-

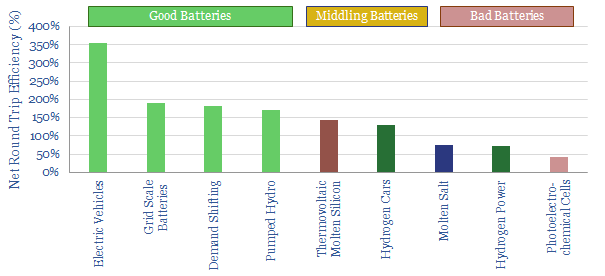

Good Batteries vs Bad Batteries?

A “good battery” enhances the efficiency of the total energy system. A “bad battery” diminishes it. Hence we have quantified battery quality, ranging from 3.5x efficiency gains for EVs to c30% efficiency losses for grid-scale hydrogen. This distinction must not be overlooked in the world’s quest for cleaner energy.

-

Oil Companies Drive the Energy Transition?

There is only one way to decarbonise the energy system: leading companies must find economic opportunities in better technologies. No other route can source sufficient capital to re-shape the industry. We outline seven game-changing opportunities. Remarkably, leading energy Majors are already pursuing them.

-

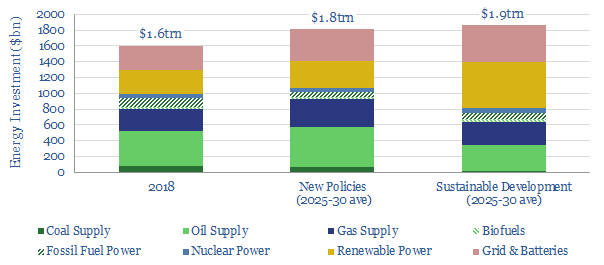

Is the world investing enough in energy?

The IEA has cautioned that global energy investment may be falling short. Spending of $1.6trn in 2018 may need to rise $220-270bn pa by 2025-30. We argue the best way to attract this capital is through the opportunities in better energy technology.

-

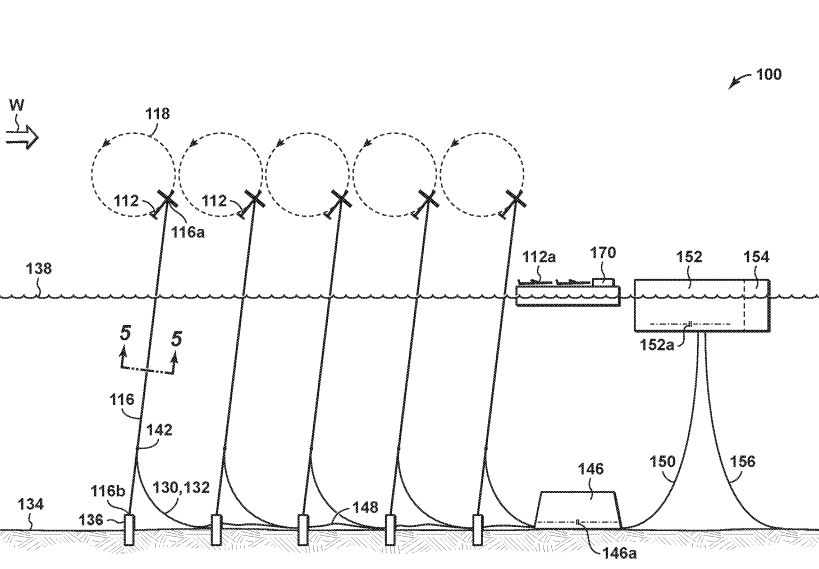

Two Majors’ Secret Race for the Future of Offshore Wind?

Tethered kites access 2-4x more wind-power at 50-90% lower costs than turbines. Intriguingly, Exxon and Shell are now at the forefront of the new opportunity.

-

Why the Thunder Said?

Energy transition is underway. Or more specifically, five energy transitions are underway at the same time. They include the rise of renewables, shale oil, digital technologies, environmental improvements and new forms of energy demand. This is our rationale for establishing a new research consultancy, Thunder Said Energy, at the nexus of energy-technology and energy-economics.

