840)

- Decarbonization (160)

- Demand (110)

- Digital (60)

- Downstream (44)

- Economic Model (205)

- Energy Efficiency (75)

- Hydrogen (63)

- Industry Data (279)

- LNG (48)

- Materials (82)

- Metals (80)

- Midstream (43)

- Natural Gas (149)

- Nature (76)

- Nuclear (23)

- Oil (164)

- Patents (38)

- Plastics (44)

- Power Grids (130)

- Renewables (149)

- Screen (117)

- Semiconductors (32)

- Shale (51)

- Solar (68)

- Supply-Demand (45)

- Vehicles (90)

- Wind (44)

- Written Research (354)