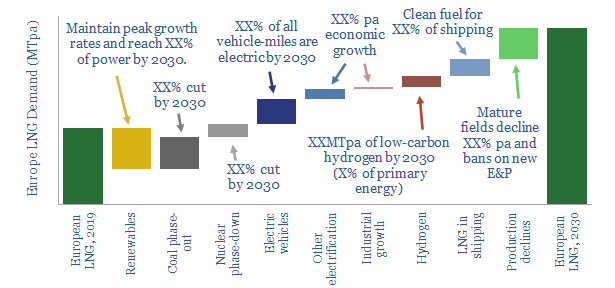

A lack of gas is likely to slow down Europe’s energy transition in the 2020s. This is the conclusion in our new 12-page note, which captures basic policy objectives, such as phasing out 50% of Europe’s coal, electrifying 20% of its vehicles, cleaning up 25% of its shipping and shifting 3% of its energy into low carbon hydrogen. To achieve this, an incremental 85MTpa of LNG must be sourced by 2030, absorbing one third of new global LNG supplies, and stoking mid-2020s LNG shortages.

Policy tilts in Europe are summarized on pages 2-3, including renewables, coal phase outs, nuclear phase-down, electric transport, broader electrification, industrial efficiency, hydrogen and oil and gas exploration.

The impacts on power markets are modelled on page 4, showing how demand will rise at c1% per year, plus the relative growth rates of renewables and gas.

The impacts on gas markets are modelled on pages 5-6, showing that Europe’s reliance on imports will rise from c50% in 2000 to over 90% in 2030.

LNG imports must therefore increase rapidly, as argued on page 7. We put Europe’s incremental demands into context against the broader LNG market.

Sensitivities are explored on pages 8-11. Across half-a-dozen of the policy tilts that we considered, a shortage of gas will be the major bottleneck.

Implications are discussed on page 12. Gas and LNG prices may need to rise sharply in the mid-2020s and/or the policy objectives discussed in this note may need to be walked back.