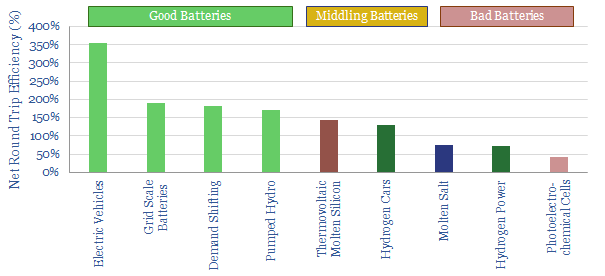

We define a “good battery” as one that enhances the efficiency of the total energy system. Conversely, a “bad battery” diminishes it. This distinction matters and must not be overlooked in the world’s quest for cleaner energy. Electric Vehicles are most favoured, while grid-scale hydrogen is questioned.

[restrict]

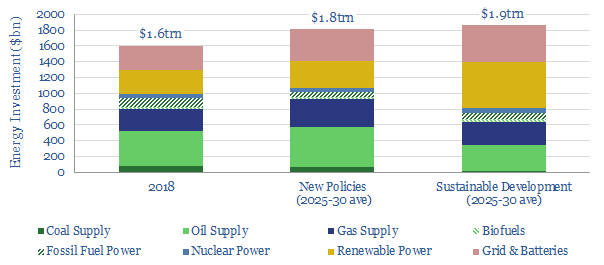

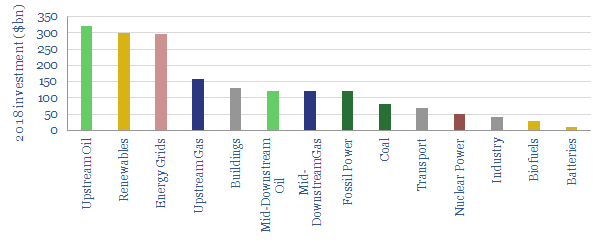

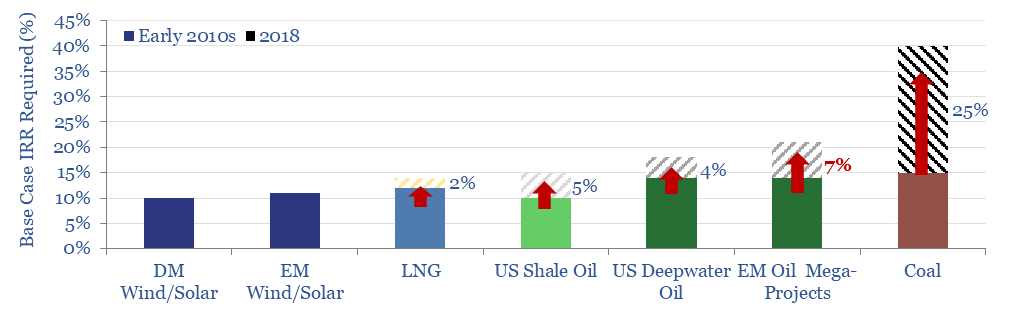

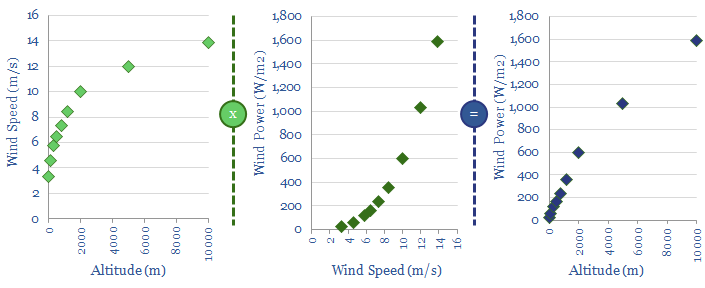

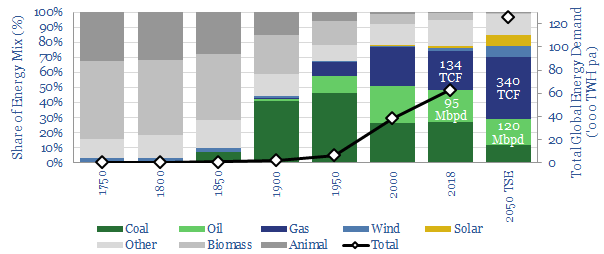

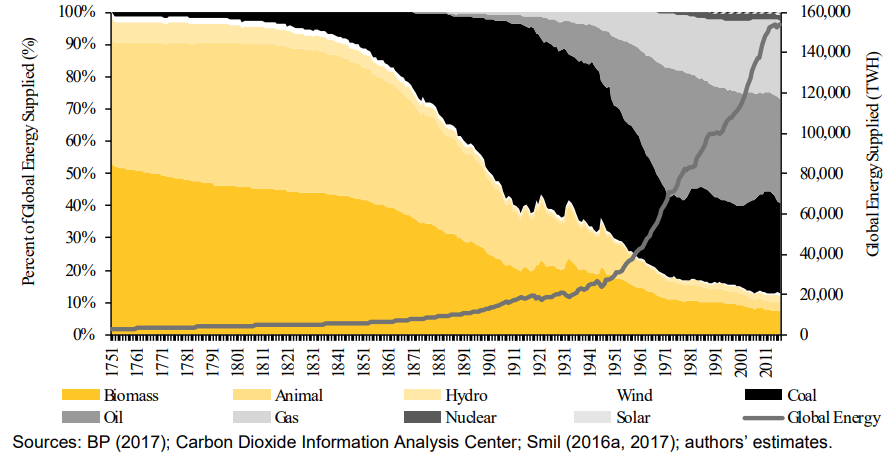

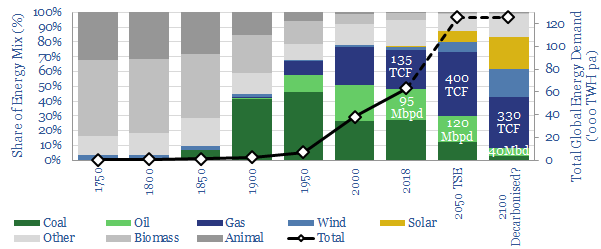

As renewable energy ramps up into the global energy mix (chart below, model here), the energy system will grow increasingly intermittent. This is unavoidable, because sunshine and wind speeds vary, and these variations are correlated over wide geographic areas.

Hence, batteries will be needed, to store up excess renewable generation for when the sun is not shining and the wind is not blowing. Most commentary on batteries focuses on their costs. But there is also an enormous opportunity in their efficiency…

Designed correctly, batteries can improve the efficiency of the global energy system, and accelerate the energy transition by lowering the total amount of energy that needs to be generated. Designed incorrectly, however, these variables are all worsened. The distinction is the topic of today’s note.

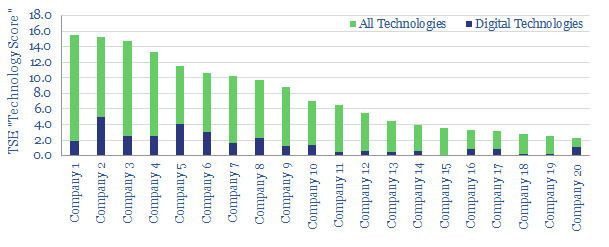

To make our distinction clearer, we have created a new data-file estimating the “net round trip efficiency” of different battery types. The calculation has two steps:

- First, we measure the energy efficiency of an energy storage system (kWh given out divided by kWh put in).

- Second, the storage system’s energy efficiency is compared with the most likely energy source that storage system will displace.

Interpretation. A score over 100% indicates a “good battery”. It is more efficient than the energy source displaced. A score below 100% indicates a “bad battery”. It is less efficient than the energy source displaced.