-

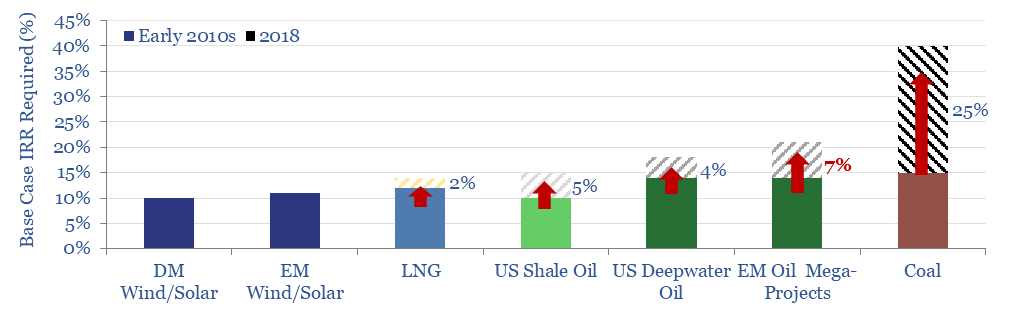

Underinvestment risks in the energy transition?

Fears over the energy transition are now restricting investment in fossil fuels, based on our new paper, published in conjunction with the Oxford Institute for Energy Studies

-

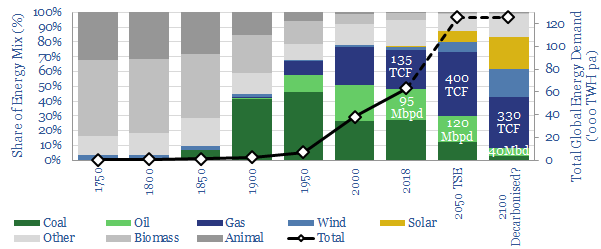

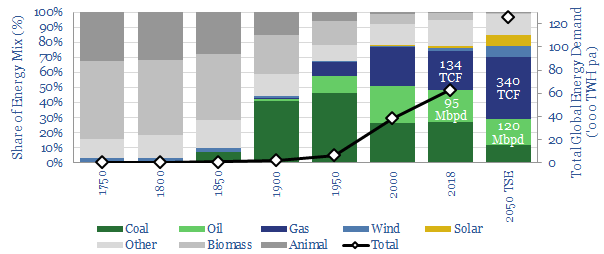

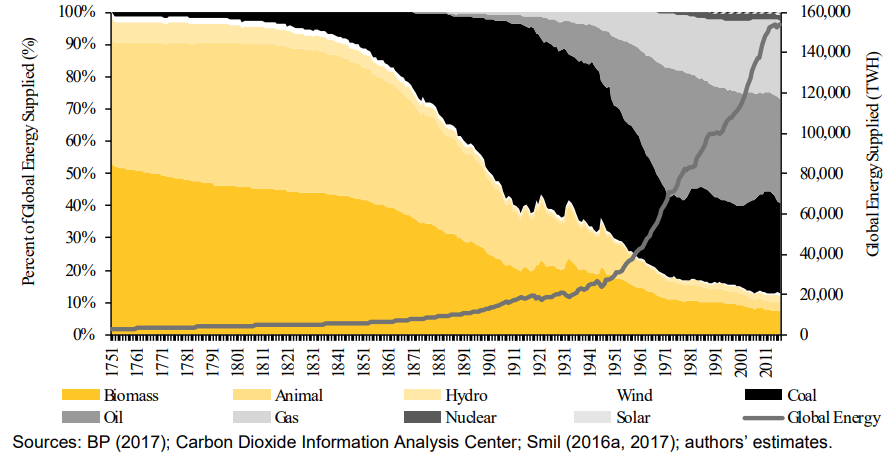

250-years of Energy Disruption?

In 2018, we reviewed 250-years of energy transitions, arguing that another great energy transition is now on hand. It will take a century. We must also improve conventional energy.

Content by Category

- Batteries (89)

- Biofuels (44)

- Carbon Intensity (49)

- CCS (63)

- CO2 Removals (9)

- Coal (38)

- Company Diligence (95)

- Data Models (840)

- Decarbonization (160)

- Demand (110)

- Digital (60)

- Downstream (44)

- Economic Model (205)

- Energy Efficiency (75)

- Hydrogen (63)

- Industry Data (279)

- LNG (48)

- Materials (82)

- Metals (80)

- Midstream (43)

- Natural Gas (149)

- Nature (76)

- Nuclear (23)

- Oil (164)

- Patents (38)

- Plastics (44)

- Power Grids (130)

- Renewables (149)

- Screen (117)

- Semiconductors (32)

- Shale (51)

- Solar (68)

- Supply-Demand (45)

- Vehicles (90)

- Wind (44)

- Written Research (354)