Examples to illustrate good vs bad batteries

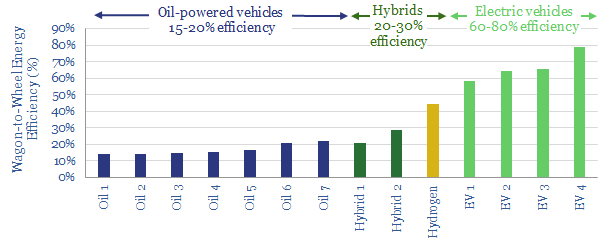

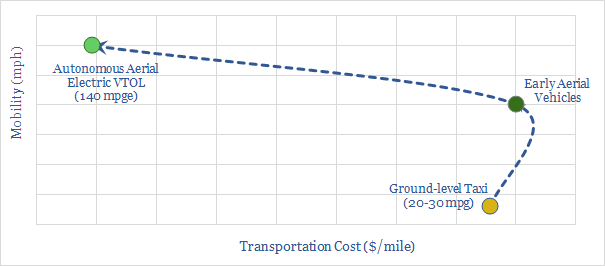

Electric cars are our top example of a “good battery”, with potential to uplift energy efficiency by 3.5x. This is because electric vehicles achieve c60-80% energy efficiencies. An electric vehicle, in turn, is most likely to displace an internal combustion engine, which typically achieves 15-20% energy efficiency (chart below, model here). Mop up c100 units of excess renewable energy with an electric vehicle battery, and it therefore displaces the equivalent of 350 units of oil-energy.

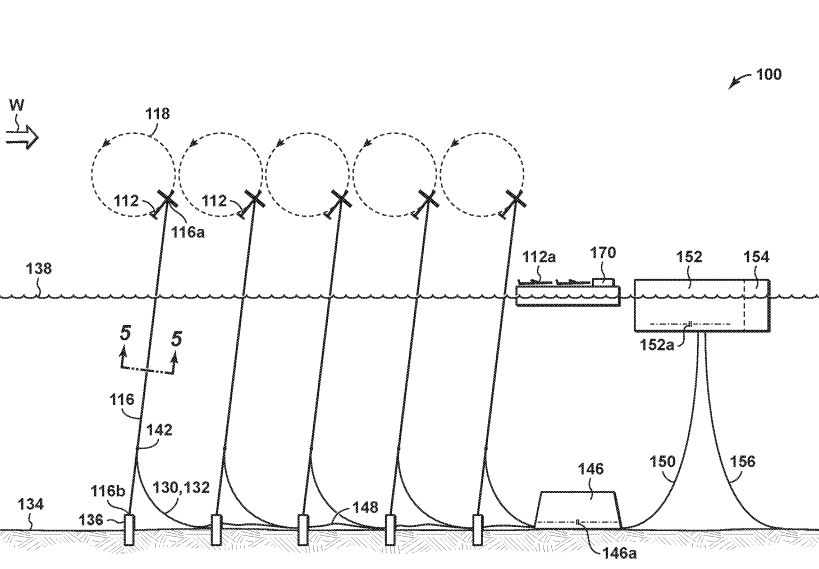

The same 3.5x uplift applies to the battery in an ‘aerial vehicle‘, as we recently reviewed in depth, with flying cars set to achieve the equivalent of 140mpg (chart below).

Grid-scale batteries can also achieve impressive uplifts in efficiency, when inefficient fuel use is displaced. As a general rule of thumb, a power plant might be c50% efficient, hence replacing the power plant with renewables plus batteries can achieve a c2x efficiency uplift.

Additional opportunities are emerging to uplift system efficiency using batteries. One recent example was described by ConocoPhillips, at the Darwin LNG plant, where the gas turbines have a “sweet spot” of maximum efficiency. Battery storage allows Conoco to avoid low-efficiency turbine usage, which will will cut emissions by 20%.

Demand shifting, in the middle of our chart, deserves special mention because it is practically free and can also arguably uplift efficiency by 1-2x. It constitutes moving demand to the times when electricity is flowing abundantly into the grid. Examples range from backups at data-centers to washer-driers in homes. The practice can be encouraged by variable electricity prices, incentivising consumption when electricity supply is abundant and disincentivising consumption at times when it is scarce.

Now we arrive at the right-hand-side of our graph, where we are more cautious. Many commentators have proposed using hydrogen, molten salt or photo-electro-chemical cells as storage mechanisms, to absorb excess renewable power, for later usage…

We calculate that these “batteries” have c35-40% round-trip efficiencies: i.e., one third of the energy is lost to “charge” the battery (e.g., hydrolysing water) and another third is lost discharging it (e.g., burning hydrogen). Mop up 100 units of of renewable energy with one of these “bad batteries” and only c35-40 units can be recovered later. This means the world’s installed renewable capacity achieves less decarbonisation.

Decision-makers may wish to consider system efficiency in these terms, to maximise the impacts of both their renewable and battery investments. Efficiency and economics tend to overlap in all the models we have built.

[/restrict]